The Politics of Tax thread

Comments

-

Oh dear, this really is becoming disappointingly shrill. For now, just a correction for Dippenhall. You have attempted to define a tax haven. I am afraid it is manifestly faulty. The Netherlands, Luxembourg, the Republic of Ireland, and the US state of Delaware, do not remotely fit the description you offer.1

-

Please define a tax haven.PragueAddick said:Oh dear, this really is becoming disappointingly shrill. For now, just a correction for Dippenhall. You have attempted to define a tax haven. I am afraid it is manifestly faulty. The Netherlands, Luxembourg, the Republic of Ireland, and the US state of Delaware, do not remotely fit the description you offer.

0 -

"....the U.S. Government Accountability Office in its December 2008 report on the use of tax havens by American corporations, was unable to find a satisfactory definition of a tax haven...."

But of course CL experts know different don't they.0 -

I think in general terms a tax haven is a country or jurisdiction which accommodates citizens of other countries attempting to hide their true wealth or income from the relevant tax authorities.

The USA actually legally obliges all of its citizens to declare all wealth and income regardless of where it is held so the IRS can tax them accordingly. Most countries will report back to the US the financial activities of its citizens but sometimes this is not so forthcoming, particularly if the link between the tax haven and the US citizen is obscured by a shell company or some other corporation designed to evade tax.1 -

Perhaps the easiest solution is for the British government is recognise that the Crown Dependencies are abusing VAT law and their autonomy to waiver it and bring it in house. There is no good reason why they should have such autonomy considering they are essentially British subjects.1

-

People are incredibly greedy - it's really not that hard to understand.cafcfan said:

So much of what you've said is so silly it does not merit a response. But the "how much money do some people need" question caught my attention.hoof_it_up_to_benty said:

Greedy c***ts awash with money don't need to send their capital abroad to hide it - it's their choice to evade it. How much money do some people need?Fiiish said:

Another solution is simplifying our tax system and lowering taxes so people don't need to send their capital abroad to hide it.Dippenhall said:

No none of those, unless, you mean, like you I have a pension.Addick Addict said:

Just to say that I have no agenda whatsoever though I do wonder if you are an accountant/tax adviser/owner of a company that seeks to use these vehicles.Dippenhall said:

Your statement makes the assumption that only tax raised and spent by governments contributes to society.Addick Addict said:The corruptness and lack of morality demonstrated by those providing and reaping the benefits from tax evasion schemes to limit their contribution to society is truly mind blowing.

The Paraduse Papers haven’t been used to expose how much has been paid to charities or establish foundations. No mention of how their investments have created companies that provide jobs. No exposure of the content of Wills leaving everything to charity. No mention of Ashcroft funding the Belize orphanage to take kids off the street and HIV children abandoned by society.

Doesn’t fit the agenda does it.

All those "benefits" you mention are very laudable. I wonder what percentage of those companies profits are utilised for the benefit of charities vs the tax saved through avoidance/evasion.

But let's suppose that those companies did contribute all that they were expected to rather than using tax shelters to avoid/evade doing so? Would they not have a business to run? Would society be better or worse off?

You ask why does anyone "seek to use these vehicles" and the answer is the same reason you might shop in Amazon to find the best deal, or why on holiday you bring back some duty-free booze. If you wait until you return to the UK to pay duty on your booze instead of paying less duty to the foreign tax authorities, if you want to pay top dollar for everything on the basis you ensure you pay the most VAT, then you are in a position to moralise.

Investing is just buying money, albeit you don't know exactly what you are going to get, but just like you, it is normal, legal and reasonable to buy what you want at the lowest price to optimise how much you pay for the commodity.

Offshore tax "havens" are simply States that have a different tax regime because they have a small public sector budget and need less tax revenue. It creates potential for arbitrage between using one state or another for services or commodities that bear low taxes and therefore are cheaper, just like you can arbitrage between a black cab and Uber which have different technologies and pricing. The difference being that there is no cost of arbitrage between cabs but a significant cost for accessing foreign services and products that comply with local law, so that limits access to only those that can afford to. Pension funds and collective vehicles allow access to investment services arbitrage by sharing the cost of access to optimise net returns. So the dumb idea that people should check what their pension fund is doing and complain, is not dumb as long as every other purchasing choice you make in life is centred around how much tax you must avoid avoiding.

