Attention: Please take a moment to consider our terms and conditions before posting.

Savings and Investments thread

Comments

-

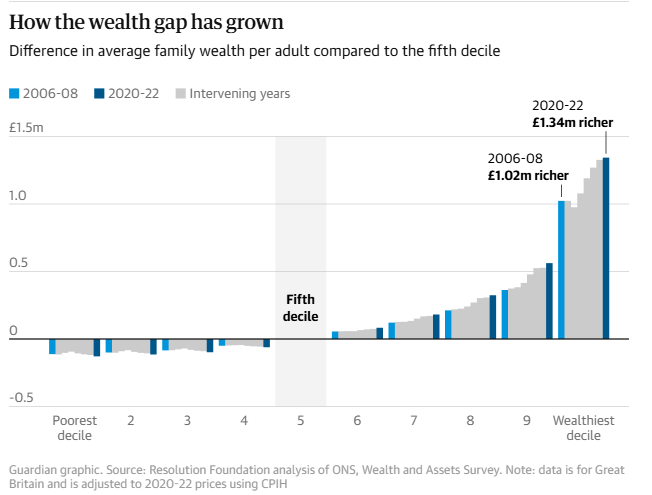

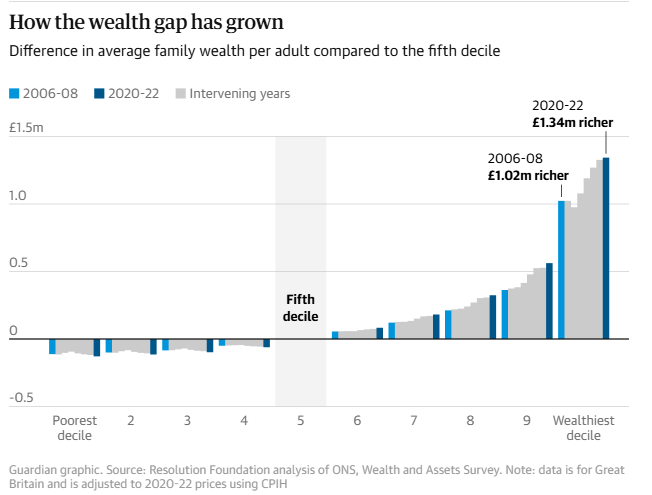

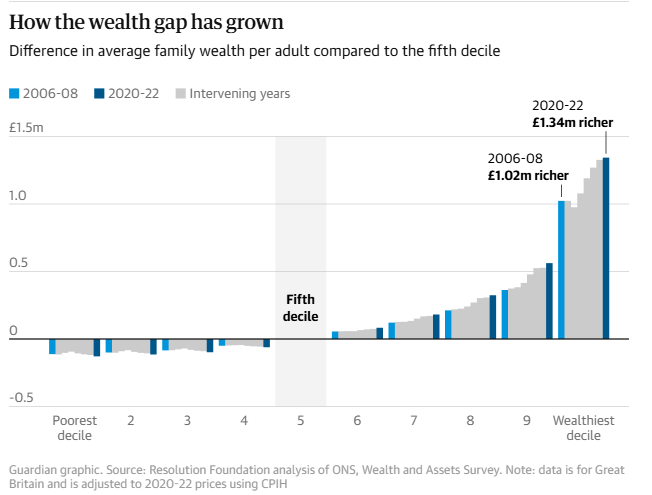

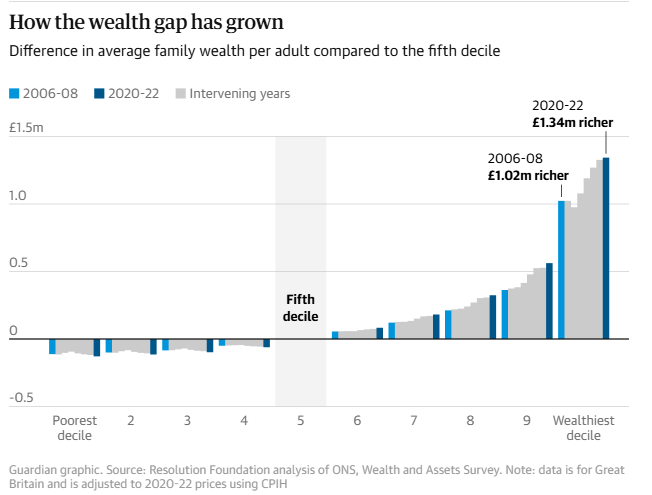

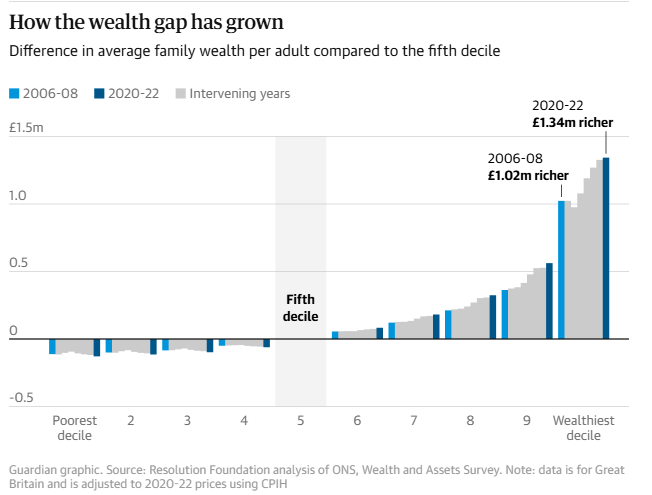

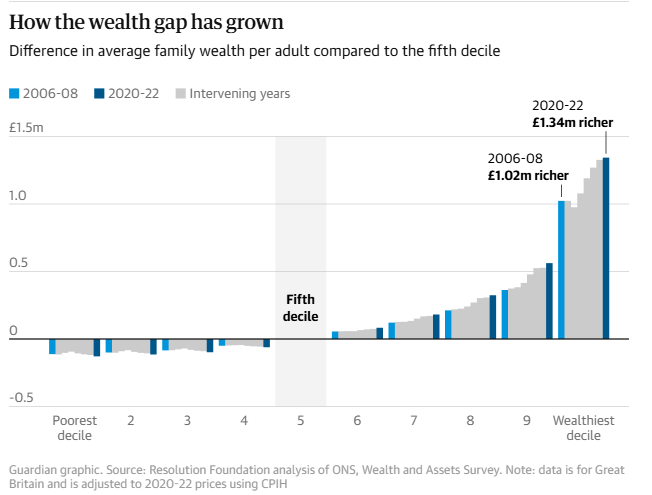

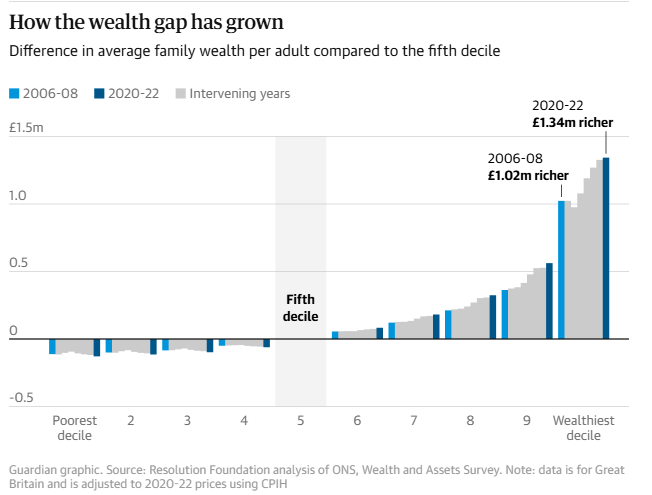

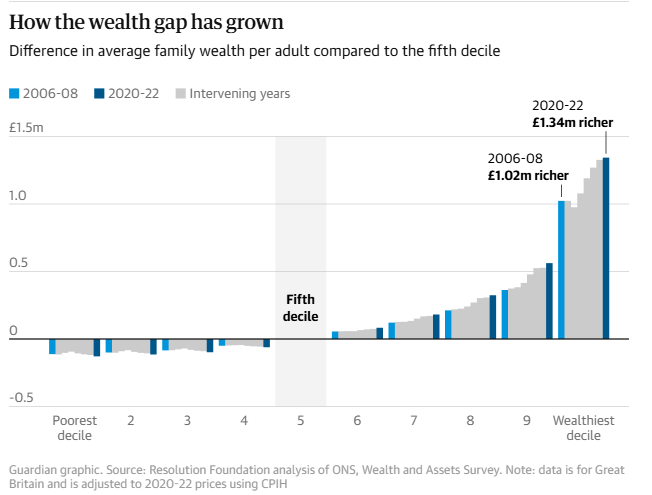

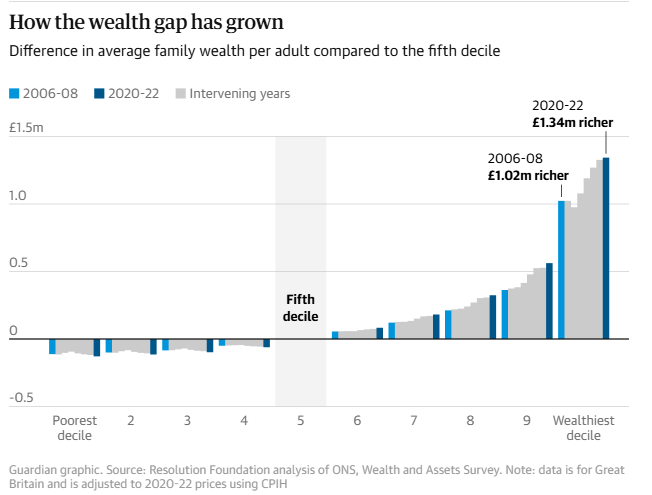

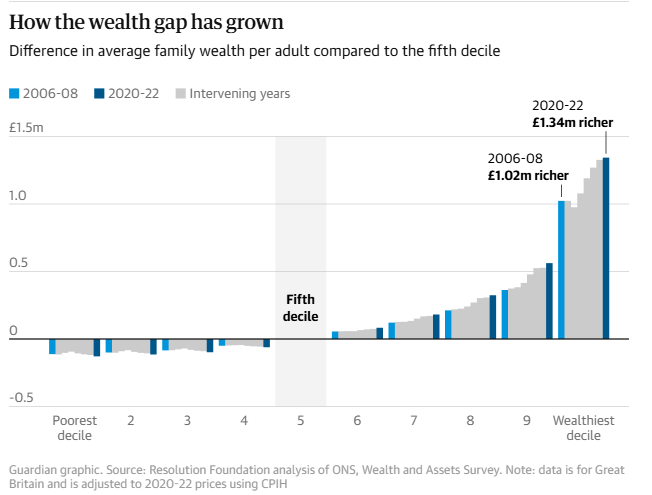

This chart is brilliant. Made by the guardian but from a Resolution foundation report. shows how for the bottom 50% there is almost no change since 06-08 but for the top 10% there has been massive growth. As that's not even the full picture as within that top 10% the growth has been massively concentrated for the top 1%.

https://www.theguardian.com/inequality/2025/oct/08/lifetime-of-earnings-not-enough-for-uk-workers-to-join-wealthiest-10-report-says5 -

