Attention: Please take a moment to consider our terms and conditions before posting.

Savings and Investments thread

Comments

-

Yes this.Rob7Lee said:

Exactly your last point, it’s not taxed (at source), but generally you simply pay the tax on it via your other income, if you have any.PragueAddick said:@golfaddick Not sure why you are suggesting the State pension is not taxed? Of course it is. It was in my taxable income for the last 8 years or so. If I had made 12k on, say, rental only in a year, and not had a state pension, I wouldn't have paid any tax.

It's only "not taxed" if you don't have to declare it, surely?

The State Pension is taxable, but it is always paid in full without any tax taken off (should you have any other income). Its that other income that is then taxed at source and paid net.

This is the problem I've been trying to highlight. There are lots of pensioners (millions?) whose only income is the State pension. Soon the State Pension will exceed the Personal Allowance. If so, where will the tax be taken from ? They have no other income to be taxed, so logically it will have to be deducted from the State Pension. But seeing as the State Pension has never had tax taken from it something will have to budge.

And I'm only been talking about the State 2nd Pension (the new one) that anyone retiring after 2016 has been receiving. There are millions drawing money from the old State Pension (my father for one) who get more due to the many changes the "Old Age Pension" has gone through. This has been brought to my attention, not only because of the forthcoming triple lock issues, but because my father is already receiving in excess of the PA and not paying tax (his pension includes the Graduation Pension and years of being contracted in during the 50's & 60's when there were no Company schemes for manual workers).

However.....I've just checked online & it seems that plans are already on place. Pensioners whose State Pension is in excess of the PA will be sent a simple assessment letter from HMRC. They will have done a calculation, based on information from DWP, and will simply ask for a payment from the individual. This is supposedly starting from the summer of 2026 & will have until 31st Jan 2027 to pay it.

Eg. Someone has a State Pension of £14000. Take off their PA of £12570 leaves taxable income of £1,430. 20% of that = £286.

I still think this will panic a lot of pensioners.

Edit.

Since writing my monologue it appears that @bobmunro has answered it more succinctly.0 -

I've been due back some tax, from my 2023/2024 self-assessment return, refund request submitted April 2024. The payment turned up today, after 19 months. HMRC must have a hefty backlog going on!0

-

The point I'm making is how raising the personal allowance in line with triple lock criteria is easily dismissed as "unaffordable" yet getting rid of the triple lock, let alone means testing pensions is seen as unspeakable, when in reality triple locking pensions is unaffordable...TelMc32 said:

It isn’t affordable. That’s why it isn’t being implemented.Huskaris said:

Would be nice if something similar was done to pensions then, interesting how that is affordable...bobmunro said:Huskaris said:Wouldn't it be great if the personal allowance got the triple lock treatment? Then it's solved and closer to some form of equity for working people.There was a call to increase the PA from £12,570 to £20,000 - that would cost £50 billion! Even raising it to say £16,000 would be cost prohibitive for our busted economy.It aint happening - the most likely outcome is that from 2028/29 tax year it will increase by CPI each year, but that still might not happen.

State pensions will have to be completely overhauled at some point.2 -

The grown up thing to do would be to go back on the election promise and up income tax a little at the top end.Yes they would take some heat but lots of excuses / rationale could be trotted out to mitigate the flack they will get - which will happen regardless.They still have a few years grace to get away with that.If they only did that at the top end and not to a silly amount I think it would land ok with most.Couple with adopting a flat rate on pension contributions that is greater than now for basic rate payers and less for higher rate payers I think they could buy themselves some extra tax revenue without outright revolt.4

-

I’m not so sure. Not enough save or can afford to save for retirement so changing it significantly might just create more issues.Huskaris said:

The point I'm making is how raising the personal allowance in line with triple lock criteria is easily dismissed as "unaffordable" yet getting rid of the triple lock, let alone means testing pensions is seen as unspeakable, when in reality triple locking pensions is unaffordable...TelMc32 said:

It isn’t affordable. That’s why it isn’t being implemented.Huskaris said:

Would be nice if something similar was done to pensions then, interesting how that is affordable...bobmunro said:Huskaris said:Wouldn't it be great if the personal allowance got the triple lock treatment? Then it's solved and closer to some form of equity for working people.There was a call to increase the PA from £12,570 to £20,000 - that would cost £50 billion! Even raising it to say £16,000 would be cost prohibitive for our busted economy.It aint happening - the most likely outcome is that from 2028/29 tax year it will increase by CPI each year, but that still might not happen.