The solution to the perceived outrage at saving money by choosing not to buy a service or product that attracts UK tax is easily solved. We have a socialist authoritarian regime on the lines of a Russian or Chinese system that controls who has access to capital, what it can be used for and who can use it. Of course, the socialist elite in power would not abuse their position to maximise their wealth simply because they were not accountable to a higher judiciary. Another option to ensure taxes are "fair" is to cancel all tax laws and let the government handle your bank account and take out what tax they need for anything they want to spend it on.

The only solution to the tax haven "problem" apart from vaporising envy, involves undermining democratic principles.

If the tax rate was 1% they'd still look at avoiding it. I'm sick to death of billionaires and global corporations evading tax whether what they do is legal or not - the pathetic apologists for them is just as bad.

The tax system is a joke and won't be reformed because it benefits the super rich who can employ tax advisers to shovel off their money to a tax haven.

Wankers like Lewis Hamilton can wrap themselves in the Union Jack whilst living in Monaco to evade tax.

The Governments have no interest in simplifying the tax system and closing loopholes that their friends benefit from.

What if you win the lottery? Say a nice £10mn. Well, you'd want a lovely new house; a Ferrari and a full fat Overfinch or maybe a Benteyga; probably a holiday home; maybe a yacht; you'd fly everywhere first class; stay in the poshest of posh 5* hotels; and drink Perrier-Jouët Belle Epoque 2008 as if it were lemonade. Oh, and the daughter would want a pony and need somewhere to keep it and someone to look after it.

But what with running costs and depreciation, you'd soon find your 10 mill had evaporated. I reckon to get yourself properly sorted out you need somewhere around £100mn at least.

Which is interesting. It means you can have a pretty good life on, say, a couple of million or you need eight zeros, minimum. All the figures in between are no good to man nor beast and will ultimately lead to dissatisfaction and despair.

I don't see having an issue with tax evasion while large numbers of people live in unnecessary poverty as being 'silly'. We live in a world that sucks up to rich immoral idiots and we have companies such as Apple that sit on huge cashpiles that it does nothing with.

Massive wealth inequality is a brilliant wheeze and hopefully the super rich will eventually get their tax rates down to 0% so that they don't have to use offshore tax havens.

The taxation system could be made fairer if there was the will to do so but ultimately there isn't as the loopholes are there to allow large corporations and the rich to evade tax.

Just because something may be legal doesn't mean it's right or moral. There are many things that have been legal in the past that we now see as wrong.

You have a choice about how you conduct yourself and the bigger the inequality in wealth becomes the more social unrest there will be.

Politics is at a crossroad at present - a bit of moral leadership is needed.5 -

Global tax systems could be simplified so that tax evasion/avoidance wasn't so simple. It's unlikely to happen as I'm sure the average billionaire would lobby against it.Dippenhall said:

"I'm sick to death of billionaires and global corporations evading tax whether what they do is legal or not"hoof_it_up_to_benty said:

Greedy c***ts awash with money don't need to send their capital abroad to hide it - it's their choice to evade it. How much money do some people need?Fiiish said:

Another solution is simplifying our tax system and lowering taxes so people don't need to send their capital abroad to hide it.Dippenhall said:

No none of those, unless, you mean, like you I have a pension.Addick Addict said:

Just to say that I have no agenda whatsoever though I do wonder if you are an accountant/tax adviser/owner of a company that seeks to use these vehicles.Dippenhall said:

Your statement makes the assumption that only tax raised and spent by governments contributes to society.Addick Addict said:The corruptness and lack of morality demonstrated by those providing and reaping the benefits from tax evasion schemes to limit their contribution to society is truly mind blowing.

The Paraduse Papers haven’t been used to expose how much has been paid to charities or establish foundations. No mention of how their investments have created companies that provide jobs. No exposure of the content of Wills leaving everything to charity. No mention of Ashcroft funding the Belize orphanage to take kids off the street and HIV children abandoned by society.

Doesn’t fit the agenda does it.

All those "benefits" you mention are very laudable. I wonder what percentage of those companies profits are utilised for the benefit of charities vs the tax saved through avoidance/evasion.

But let's suppose that those companies did contribute all that they were expected to rather than using tax shelters to avoid/evade doing so? Would they not have a business to run? Would society be better or worse off?