I agree with lots of what you say here. 2 bits jumped out at me in particular.TelMc32 said:Was about to say similar @cantersaddick

The top 10% had average earnings of £72k in 2024. The 10% aren’t the issue here, and they aren’t who are being talked about for any “wealth tax”, it’s the massive increase in wealth and income for the 1% (and even fewer as you say). That disparity has accelerated and for no discernible reason - do people really believe they deserve some of the pay hikes seen? Comparable to their employees, wider working population?There needs to be an acknowledgment that they benefit from the society they live in and, to maintain that, they need to accept a higher income tax level on their higher earnings. I appreciate that the UHNW will find ways around this, but it would be a start and there appears to be understanding of this for a growing number (e.g. Patriotic Millionaires).

I can see an additional bank levy, but I’d go further and target NW with a further additional levy until they’ve gone some way to repaying the £10bn lost by taxpayers bailing them out.

Something also needs to be done about the supermarkets. In the middle of a cost of living crisis, it’s immoral that Tesco made £3.1bn profit this year. They’ve squeezed their own suppliers, but haven’t passed that on in any way by the looks of it.Keep going after the billions defrauded during COVID - those fast track cons and those who took out business loans, guaranteed by government, with no business to speak of.And then there’s the issue of the welfare state. We have to protect our weakest, but there needs to be a complete rethink on what exactly we are providing benefit for. It won’t be easy, as a decision or to live with, but the alternative is a total collapse as it simply can’t be paid for and you can’t just keep taxing. If only we’d had Norway’s foresight for the North Sea Oil riches.