State pensions will have to be completely overhauled at some point.It’s also political suicide to do something radical so falls into the category of leave alone or only tweak.0 -

Saw a piece on tv the other day that said that pre the triple lock a typical 2 pensioner household's income was roughly the same as a 2 adult / 2 children household income.

It is now £5k pa more, as pensions have gone up year by year but working incomes haven't due to pay freezes etc.2 -

The triple lock makes little sense to me, other than dragging our generally low level of state pension provision up to a liveable level.

Is it unreasonable to suggest that inflation drives wages which in turn drive inflation and so on?

So if inflation in year 1 is 5% and wages in year two are increased by 5% to keep pace, pensioners will receive 2 x 5%, thus gaining on both sides, costing taxpayers billions. Surely just linking pensions to inflation plus a small fixed addition would keep things more aligned while pensioners gradually catch up.

If the PA is lower than the state pension, the government will be pilloried for making pensioners have to pay additional tax, so the PR benefit of sticking to the triple lock will be more than wiped out despite the pensioners being taxed only because the pension has been increased so much by comparison.0 -

Out of interest does anyone know what the state pension is for other European countries? (and what age do they retire?). I wouldnt be at all surprised if we are in the bottom 4 of all out European 'friends'1

-

I’m not following the maths.golfaddick said:Saw a piece on tv the other day that said that pre the triple lock a typical 2 pensioner household's income was roughly the same as a 2 adult / 2 children household income.

It is now £5k pa more, as pensions have gone up year by year but working incomes haven't due to pay freezes etc.2 pensions = c£25k

average salary =£35k

What am I misunderstanding?0 -

It’s referencing the costs that a family have to deal with as against the pensioners who no longer have to deal with those. It’s suggested that the family would need closer to £48k to have a comparable lifestyle after you take account of housing costs, childcare, education, food bills etc.valleynick66 said:

I’m not following the maths.golfaddick said:Saw a piece on tv the other day that said that pre the triple lock a typical 2 pensioner household's income was roughly the same as a 2 adult / 2 children household income.

It is now £5k pa more, as pensions have gone up year by year but working incomes haven't due to pay freezes etc.2 pensions = c£25k

average salary =£35k

What am I misunderstanding?3 -

Sponsored links:

-

France went on strike & had riots when they increased their retirement age....from 62 to 64 !CheshireAddick said:Out of interest does anyone know what the state pension is for other European countries? (and what age do they retire?). I wouldnt be at all surprised if we are in the bottom 4 of all out European 'friends'

No idea what it us in other European countries but I would hazard a guess that the UK current retirement age of 67 is one of the highest.0 -

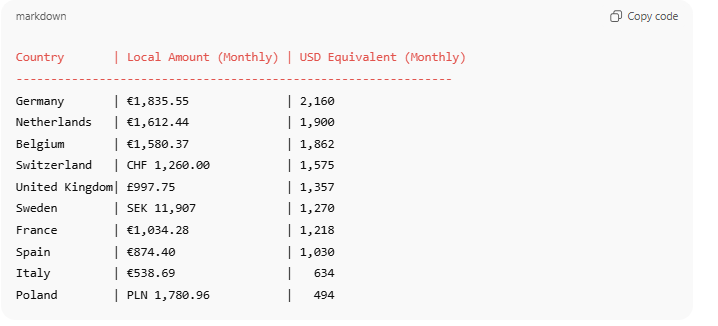

ChatGPT did this for me (and I converted to USD for ease of comparison). We are 5th of the major nations in Europe for monthly state pension values (there are of course some nuance to this, but this is broadly correct when double checked)CheshireAddick said:Out of interest does anyone know what the state pension is for other European countries? (and what age do they retire?). I wouldnt be at all surprised if we are in the bottom 4 of all out European 'friends'

Same data with added state pension ageCountry

Local Amount (Monthly)

USD Equivalent (Monthly)

Retirement Age (2025)

Germany

€1,835.55

2,160

66y 10m (rising to 67 by 2031)

Netherlands

€1,612.44

1,900

67 (linked to life expectancy)

Belgium

€1,580.37

1,862

65 (rising to 66 in 2025, 67 in 2030)

Switzerland

CHF 1,260.00

1,575

65 (men), 64 (women; aligning to 65 by 2028)