You ask why does anyone "seek to use these vehicles" and the answer is the same reason you might shop in Amazon to find the best deal, or why on holiday you bring back some duty-free booze. If you wait until you return to the UK to pay duty on your booze instead of paying less duty to the foreign tax authorities, if you want to pay top dollar for everything on the basis you ensure you pay the most VAT, then you are in a position to moralise.

Investing is just buying money, albeit you don't know exactly what you are going to get, but just like you, it is normal, legal and reasonable to buy what you want at the lowest price to optimise how much you pay for the commodity.

Offshore tax "havens" are simply States that have a different tax regime because they have a small public sector budget and need less tax revenue. It creates potential for arbitrage between using one state or another for services or commodities that bear low taxes and therefore are cheaper, just like you can arbitrage between a black cab and Uber which have different technologies and pricing. The difference being that there is no cost of arbitrage between cabs but a significant cost for accessing foreign services and products that comply with local law, so that limits access to only those that can afford to. Pension funds and collective vehicles allow access to investment services arbitrage by sharing the cost of access to optimise net returns. So the dumb idea that people should check what their pension fund is doing and complain, is not dumb as long as every other purchasing choice you make in life is centred around how much tax you must avoid avoiding.

The solution to the perceived outrage at saving money by choosing not to buy a service or product that attracts UK tax is easily solved. We have a socialist authoritarian regime on the lines of a Russian or Chinese system that controls who has access to capital, what it can be used for and who can use it. Of course, the socialist elite in power would not abuse their position to maximise their wealth simply because they were not accountable to a higher judiciary. Another option to ensure taxes are "fair" is to cancel all tax laws and let the government handle your bank account and take out what tax they need for anything they want to spend it on.

The only solution to the tax haven "problem" apart from vaporising envy, involves undermining democratic principles.

If the tax rate was 1% they'd still look at avoiding it. I'm sick to death of billionaires and global corporations evading tax whether what they do is legal or not - the pathetic apologists for them is just as bad.

The tax system is a joke and won't be reformed because it benefits the super rich who can employ tax advisers to shovel off their money to a tax haven.

Wankers like Lewis Hamilton can wrap themselves in the Union Jack whilst living in Monaco to evade tax.

The Governments have no interest in simplifying the tax system and closing loopholes that their friends benefit from.

Like i said before, the solution is the socialist elite abandoning the rule of law to decide themselves who pays tax.

I'm not an apologist for anyone, but clearly you think the wealthy should be apologising to you because you're shit green with envy you aren't rich. You avoid tax every day by not emigrating to Sweden where they pay much more tax than in the UK.

Hope you've opted out of your evil pension scheme that avoids paying tax by using offshore financial centres where it has a choice. Hope you don't take any of it in cash tax free.

Apart from being rich, (and paying over 60% of UK income tax), what's the issue with choosing not to bear tax if the tax laws don't require it?

Please suggest your solution for getting more tax from people who can choose where they live and where they spend and invest their money.

You choose to ignore the distinction between tax evasion and tax avoidance, because you have so much jealousy and hate to spew out, but evasion is illegal, and you don't evade UK tax by sending it overseas, because every UK account holder's details are sent back to HMRC so they have to declare it for UK tax.

Presumably if you had Lewis Hamilton's wealth you would live in small flat in Bradford, drive a second hand hatchback and give everything to the government - if not, at what stage do you become a wanker?

Lewis Hamilton resides in Monaco to avoid paying tax yet bangs on about being British.

I just happen to think massive wealth inequality and an unfair tax system are perhaps not the best thing for the world. It's not jealousy and hate but just an acknowledgement at how unhealthy it all is.

So much wealth being concentrated in the hands of so few is in my opinion not a good thing however they came about about it.

If you're happy with the current levels of inequality that's fine and if you wish to have Lewis Hamilton's lifestyle that's up to you. I wouldn't choose to live abroad just to minimise my tax if I was worth as much as him - money really shouldn't be that important.

Paying tax doesn't involve giving everything to the government as you seem to imply.

3 -

I quite like Fishy's above. Certainly fits my little group of rogues better than yours did.Dippenhall said:

Please define a tax haven.PragueAddick said:Oh dear, this really is becoming disappointingly shrill. For now, just a correction for Dippenhall. You have attempted to define a tax haven. I am afraid it is manifestly faulty. The Netherlands, Luxembourg, the Republic of Ireland, and the US state of Delaware, do not remotely fit the description you offer.