1) What you said about supermarkets. This is a scandal no one seems to be talking about. They have been guilty of horrendous levels of greed and profiteering in the cost of living crisis. In a properly competitive market what should happen when an external shock happens is the cost of this is shared in some way between increased prices on consumers and reduced profits for business. What they claim happened is that their costs when up 10% and so they put prices up 10% (illustrative numbers) and so their profits went up 10% - but importantly their profit margin would stay the same. What actually happened was the costs went up 10% so they used the opportunity to hike prices 30% (again illustrative numbers)and keep hiking them form much longer than the external shock. So not only did their profits go up but their profit margins also went up. As you say this is completely immoral in a society. It demonstrates that they hold oligopoly power and are making economically excess profits. It was particularly galling to see the CEO of Sainsburys appearing on the news throwing his toys out the pram about an £11m increase in NI bill just days after announcing record £600m profits.

So what can we do about it? We should be looking to tackle oligopoly power across the economy. I did a post on here a couple of days ago about the Branded medicines pricing schemes and how we use the law to limit the profits big pharma can make in the UK market. We aren't allowed to call it a tax but it basically claims back all revenue above a certain point each year. It keeps drug costs low for the UK and brings in cash (badged as a saving). I think we should apply the same to other sectors, first on my list is energy. My very very rough calculations suggest doing similar to the energy sector could take £350 a year off the "average" energy bill, raise £10bn for the government and leave £10bn in profit for the sector - if anything too generous for the fossil fuel giants. I think we should do the same to supermarkets on non-luxury food items. Its important to note these kind of schemes are designed for essential services. We could design scheme that reduced the cost of essential food items to consumers, raise money (which could be used to support farmers) and curb excess profits on those items.

I think we should also use the model of the digital services tax applied to large tech firms who are based abroad for tax purposes but operate in the UK and has been hugely successful to the point its been copied by most countries in the developed world. Apply this same model to other sectors where there are large multinationals who operate here but aren't taxed here. It isn't going to replace corporation tax but it is going to raise something.

2) what you say about acknowledging that everyone benefits from the society they live in, and those with large businesses benefit the most. They need an educated, healthy workforce with access to roads and public transport and clean water and energy and childcare etc. for that we have to spend some money.1 -

I get what you're saying that overall living standards even for the worst off are higher than in the Victorian era. But inequality - the difference between the richest and poorest is very much moving in that direction. IOts not saying that people are living in Victorian conditions but they are as far (or rather getting there) from the very rich as they were in the Victorian era. Social mobility is not that far behind either peaking in the late 70s early 80s.valleynick66 said:

surely the best measure is the standard of living of those impacted? It doesn’t matter as much if the super rich outstrip me if I am ‘better off’ than I would have comparatively been in ‘Victorian’ times.cantersaddick said:Jints said:cantersaddick said:But pointing out that we are at near Victorian era levels of inequality and social mobility is an important message. Whether or not you agree with his approach to fixing it you can't argue with that fact. Or were people hoping we would all just collectively be gaslit into thinking everything was fine for a couple decades longer?

You can point it out if you like, but it's not even close to being true. The top 10% earned 55.8% of income in 1900 and 35.7% in 2021. The bottom 50% earned 13.8% in 1900 and 20.4% in 2021, a little down from the peak in 1970 of 21.4% but higher than in 2013 (18.4%) https://equalitytrust.org.uk/scale-economic-inequality-uk/

You've made the age old mistake of quoting income inequality in a conversation about wealth inequality. You've also selected some very specific points on the scale which dilute the problem. Its the top 1% or even 0.1% who are showing massive growth and are largely the problem.

50 Families in the UK own more wealth than 50% of the population combined. Its becoming more and more like an old fashioned aristocratic class, or even worse a feudalistic land owning class. https://www.theguardian.com/news/2025/may/19/uk-50-richest-families-hold-more-wealth-than-50-of-population-analysis-finds

Read the LSE report on it here (actually only uses pre COVID data so likely underestimates the scale of the issue) https://blogs.lse.ac.uk/inequalities/2024/10/29/the-uks-wealth-gap-has-grown-by-50-in-eight-years/

or the Joseph Rowntree foundation https://www.jrf.org.uk/narrative-change/changing-the-narrative-on-wealth-inequality