United Kingdom

£997.75

1,357

66 (rising to 67 by 2028, 68 later)

Sweden

SEK 11,907

1,270

66 (2025; rising to 67 by 2026, linked to life expectancy)

France

€1,034.28

1,218

64 (raised from 62 in 2023 reform)

Spain

€874.40

1,030

66y 6m (rising to 67 by 2027)

Italy

€538.69

634

67 (linked to life expectancy)

Poland

PLN 1,780.96

494

65 (men), 60 (women)

2 -

That a lot of pensioners have other incomes other than the State Pension. My father is 94 next month & he only had an occupational pension scheme for the last 10 years of his working life.valleynick66 said:

I’m not following the maths.golfaddick said:Saw a piece on tv the other day that said that pre the triple lock a typical 2 pensioner household's income was roughly the same as a 2 adult / 2 children household income.

It is now £5k pa more, as pensions have gone up year by year but working incomes haven't due to pay freezes etc.2 pensions = c£25k

average salary =£35k

What am I misunderstanding?

Lots of Baby boomers were / have been employed in sectors where occupational schemes are the norm. Lots of baby boomers have been in final salary schemes that are now closed to new employees.

I have clients (mainly NHS doctors) that have an index linked pension in excess of £50k pa. 2 that I deal with (in their 70's) now have an NHS pension of £85k pa. I know a NHS consultant who is taking his (old) NHS pension at age 59 and the increased TFC is more than the maximum £268,275. Taking his TFC at the maximum will still give him a pension of £70k pa.

0 -

Interesting piece here about current and future pension ages across EU. Looks like Turkey are taking the proverbial a bit!! Retirement age of 52!!! Rising to 65, but only for those entering the workforce from 2022.1

-

Yes I understand if you are saying a group don’t ‘need’ the state pension in addition to other income sources. I guess though that’s arguably addressed by it being taxable income.golfaddick said:

That a lot of pensioners have other incomes other than the State Pension. My father is 94 next month & he only had an occupational pension scheme for the last 10 years of his working life.valleynick66 said:

I’m not following the maths.golfaddick said:Saw a piece on tv the other day that said that pre the triple lock a typical 2 pensioner household's income was roughly the same as a 2 adult / 2 children household income.

It is now £5k pa more, as pensions have gone up year by year but working incomes haven't due to pay freezes etc.2 pensions = c£25k

average salary =£35k

What am I misunderstanding?

Lots of Baby boomers were / have been employed in sectors where occupational schemes are the norm. Lots of baby boomers have been in final salary schemes that are now closed to new employees.

I have clients (mainly NHS doctors) that have an index linked pension in excess of £50k pa. 2 that I deal with (in their 70's) now have an NHS pension of £85k pa. I know a NHS consultant who is taking his (old) NHS pension at age 59 and the increased TFC is more than the maximum £268,275. Taking his TFC at the maximum will still give him a pension of £70k pa.But surely the greater risk down the line is more will need it in addition to other sources because they aren’t making (or are unable to) sufficient provision for personal pensions.All circles back to the personal allowance thresholds I suppose.0 -

I don’t think means testing state pensions is workable long term. It’ll hardly encourage people to make their own plans.

we can talk about a tax rise here and there or coming up with new taxes. But the elephant in the room is how much the government is of the national economy and how we now spend almost double we did ten years ago. Yet nothing seems to have improved.

until the government gets a grip on that and growth it’s piddling in the wind.

so who’s moving to Guernsey with me?! 😂2 -

If anybody has tried living off 14k a year on this forum, ask yourself what getting a letter from HMRC asking for £286 (with their usual menaces) would feel like. Also, one reason this government got into trouble was by trying to take £200 from pensioners through the winter fuel allowance. Just wait for the s*** to hit the fan when these HMRC letters start arriving.golfaddick said:

Yes this.Rob7Lee said:

Exactly your last point, it’s not taxed (at source), but generally you simply pay the tax on it via your other income, if you have any.PragueAddick said:@golfaddick Not sure why you are suggesting the State pension is not taxed? Of course it is. It was in my taxable income for the last 8 years or so. If I had made 12k on, say, rental only in a year, and not had a state pension, I wouldn't have paid any tax.

It's only "not taxed" if you don't have to declare it, surely?

The State Pension is taxable, but it is always paid in full without any tax taken off (should you have any other income). Its that other income that is then taxed at source and paid net.