0 -

I'm sorry @hoof_it_up_to_benty, I had to cut out the "quotes" because it had got too long.

But you said: "The taxation system could be made fairer if there was the will to do so but ultimately there isn't as the loopholes are there to allow large corporations and the rich to evade tax."

So, setting aside taxes we all can't avoid if we are in the country, like VAT, fuel and booze duty, council tax and the like, here's some actual facts. First, about 90% of income tax is paid by the wealthiest 50%. Meanwhile, around 45% of the working age population pay no income tax at all. Nothing, nada, not a bean. The Government is so reliant on the rich that the richest 1% actually pay 27% of all income tax. Perhaps you have been misled by the lies put forward by John McDonnell. If so, here's the BBC's "reality check" bbc.co.uk/news/uk-politics-39641222

So, how do you make the tax system "fairer"? How much tax have the rich evaded? This FT article sort of sums it up really https://ft.com/content/afd88af6-3645-11e7-99bd-13beb0903fa3.

In short, there just aren't enough rich people to squeeze out sufficient revenues from to make up for the fact that close to 55% of UK households are net beneficiaries from the combined taxation/benefits systems. The percentage has been going up inexorably. But clearly it's impossible for that to continue!

According to the ONS, "The overall impact of taxes and benefits are that they lead to income being shared more equally between households. In the financial year ending (fye) 2016 (April 2015 to March 2016), before taxes and benefits, the richest fifth (those in the top income quintile group) had an average original income of £84,700 per year, compared with £7,200 for the poorest fifth – a ratio of 12 to 1. This ratio has decreased from 14 to 1 in fye 2015 indicating that inequality of original income has reduced slightly according to this measure. This was mainly due to an increase in the average income from employment for the poorest fifth, reflecting increases in both the wages and employment of people living in those households."

So, it would seem maybe that the Government has actually taken steps to share income more equally! Be this from hugely increased personal tax allowances (up from £6475 in the tax year 2010/11 to £11,500 in the current year or from increases to the minimum wage. Unless you earn over £122k of course in which case there is no tax free allowance. Then there are the extra hits to the wealthy through things like the tapered annual allowance to pension contributions and the incremental drift of higher rate tax bands. Is any of that, do you think, actually "fair"?

Now, on to large corporations. A different kettle of fish completely. I still wonder whether they should be subject to corporation tax at all frankly. The "No taxation without representation" mantra seems fair doesn't it? Should we give Apple a block vote at general elections based upon the amount of tax it pays?

Perhaps it would be better and more efficient to slap an equivalent tax paid by the end user of the various products/services. That way, taxation would be impossible to avoid, the end user gets a vote and can vote accordingly if they don't like a tax rise and, hopefully, the pre-tax price per unit would decrease and offset the cost to the consumer of the extra tax. The stumbling block is how you'd deal with the value of overseas sales, I suppose. I somehow doubt the UK voter would take too kindly to subsidising the sale of a Bentley to someone in Dubai.

2 -

Cop out.PragueAddick said:

I quite like Fishy's above. Certainly fits my little group of rogues better than yours did.Dippenhall said:

Please define a tax haven.PragueAddick said:Oh dear, this really is becoming disappointingly shrill. For now, just a correction for Dippenhall. You have attempted to define a tax haven. I am afraid it is manifestly faulty. The Netherlands, Luxembourg, the Republic of Ireland, and the US state of Delaware, do not remotely fit the description you offer.

0 -

Sponsored links:

-

@hoof_it_up_to_benty You only remove the problems that you feel so strongly about if there is global harmonisation of tax, that's a simple solution.

So a small island with a few million inhabitants and no natural resources of manufacturing capability would have to charge the same income tax and corporation tax as the UK. The result is a mass transfer of wealth to the developed large economies through increased tax revenues and the sucking away of the tax revenue enjoyed by small Island nations who don't need to charge a high tax rate to cover public spending. Shame if that it would leave the islands unable to support the inhabitants with either employment or benefits. Who cares if they starve and die, certainly not those who want tax havens abolished to make the world fairer.

Do you want to point out the flaws in the solution. Here's one - make sure you define a tax haven carefully so you only starve out the inhabitants who deserve it. Did you say you were concerned with inequality, or is that only between you and those richer than you?

Every other solution involves barriers to free movement - not a Remainer are you?