Or the Resolution foundation https://www.resolutionfoundation.org/app/uploads/2020/12/The-UKs-wealth-distribution.pdf

As I observed earlier sometimes labels are misleading - millionaires and Victorian for example. It’s what people can or can’t do with their ‘wealth’.Lies damned lies and statistics.I’m not suggesting home ownership is anything other than a challenge and worse than it was a couple of decades ago but it’s not Victorian.0 -

In it's simplest form isn't that chart a simple math/economics when asset prices increase? (it seems to be based on wealth and asset).cantersaddick said:This chart is brilliant. Made by the guardian but from a Resolution foundation report. shows how for the bottom 50% there is almost no change since 06-08 but for the top 10% there has been massive growth. As that's not even the full picture as within that top 10% the growth has been massively concentrated for the top 1%.

https://www.theguardian.com/inequality/2025/oct/08/lifetime-of-earnings-not-enough-for-uk-workers-to-join-wealthiest-10-report-says

By virtue of the fact someone is in the top x% means they hold more asset. If asset prices increase then of course the gap will widen. If asset prices dropped, i.e. a housing market crash, stock market and/or gold prices plummet, the chart would look very different.

It's like saying I have £10,000 in the bank @ 5% APR earning or increasing my assets by £500, yet someone who has £1,000 in the bank only increase by £50 with the same 5% APR, therefore the gap widens - of course it will.

Unless we lived in a communist state where everyone owns the same and earns the same, the chart is always going to head that way in a time of asset appreciation.

If all assets dropped 50% would it be OK for the top percentiles to complain they've reduced more than the lower percentiles and that's really unfair? Or is that basic math?1 -

Definitely need to hit the welfare budget.cantersaddick said:This chart is brilliant. Made by the guardian but from a Resolution foundation report. shows how for the bottom 50% there is almost no change since 06-08 but for the top 10% there has been massive growth. As that's not even the full picture as within that top 10% the growth has been massively concentrated for the top 1%.

https://www.theguardian.com/inequality/2025/oct/08/lifetime-of-earnings-not-enough-for-uk-workers-to-join-wealthiest-10-report-says 1

1 -

Yes. But the reason you / the authors use ‘Victorian’ as the base / reference point is to be provocative and it implies something more.cantersaddick said:

I get what you're saying that overall living standards even for the worst off are higher than in the Victorian era. But inequality - the difference between the richest and poorest is very much moving in that direction. IOts not saying that people are living in Victorian conditions but they are as far (or rather getting there) from the very rich as they were in the Victorian era. Social mobility is not that far behind either peaking in the late 70s early 80s.valleynick66 said:

surely the best measure is the standard of living of those impacted? It doesn’t matter as much if the super rich outstrip me if I am ‘better off’ than I would have comparatively been in ‘Victorian’ times.cantersaddick said:Jints said:cantersaddick said:But pointing out that we are at near Victorian era levels of inequality and social mobility is an important message. Whether or not you agree with his approach to fixing it you can't argue with that fact. Or were people hoping we would all just collectively be gaslit into thinking everything was fine for a couple decades longer?

You can point it out if you like, but it's not even close to being true. The top 10% earned 55.8% of income in 1900 and 35.7% in 2021. The bottom 50% earned 13.8% in 1900 and 20.4% in 2021, a little down from the peak in 1970 of 21.4% but higher than in 2013 (18.4%) https://equalitytrust.org.uk/scale-economic-inequality-uk/

You've made the age old mistake of quoting income inequality in a conversation about wealth inequality. You've also selected some very specific points on the scale which dilute the problem. Its the top 1% or even 0.1% who are showing massive growth and are largely the problem.

50 Families in the UK own more wealth than 50% of the population combined. Its becoming more and more like an old fashioned aristocratic class, or even worse a feudalistic land owning class. https://www.theguardian.com/news/2025/may/19/uk-50-richest-families-hold-more-wealth-than-50-of-population-analysis-finds

Read the LSE report on it here (actually only uses pre COVID data so likely underestimates the scale of the issue) https://blogs.lse.ac.uk/inequalities/2024/10/29/the-uks-wealth-gap-has-grown-by-50-in-eight-years/

or the Joseph Rowntree foundation https://www.jrf.org.uk/narrative-change/changing-the-narrative-on-wealth-inequality