This is the problem I've been trying to highlight. There are lots of pensioners (millions?) whose only income is the State pension. Soon the State Pension will exceed the Personal Allowance. If so, where will the tax be taken from ? They have no other income to be taxed, so logically it will have to be deducted from the State Pension. But seeing as the State Pension has never had tax taken from it something will have to budge.

And I'm only been talking about the State 2nd Pension (the new one) that anyone retiring after 2016 has been receiving. There are millions drawing money from the old State Pension (my father for one) who get more due to the many changes the "Old Age Pension" has gone through. This has been brought to my attention, not only because of the forthcoming triple lock issues, but because my father is already receiving in excess of the PA and not paying tax (his pension includes the Graduation Pension and years of being contracted in during the 50's & 60's when there were no Company schemes for manual workers).

However.....I've just checked online & it seems that plans are already on place. Pensioners whose State Pension is in excess of the PA will be sent a simple assessment letter from HMRC. They will have done a calculation, based on information from DWP, and will simply ask for a payment from the individual. This is supposedly starting from the summer of 2026 & will have until 31st Jan 2027 to pay it.

Eg. Someone has a State Pension of £14000. Take off their PA of £12570 leaves taxable income of £1,430. 20% of that = £286.

I still think this will panic a lot of pensioners.

Edit.

Since writing my monologue it appears that @bobmunro has answered it more succinctly.0 -

Thanks all. In all honesty I though we would be further down the 'league ladder'TelMc32 said:Interesting piece here about current and future pension ages across EU. Looks like Turkey are taking the proverbial a bit!! Retirement age of 52!!! Rising to 65, but only for those entering the workforce from 2022.

0 -

I know, hence why I think that Rachel Reeves will have to increase the Personal Allowance.....even if it's just for those on limited incomes.Southbank said:

If anybody has tried living off 14k a year on this forum, ask yourself what getting a letter from HMRC asking for £286 (with their usual menaces) would feel like. Also, one reason this government got into trouble was by trying to take £200 from pensioners through the winter fuel allowance. Just wait for the s*** to hit the fan when these HMRC letters start arriving.golfaddick said:

Yes this.Rob7Lee said:

Exactly your last point, it’s not taxed (at source), but generally you simply pay the tax on it via your other income, if you have any.PragueAddick said:@golfaddick Not sure why you are suggesting the State pension is not taxed? Of course it is. It was in my taxable income for the last 8 years or so. If I had made 12k on, say, rental only in a year, and not had a state pension, I wouldn't have paid any tax.

It's only "not taxed" if you don't have to declare it, surely?

The State Pension is taxable, but it is always paid in full without any tax taken off (should you have any other income). Its that other income that is then taxed at source and paid net.

This is the problem I've been trying to highlight. There are lots of pensioners (millions?) whose only income is the State pension. Soon the State Pension will exceed the Personal Allowance. If so, where will the tax be taken from ? They have no other income to be taxed, so logically it will have to be deducted from the State Pension. But seeing as the State Pension has never had tax taken from it something will have to budge.

And I'm only been talking about the State 2nd Pension (the new one) that anyone retiring after 2016 has been receiving. There are millions drawing money from the old State Pension (my father for one) who get more due to the many changes the "Old Age Pension" has gone through. This has been brought to my attention, not only because of the forthcoming triple lock issues, but because my father is already receiving in excess of the PA and not paying tax (his pension includes the Graduation Pension and years of being contracted in during the 50's & 60's when there were no Company schemes for manual workers).

However.....I've just checked online & it seems that plans are already on place. Pensioners whose State Pension is in excess of the PA will be sent a simple assessment letter from HMRC. They will have done a calculation, based on information from DWP, and will simply ask for a payment from the individual. This is supposedly starting from the summer of 2026 & will have until 31st Jan 2027 to pay it.

Eg. Someone has a State Pension of £14000. Take off their PA of £12570 leaves taxable income of £1,430. 20% of that = £286.

I still think this will panic a lot of pensioners.

Edit.

Since writing my monologue it appears that @bobmunro has answered it more succinctly.

As I said, I wouldn't want to he in her shoes.0 -

I may well have completely lost it, but FFS....

On what planet does it make any sense to tax a State pension, whose payments are regulated by the State? Give millions of citizens money and then make them pay back 20% or so a year later via a convuluted tax reporting system to a tax office that is barely functioning? FFS!!! If you want to reduce the size of the State pension, then do it. Reduce, or don't increase, the net payment. Not this way, by taxing it, driving everyone even more nuts with their tax returns and putting an even bigger burden on the hapless HMRC.