2 -

Some of these are bordering or actually illegal but, unfortunately, HMRC don't have sufficient resource - why work for HMRC for £50K a year when a tax adviser at the upper end can earn ten times that?bobmunro said:Most of the arguments I've read here are arguing from a moral standpoint, not a legal one.

This may have been said already, but if a scheme is considered tax evasion then a criminal offence has been committed and should be prosecuted. If a scheme is considered tax avoidance then if this is against the spirit of legislation but still legal then the legislation is shit and should be amended to close the loophole.

Most of the examples given in the Panorama programmes (and I haven't seen all of it) seem to me to be underhand but still legal tax avoidance.

However, as in the case with the Ingenious Film Funding Scheme, investors do get caught with their trousers down.

But I take the moral point and just wish more of these individuals were similarly like minded.0 -

@cafcfan I really can't be having this "do away with corporation tax" line

Apple, Google, and the like benefit hugely from the following:

- an educated work force

- a healthy work force (including their expats if they fall sick)

- an outstanding justice system that will protect their legitimate interests

- equally outstanding police force that will protect their legitimate interests

- equally outstanding emergency services that will protect their health and their properties

- a very good - but not best in class - transport infrastructure

- access to brilliant academic and scientific research in our State run Universities

all of which are paid for by tax revenue. In addition, the vast majority of their employees in the UK do have a vote, and will doubtless consider their employer when deciding how to vote. In my experience, the average Google employee, once a few drinks have loosened their ties to the cult, is pretty embarassed by the company's tax dodging.

So I think the idea that they should not contribute to paying for all that is wholly without merit. The fact that they actually don't, where their UK based or less bent global competitors such as Nokia, ITV, or numerous long established regional print media,do, goes to the heart of this discussion.

2 -

You are kidding aren't you? Isn't that a fine example of what @Fiiish would call Poe's Law.Dippenhall said:@hoof_it_up_to_benty You only remove the problems that you feel so strongly about if there is global harmonisation of tax, that's a simple solution.

So a small island with a few million inhabitants and no natural resources of manufacturing capability would have to charge the same income tax and corporation tax as the UK. The result is a mass transfer of wealth to the developed large economies through increased tax revenues and the sucking away of the tax revenue enjoyed by small Island nations who don't need to charge a high tax rate to cover public spending. Shame if that it would leave the islands unable to support the inhabitants with either employment or benefits. Who cares if they starve and die, certainly not those who want tax havens abolished to make the world fairer.

Do you want to point out the flaws in the solution. Here's one - make sure you define a tax haven carefully so you only starve out the inhabitants who deserve it. Did you say you were concerned with inequality, or is that only between you and those richer than you?

Every other solution involves barriers to free movement - not a Remainer are you?0 -

Rich people who make the rules in making rules so it’s easy for them to hide money and avoid paying tax shock.1

-

that’s if they get to leave thePragueAddick said:@cafcfan I really can't be having this "do away with corporation tax" line

Apple, Google, and the like benefit hugely from the following:

- an educated work force

- a healthy work force (including their expats if they fall sick)

- an outstanding justice system that will protect their legitimate interests

- equally outstanding police force that will protect their legitimate interests

- equally outstanding emergency services that will protect their health and their properties

- a very good - but not best in class - transport infrastructure

- access to brilliant academic and scientific research in our State run Universities

all of which are paid for by tax revenue. In addition, the vast majority of their employees in the UK do have a vote, and will doubtless consider their employer when deciding how to vote. In my experience, the average Google employee, once a few drinks have loosened their ties to the cult, is pretty embarassed by the company's tax dodging.

So I think the idea that they should not contribute to paying for all that is wholly without merit. The fact that they actually don't, where their UK based or less bent global competitors such as Nokia, ITV, or numerous long established regional print media,do, goes to the heart of this discussion.Truman showbrand new offices in Kings Cross0 -

So do you not think the 13.8% employers national insurance contributions plus business rates might not go some way towards doing that already? Surely the road tax and fuel duty we all pay is supposed to fund the transport network?PragueAddick said:@cafcfan I really can't be having this "do away with corporation tax" line

Apple, Google, and the like benefit hugely from the following:

- an educated work force

- a healthy work force (including their expats if they fall sick)

- an outstanding justice system that will protect their legitimate interests

- equally outstanding police force that will protect their legitimate interests

- equally outstanding emergency services that will protect their health and their properties

- a very good - but not best in class - transport infrastructure

- access to brilliant academic and scientific research in our State run Universities

all of which are paid for by tax revenue. In addition, the vast majority of their employees in the UK do have a vote, and will doubtless consider their employer when deciding how to vote. In my experience, the average Google employee, once a few drinks have loosened their ties to the cult, is pretty embarassed by the company's tax dodging.