Or the Resolution foundation https://www.resolutionfoundation.org/app/uploads/2020/12/The-UKs-wealth-distribution.pdf

As I observed earlier sometimes labels are misleading - millionaires and Victorian for example. It’s what people can or can’t do with their ‘wealth’.Lies damned lies and statistics.I’m not suggesting home ownership is anything other than a challenge and worse than it was a couple of decades ago but it’s not Victorian.I don’t disagree the gap is moving the wrong way but the very top earners/wealthiest are so far removed from us mere mortals and so few in number they aren’t the most important group (to me).I’m more concerned by the executive level (for want of a better label) who reward themselves with salaries far in excess of their junior staff and outsource to squeeze every last penny and can’t put themselves in the shoes of their junior employees as to what life looks like to them.The growing social concern is more about that group of people who live very different lives to their employees but squeeze them even harder.I’m all for a restriction on multiple of earnings someone can get relative to their junior staff.3 -

We've done this before so I don't wanna go down that rabbit hole but I don't agree that wealth is too mobile. We were told the non-doms were all going to leave but the much trailed (and briefed to the press) OBR report on them which is going to accompany the budget is expected to show the rate of exit is unchanged. The people may be but the assets remain and could be taxed - see how we managed to sanction Roman Abramovic after he left the country - his assets were still effectively taxed. But we agree to disagree on that so happy to ignore.Rob7Lee said:

I think you are reading too much into my comment, he has a large following, yet a lot of what he spouts (and is calling for) is factually incorrect. See his podcast with Daniel Priestly, for one he kept banging on about that he paid 60% income tax on all his income (cannot be true) he didn't understand that the DoW is one of the highest tax payers in the country, the Trust paid periodic tax (not sure he even knew what that was) and in my view made himself look quite stupid and uneducated in the subject he's making his life's work.cantersaddick said:

That was very much a theoretical "perfect world" not actually advocating for it.Rob7Lee said:

There’s a difference between expecting (or planning) on receiving an inheritance and actually receiving one. I’ve told my kids to expect nothing (ie plan their lives with what they have and earn) and view anything they do receive as a Brucey bonus.cantersaddick said:Rob7Lee said:

Garys economics - the guys spouts quite a lot of nonsense and believes the answer to everyone's financial problems is a wealth tax and people lap it up. The few times he's actually debated with someone half intelligent he's come out looking like a bit of a wally. Spent 15 minutes debating tax of the Duke of Westminster yet seemingly not knowing the difference between income tax, periodic tax and IHT let alone how much tax the Grovesnors pay (nor himself).cantersaddick said:

Only if you assume no existing debt or any other major life costs. Again just feels like you're massively overestimating what the average person's situation looks like. The evidence seems to agree. And sure some people will be able to buy some assets with the windfall. But it's gonna be nothing like the level of assets held by the person they inherited from. Where have those additional assets gone? Via corporations to that same small group of asset owners.Rob7Lee said:

You were referring to assets.cantersaddick said:

Again on day 1 the maths says it's the same. Over time the gap grows exponentially.Rob7Lee said:

Glad we agree that upon sale of the asset to LBG there has been no wealth transfer to the corporations (which was where this started and was my original response/disagreement).cantersaddick said:

I feel like I'm going insane. Have you actually ready any of my posts? Or am I just not communicating well? This whole time I've been talking about asset owners vs non- asset owners. So obviously we are talking about people who don't have anything.Rob7Lee said:

Lloyds buying houses isn’t transferring wealth. It may be transferring housing stock to Lloyds, but in return ‘cash’ is transferring from Lloyds.cantersaddick said:

It's literally the definition of a transfer of wealth. Wealth is going from one group to another - transfer.Rob7Lee said:

Whether you use the words disappearing or transferring, your statement was that the wealth is moving from individuals to corporations and how by aged 40 Gen Z will have less than 1% of the wealth, when I asked where this wealth was disappearing to you used the example of Lloyds etc buying up the houses. My overriding point it that doesn't make wealth disappear or transfer, it's just held in a different form. It may mean corporations own more property, but conversely the individual will own more cash (or wherever they then choose to put that cash).cantersaddick said:

I have never talked about wealth disappearing, though you have gone to great pains to say that i was. I have only talked about wealth transfers.Rob7Lee said:

Again, that wasn't what you were saying. Your comment was that these companies buying up property is taking away wealth, thats simply not true as I have explained. When I asked you where this wealth was disappearing to you said:cantersaddick said:

So why haven't you kept all your wealth in cash then? Why do we have this thread? If cash is just as good then why do we need assets at all? Genuinely can't work out if you're being obtuse here!Rob7Lee said:

Please explain to me, if I sell a property for market value how I am worse off? I had £1.35m in a property, I now have £1.35m in cash (and then wherever I choose to invest it). There has been no transfer of my wealth aside from a tiny amount to an estate agent and solicitor for the transaction.cantersaddick said:

Nope not missed the point at all in fact I think you have.Rob7Lee said:

But that's not what you said.cantersaddick said:

Well sure but with what that injection of cash will do to already massively inflated house prices will ensure that people will find it harder and harder to buy houses. For the majority of people it's the largest or only asset they will own in their life. Take that away and what do they have?Rob7Lee said:

I'm assuming Black Rock et all will be paying money for these properties? Where does that money go? And who owns Lloyds & Blackrock?cantersaddick said:

It will go to corporations the likes of Blackrock and Lloyd's who are targeting between them 18bn of UK housing purchases in the next 2 years. Offshore ownerships and private equity are planning to hoover up the assets as they become available as boomers die.Rob7Lee said:

Your not comparing apples with apples, The silent generation were in broad terms quite poor, because the country was poor. By the time we go to the 80's through to early 00's wealth (in a large part due to property) and inflation earlier meant that those 40 year olds had seen their wealth grow. Also Generations are now living longer, so in part it is taking longer for wealth to pass down (I'm ignoring death taxes for this purpose)cantersaddick said:

It's not that older people have more wealth its that a particular cohort have a higher share of all wealth than any cohort in history.Rob7Lee said:

How many of the 50-64 age group not working have chosen to do so, have paid into the system for the last 35-45 years and are living off their previous earnings and how many are claiming any form of benefit? I suspect there's far fewer of the latter. I'll certainly be joining that group soon and I won't be getting anything from the state, in fact I'll still be paying in, if I'm still here.cantersaddick said:

3.5m aged 50-64 out of work (Labour market stats for 2025 linked below) much more of a problem as these will likely never work again. https://www.gov.uk/government/statistics/economic-labour-market-status-of-individuals-aged-50-and-over-trends-over-time-september-2025/economic-labour-market-status-of-individuals-aged-50-and-over-trends-over-time-september-2025#:~:text=In 2025 there were 3.5,for not looking for work.blackpool72 said:

Huge generalisation there.Diebythesword said:

1 million young people out of work isn’t enough to warp the figures that much, it’s very much the aging population and the refusal of pensioners to realise that in order for this country to get out the doldrums they need to take a hit to their state pensions and other state benefits like the fuel allowance. Pensioners are currently the richest generation, they can shoulder more of the burden.blackpool72 said:I read somewhere that in the 60s and 70s we had roughly 5 working people for every pensioner we had.

That meant that pensions were affordable.

We now have about 3 working people per pensioner.

This is partly due to people living longer, but another cause for this is about 1 million younger people between the age of 17 and 20 are neither in education or work.

They are simply living at home on benefits.

Unless they are genuinely in a bad way with a real reason why they cannot work they shouldn't be paid a penny.

The system in this country is broken and far too many people are being paid for doing naff all.

This needs to change

Not all pensioner's are rich, plenty are struggling.

I agree the triple lock has to go at some point, but the millions of working age people out of work and claiming benefits has to also be addressed.

Current pensioner are the richest generation in history with 27% as millionaires. https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/incomeandwealth/datasets/totalwealthwealthingreatbritain?

They hold half of all wealth in the country and more than 65% of housing wealth. https://www.telegraph.co.uk/business/2025/10/08/pensioners-now-hold-half-of-britains-wealth/#:~:text=Pensioners now hold nearly half,generational inequality across the UK.

Pensioners were protected from 15 years of Tory Austerity. In fact they were the only cohort of people who got better off due to the triple lock. Every other age group came out worse off. Personally I've tried to move away from having the generational conversation as I think it's counterproductive and a wedge issue designed to place blame and cause division and detract away from the real issue of wealth inequality. But there is a strong corelation between generation and wealth so it does still form part of the equation. I believe most of the things the government are doing at the moment are tinkering without actually tackling the real issue. But if you're gonna tinker you might as well tinker with the wealthiest people not crap all over those who have been crapped on for 15 years.