I mean...what am I missing here?

5 -

Sponsored links:

-

Partly agree, but this is the issue with the tax free allowance being frozen yet the state pension being raised significantly (wasn't only around £7k in 2020).PragueAddick said:I may well have completely lost it, but FFS....

On what planet does it make any sense to tax a State pension, whose payments are regulated by the State? Give millions of citizens money and then make them pay back 20% or so a year later via a convuluted tax reporting system to a tax office that is barely functioning? FFS!!! If you want to reduce the size of the State pension, then do it. Reduce, or don't increase, the net payment. Not this way, by taxing it, driving everyone even more nuts with their tax returns and putting an even bigger burden on the hapless HMRC.

I mean...what am I missing here?

My solution solves all of this, make the tax free allowance £18-20k. Simples........ Anyone earning over around £125k doesn't get the allowance anyway, so it can't be said to be helping the richest. Then just tweak the 20/40 and maybe 45p bands to a slightly higher level to balance out along with in work benefits. You'd likely also raise more VAT as for the lower earners the additional net income will be spent rather than saved.2 -

This.Rob7Lee said:

Partly agree, but this is the issue with the tax free allowance being frozen yet the state pension being raised significantly (wasn't only around £7k in 2020).PragueAddick said:I may well have completely lost it, but FFS....

On what planet does it make any sense to tax a State pension, whose payments are regulated by the State? Give millions of citizens money and then make them pay back 20% or so a year later via a convuluted tax reporting system to a tax office that is barely functioning? FFS!!! If you want to reduce the size of the State pension, then do it. Reduce, or don't increase, the net payment. Not this way, by taxing it, driving everyone even more nuts with their tax returns and putting an even bigger burden on the hapless HMRC.

I mean...what am I missing here?

My solution solves all of this, make the tax free allowance £18-20k. Simples........ Anyone earning over around £125k doesn't get the allowance anyway, so it can't be said to be helping the richest. Then just tweak the 20/40 and maybe 45p bands to a slightly higher level to balance out along with in work benefits. You'd likely also raise more VAT as for the lower earners the additional net income will be spent rather than saved.

As @Pragueaddick says, none of it makes sense. And as I said earlier, a decision will have to be made either at this Budget in November or the next one.

0 -

Think you guys are overstating the issues. To be liable for tax youd have to be on the full state pension with 35 years NI contributions. I'll bet very few people who qualify won't have any kind of private pension at all.

The real issue is the triple lock. It will kill the country's finances gradually like a frog in a pot but I doubt anyone will be brave enough to get rid.0 -

That wouldn't be a tweak. A raise to 20k would cost £60 billion. Either huge increases in tax elsewhere or massive cuts. Not simples at allRob7Lee said:

Partly agree, but this is the issue with the tax free allowance being frozen yet the state pension being raised significantly (wasn't only around £7k in 2020).PragueAddick said:I may well have completely lost it, but FFS....

On what planet does it make any sense to tax a State pension, whose payments are regulated by the State? Give millions of citizens money and then make them pay back 20% or so a year later via a convuluted tax reporting system to a tax office that is barely functioning? FFS!!! If you want to reduce the size of the State pension, then do it. Reduce, or don't increase, the net payment. Not this way, by taxing it, driving everyone even more nuts with their tax returns and putting an even bigger burden on the hapless HMRC.

I mean...what am I missing here?

My solution solves all of this, make the tax free allowance £18-20k. Simples........ Anyone earning over around £125k doesn't get the allowance anyway, so it can't be said to be helping the richest. Then just tweak the 20/40 and maybe 45p bands to a slightly higher level to balance out along with in work benefits. You'd likely also raise more VAT as for the lower earners the additional net income will be spent rather than saved.

https://www.tax.org.uk/raising-income-tax-threshold-boost-for-vulnerable-or-blow-to-public-services1 -

If you are still working at retirement age then employee NI becomes zero. It wouldn't be that difficult to have a different PA that kicks in when a person hits their retirement age. Tie that increase in PA to the triple lock too, or rate of inflation and basic state pension shouldn't ever get taxed.2

-

https://www.gov.uk/government/statistics/pensioners-incomes-financial-years-ending-1995-to-2023/pensioners-incomes-financial-years-ending-1995-to-2023