So I think the idea that they should not contribute to paying for all that is wholly without merit. The fact that they actually don't, where their UK based or less bent global competitors such as Nokia, ITV, or numerous long established regional print media,do, goes to the heart of this discussion.

Business rates collected in total are around half of the record level of corporation tax. I have no idea what employers NICs add to the cost of doing business. Not a small matter I'd have thought.

My suggestion was tax neutral, with the concept being that the price charged for goods and services by companies could be reduced. That would accommodate the fact that they'd no longer have to consider the impact of corporation tax in their pricing structure and that would be balanced out by the extra cost of VAT2 or whatever you wanted to call it.

In any event, as you well know, the reality it is the consumers of goods and services that pay all the tax: not the companies. If corporation tax goes up, prices and inflation will follow: as sure as night follows day. It is not a free lunch.

In terms of the total tax take, again at record levels, the UK Govt. last year harvested the equivalent of £10,500 per person. That's per person, not per adult! You'd think maybe that would be enough wouldn't you? It's now up to close to 40% of GDP. I've no doubt, soon, it will be up towards the Scandinavian levels at around 50%. We really do need to wean Governments off their addiction to other people's money.3 -

NIC’s raises around 130bn a year, as there is no upper cap on employers contributions I suspect they account for the majority, maybe 2/3rds or more.

In total NIC’s is getting towards 20% of all tax receipts.

Corporation tax, although at an all time high is roughly 50bn or circa 40% of NIC’s.

If government can’t sort out Corp tax then maybe a rise in NIC’s isn’t such a bad idea although could potentially hurt smaller businesses but you could balance it out by raising the starting level.

0 -

Ah, @cafcfan , now you have set your stall out. You believe fundamentally in a low-tax society. It's a perfectly reasonable stance to take and to debate. Let's do that in the context of the subject of this thread.

Since it's you, I will assume your figures to be correct. I am glad that you mention Scandinavia, and I believe you can add Germany to that list. CIT there is 29%. Now, although US CIT is even higher, it is typically US people who say things like "addiction to other people's money.". And of course the big corporations leading the charge of industrial scale tax avoidance (and associated fairy tale spinning) are all US companies.

So it comes down to a wider view of the type of society you want. Do you want the UK to be more like the USA, or more like Scandinavia and Germany? That, fundamentally is what underpins the stance of intellectually rigorous defenders of Google and co. such as you, @Dippenhall and @newyorkaddick. Am I not right, gentlemen?

I of course am in the Scandi/German camp all day long, not least because I look at their economies and find them to be in rude health compared with the UK's and because the number and living conditions of their poorest and most vulnerable is less/less poverty stricken than in the USA.

Back to the main topic of this thread. I don't think there is a case for a low tax society. There is a very strong case to ensure that while we have the tax regime we have, everybody subject to it pays what Parliamnet intended, and if new business models make that difficult, we change the law to accomodate those models (in concert with our global partners). Then we address any "addiction" by rigorously policing how our tax revenues are spent. That's where private-sector hardened people like us can play a positive role, and our Olympic Stadium campaign is surely an excellent example of that in practice.

0 -

The main difference between Scandinavian countries and the US (and UK) is their income tax top band starts at a much lower level, isn’t Denmark at 1.2 the average wage? If we did that in the UK anyone earning about £27k would be on the top band. Sweden is 1.5 times so circa at 35k, Normay 1.6 times although their top rate is less than 40%.

Corporate taxation rate is also higher in the US compared to those countries.

Lastly only Denmark have IHT out of the Scandinavians I believe.

If anything it seems to me the Scandinavians place a higher level on taxation of income and goods (VAT) and less on corporate tax than the US or UK?1 -

Sponsored links:

-

I am not a staunch defender of large global tax avoiders at all. I am merely pointing out that if they paid more tax, whether corporation tax or some other kind of tax, inevitably it would be us, the consumer, that actually picked up the tab in due course with the added hit of increased inflation. Do you not agree? The companies' net profits and dividend payments would stay in the same ball park: if they did not, then their share price would suffer compared with their peers because their P/E ratios would slump.PragueAddick said:Ah, @cafcfan , now you have set your stall out. You believe fundamentally in a low-tax society. It's a perfectly reasonable stance to take and to debate. Let's do that in the context of the subject of this thread.

Since it's you, I will assume your figures to be correct. I am glad that you mention Scandinavia, and I believe you can add Germany to that list. CIT there is 29%. Now, although US CIT is even higher, it is typically US people who say things like "addiction to other people's money.". And of course the big corporations leading the charge of industrial scale tax avoidance (and associated fairy tale spinning) are all US companies.

So it comes down to a wider view of the type of society you want. Do you want the UK to be more like the USA, or more like Scandinavia and Germany? That, fundamentally is what underpins the stance of intellectually rigorous defenders of Google and co. such as you, @Dippenhall and @newyorkaddick. Am I not right, gentlemen?

I of course am in the Scandi/German camp all day long, not least because I look at their economies and find them to be in rude health compared with the UK's and because the number and living conditions of their poorest and most vulnerable is less/less poverty stricken than in the USA.

Back to the main topic of this thread. I don't think there is a case for a low tax society. There is a very strong case to ensure that while we have the tax regime we have, everybody subject to it pays what Parliamnet intended, and if new business models make that difficult, we change the law to accomodate those models (in concert with our global partners). Then we address any "addiction" by rigorously policing how our tax revenues are spent. That's where private-sector hardened people like us can play a positive role, and our Olympic Stadium campaign is surely an excellent example of that in practice.

I also don't think I'm a supporter of a low-tax regime. But, frankly, a tax-take of around 40% of GDP sounds about right to me. Germany's, I think, is about 44%. (Perhaps that's why my Siemens coffee machine was made in Slovakia (tax only 30% of GDP) rather than Germany?) The US tax take - perhaps it might surprise some as it's deemed a low-tax environment - is a little higher than ours. The Yanks are voracious harvesters of tax dollars whether at Federal or State or County level. One of the side effects of that is that we suffer form US firms' strenuous efforts to avoid tax. Perhaps that would not be the case if the IRS wasn't so keen to take a hefty slice of world-wide earnings and all the double taxation issues that brings to the table?

Anyway, the Americans need tax like there's no tomorrow. They have to fund their enormous "defense" budget, circa 18,000 different law enforcement agencies and ridiculous bureaucracy. Remarkably, the US Government also spends far more than us per capita on health (private health costs are excluded from the figures I provide here). It's around $4,900 per person each year. Our NHS spend as far as I can tell is around £2k per person in England and a little more than that in the other countries that make up the UK.

I suppose the Scandinavian tax payer suffers from two main issues. The "cradle to grave" care and support and the fact that they are relatively small countries and their infrastructure doesn't bring much by way of economies of scale.

It's fair to say, I think, that by far and away the best way of raising tax revenues is by raising GDP. It might well be that the best way of doing that is by being an attractive base for overseas companies. In that regard, most, though not all, would be happy paying their fair share in a benign tax environment. That might not be the case in Labour's proposed utopia.2 -

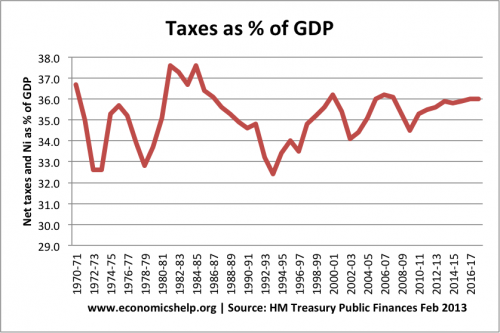

Since Prague brought me (back?) into the discussion, I think the chart below provides some useful perspective.

In short it demonstrates that over the past 50 years or so, regardless of which party was in government and which type of economic environment we faced, the UK's tax receipts as a % of GDP is remarkably stable around 35%.

This suggests to me that whilst left or right-leaning parties can tweak the percentage slightly in one direction or the other, ultimately this is a natural equilibrium level to which the economy naturally gravitates back to given well known behavioural and economic impacts (eg. tax avoidance, weaker growth, lower investment etc.).

Interestingly by way of comparison, the OECD average in 2015 was 34.3% suggesting we are in line with our peers (above say the US and Australia, but below most developed European countries as one would expect).