According to this Govt report, 17% of pensioners had private pensions in 20230 -

Would only cost 60bn if you did nothing else, you’d need the full facts and figures, but raising to 25p/45p the two bands for instance may balance it out together with lower working tax credits etc.Jints said:

That wouldn't be a tweak. A raise to 20k would cost £60 billion. Either huge increases in tax elsewhere or massive cuts. Not simples at allRob7Lee said:

Partly agree, but this is the issue with the tax free allowance being frozen yet the state pension being raised significantly (wasn't only around £7k in 2020).PragueAddick said:I may well have completely lost it, but FFS....

On what planet does it make any sense to tax a State pension, whose payments are regulated by the State? Give millions of citizens money and then make them pay back 20% or so a year later via a convuluted tax reporting system to a tax office that is barely functioning? FFS!!! If you want to reduce the size of the State pension, then do it. Reduce, or don't increase, the net payment. Not this way, by taxing it, driving everyone even more nuts with their tax returns and putting an even bigger burden on the hapless HMRC.

I mean...what am I missing here?

My solution solves all of this, make the tax free allowance £18-20k. Simples........ Anyone earning over around £125k doesn't get the allowance anyway, so it can't be said to be helping the richest. Then just tweak the 20/40 and maybe 45p bands to a slightly higher level to balance out along with in work benefits. You'd likely also raise more VAT as for the lower earners the additional net income will be spent rather than saved.

https://www.tax.org.uk/raising-income-tax-threshold-boost-for-vulnerable-or-blow-to-public-services

it simply crazy that someone on minimum wage has 1/3rd of their salary taxed.0 -

I was a bit confused by this stat until I worked out that personal pension is not the same as a private pension and essentailly means non-occupational pension (eg you set it up and run it yourself).Southbank said:https://www.gov.uk/government/statistics/pensioners-incomes-financial-years-ending-1995-to-2023/pensioners-incomes-financial-years-ending-1995-to-2023

According to this Govt report, 17% of pensioners had private pensions in 2023

Private pension (eg one your pay into via your salary) income was received by 70% of pensioners in FYE 2023, which is more consistent with the pensioners I know.6 -

We are not overstating the issue but you are correct that the triple lock is the problem.Jints said:Think you guys are overstating the issues. To be liable for tax youd have to be on the full state pension with 35 years NI contributions. I'll bet very few people who qualify won't have any kind of private pension at all.

The real issue is the triple lock. It will kill the country's finances gradually like a frog in a pot but I doubt anyone will be brave enough to get rid.

My father is 94 and draws the "old age" pension. He now receives around £16k pa. Plus a very small company pension (c£1600pa) which looks like is not being taxed. No idea why.

However, anyone retiring since 2016 receives the New State pension. With full NI contributions this is currently paying £230.25 per week = £11,973 pa. In April next year, if it increases in line with average earnings (4.7%) then it rises to £12, 535. Just a smidgen under the Personal Allowance.

You wont need any other pension income to soon be over the PA and thus paying tax. As @pragueaddick said - it is madness that a "benefit" that is paid to all pensioners will soon be taxed. DWP pay it to you with one hand and HMRC will be taking some back with the other.0 -

2008 HBOS. Gordon Brown, mugged Eric Daniels into a rushed takeover of HBOS to prevent their collapse. Without proper due diligence, Lloyds were massively misled regarding the volume of Debt that HBOS had. That debt in the end started to bring Lloyds down. Prior to that disasterous takeover, Lloyds had been regarded as the most stable of the banks during the crisis. Ultimately the Government had to bail Lloyds out, and took a significant shareholding in the bank.golfaddick said:

Means absoluty nothing. No UK Government would let a British bank fail. Certainly not one of the mainstream ones. Look at what happened in 2008 to HBOS. The taxpayer lost millions in that deal. Any protection should be at a much lower level, say £30k. Protect the masses by all means.Valianterith said:Earlier in the year there was talk of the £85000 limit being increased has anything more happenedIn the years that followed, the Government sold its holding back into the market, and when completed actually made a profit on its original bail out figure.I fail to see where the Tax Payer made a loss. In fact the only losers were the Lloyds Shareholders. They saw their investments, totally destroyed and in many cases completely wiped out. The heaviest hit amongst Shareholders were Lloyds Staff, many of whom lost their life savings.3