I have difficulties with the concept that one could imagine superimposing a Scandinavian type tax structure on the UK economy (and expecting similar outcomes), because it ignores how we got to this (relatively strong) position in the first place eg. how much of the current significant foreign investment we receive every year (implied by our large current account deficit) is a function of the attractiveness of a relatively lower tax burden versus our European peers?

Ps - having just read @cafcfan 's comments above, I should note my percentages above or for general government revenues only ('Federal' tax equivalent in the US for example)1 -

Thank you all for your most interesting posts since my last. Need to think about it, and need in the meantime to do some work and boost my CIT liability:-) Just a quick link to KPMG's useful global CIT table.

Shows us that both Sweden and Denmark are on 22%, Norway 24%, and Germany just below 30%. All higher than the UK at 19%. Netherlands is 25%...nominally!!!

As for @cafcfan 's Slovak (CIT21%) made Siemens machine I would think the key drivers of their choice are firstly the very much lower wage levels for a relatively smart and well equipped work force, the fact that Slovakia is in the eurozone, the fact that bureaucracy and corruption there has been seriously tackled in the last 10 years and the (Czechoslovak) tradition of "golden hands" when it comes to precision tool manufacture.0 -

As an aside, I've just ordered some water filters and cleaning tablets for the coffee machine together with a carbon filter for the cooker hood. I thought I'd re-check the Siemens on-line UK shop for prices - what with the demise of the GBP - and it's still far cheaper for me to order in € from Germany and pay through SEPA. Even with P&P, I'm spending €104 for what would have cost me £145 here! Rip-off Britain is alive and well anyway.PragueAddick said:Thank you all for your most interesting posts since my last. Need to think about it, and need in the meantime to do some work and boost my CIT liability:-) Just a quick link to KPMG's useful global CIT table.

Shows us that both Sweden and Denmark are on 22%, Norway 24%, and Germany just below 30%. All higher than the UK at 19%. Netherlands is 25%...nominally!!!

As for @cafcfan 's Slovak (CIT21%) made Siemens machine I would think the key drivers of their choice are firstly the very much lower wage levels for a relatively smart and well equipped work force, the fact that Slovakia is in the eurozone, the fact that bureaucracy and corruption there has been seriously tackled in the last 10 years and the (Czechoslovak) tradition of "golden hands" when it comes to precision tool manufacture.

So, amongst other things, I hope the UK's super-fine Brexit negotiators mange to remember stuff like SEPA!0 -

Of course, it's all in the relevant Impact Assessment. What? Oh....cafcfan said:

As an aside, I've just ordered some water filters and cleaning tablets for the coffee machine together with a carbon filter for the cooker hood. I thought I'd re-check the Siemens on-line UK shop for prices - what with the demise of the GBP - and it's still far cheaper for me to order in € from Germany and pay through SEPA. Even with P&P, I'm spending €104 for what would have cost me £145 here! Rip-off Britain is alive and well anyway.PragueAddick said:Thank you all for your most interesting posts since my last. Need to think about it, and need in the meantime to do some work and boost my CIT liability:-) Just a quick link to KPMG's useful global CIT table.

Shows us that both Sweden and Denmark are on 22%, Norway 24%, and Germany just below 30%. All higher than the UK at 19%. Netherlands is 25%...nominally!!!

As for @cafcfan 's Slovak (CIT21%) made Siemens machine I would think the key drivers of their choice are firstly the very much lower wage levels for a relatively smart and well equipped work force, the fact that Slovakia is in the eurozone, the fact that bureaucracy and corruption there has been seriously tackled in the last 10 years and the (Czechoslovak) tradition of "golden hands" when it comes to precision tool manufacture.

So, amongst other things, I hope the UK's super-fine Brexit negotiators mange to remember stuff like SEPA!

1 -

@PragueAddick I remember you quite rightly had a big thing about the below. Disappointing outcome that they seem to have got away with it again.

Apple has been told it will not have to pay Ireland €13bn (£11.6bn) in back taxes after winning an appeal at the European Union's second-highest court.

It overturns a 2016 ruling which found the tech giant had been given illegal tax breaks by Dublin.

The EU's General Court said it had annulled that decision because there was not enough evidence to show Apple broke EU competition rules.

It is a blow for the European Commission, which brought the case.

However, it has 14 days to appeal against the decision at the EU's supreme court, the European Court of Justice.

https://www.google.co.uk/amp/s/www.bbc.com/news/amp/business-53416206

0