If you don't think a million aged 17-20 not in education or work isn't a major issue......... if that trend continues in 10-15 years time we'll have half the working aged population not working. We should be looking to have 95%+ in education or work at that age.

And wow - NSS - older people have more wealth than younger people, who'd have thought that would be the case, can't understand why I'm wealthier at 52 than I was at 22/32/42. Is it a bad thing that pensioners now are richer than the generation before (and those before and so on). If only we could pass more of that wealth down upon death...... instead the state will tax it and waste it.

When the first baby boomers turned 40 their generation held 45% of all the wealth. When the first millennials turned 40 it was 4%. For gen Z it's forecasted to be less than 1%. Can you see a problem there?

I find it hard to believe that in say 2050 Gen Z will have less than 1% of the wealth. Baby boomers will sadly be a lot less in number (as they'll be approaching 90 or over 100) - where has their wealth gone, or is it with them in Heaven (and hell), even Gen X will be 75+. Where's all the money gone!?!

And as for who owns them - a smaller and smaller class of asset owners.

Can you genuinely not see a problem here?

I asked where the wealth would go that you were suggesting is disappearing somewhere (when the baby boomers pass etc), you said it would go to companies like Blackrock and Lloyds by purchasing these properties. That isn't removing the wealth from people, it's exchanging one asset (bricks and mortar) for another - Cash. If I sell you my house, assuming I sell at the market value, today I have an asset (House) worth 1.35m, tomorrow I have cash of 1.35m - the wealth hasn't left me.

You were saying the money is moving from the people to the corporations, that's simply not true. If they do buy up 18bn of property it will of course mean certain assets are moving (each way) more property will be moving to corporations and more cash/money will be moving to people.

My second point which you missed or misunderstood, who owns blackrock and Lloyds Banking Group..... Blackrock and Lloyds two biggest shareholders are Vanguard and Blackrock themselves. I.E. it's mine, yours and millions of others pension, ISA's etc that own large parts of these companies.

So again, where does the money/value/asset go? I think you are confusing asset choice and investment return, Blackrock etc are gambling that they'll make more money on Property than elsewhere (and they may be right, but I'm not convinced).

Where I was trying to get you to, is there is only one place the money goes to (meaning the assets diminish) that is currently owned by 'the people' - and that's to Government by way of taxation (in this instance, IHT). If there was no IHT and no crown receipts from death, the money wouldn't be leaving people. However some love the idea of IHT as they believe it redistributes wealth, yet in reality it doesn't.

The housing issue in this country is a whole other topic, until such time as we grow up and start building new towns and millions of houses (and all the infrastructure that requires) it will not change but likely only get worse.

You're kidding yourself if you think substituting an asset for cash leaves people equally well off.

Those assets both the housing and financial are being owned by an ever smaller asset owning class of people. That's already happening. A much smaller proportion of people own financial assets than houses as is and that's only getting worse as well. The massive transfer of wealth from people owning houses to corporations and financial services that's coming as the boomer generation die is only going to squeeze people out of housing and make that worse. And the people that can't afford housing don't buy financial assets either. Having any kind of pension wealth at all puts you in the top 40% of the UK. For a large amount of people the only financial service they buy in their entire life is insurance.

So as said a smaller and smaller asset owning class.

I get it's not gonna be a problem for you and yours but sure you can see its a problem for society?

You seem to believe the wealth is disappearing, I'm trying to work out where you think it's going? Your initial point was that it's going to these corporations that are buying up houses, but fail to see the point that they are paying for those houses, so at the point of asset transfer that is not having the effect of transferring wealth from individuals to corporations. You also seem to miss the fact that those companies buying the properties are ultimately owned mostly by individuals!

Now it may be that house price inflation will out strip other asset inflation/growth, but that's a whole other conversation and a gamble/bet. If I'd have 5 years ago bought property in my pension I'd be worse off than I am now as property has flat lined compared to the stocks and shares I instead held. How have property values compared to the stock market over the last 30-40 years? Not even in the same growth ball park.

There is broadly only one place wealth is going to from individuals and thats to the Government. Let's say I have £5m of asset, whether property, stocks and shares, gold, cash etc etc. That's what I have, if my wife and I die tomorrow that will end up at around £3.4m to my children, the remainder goes to HMRC. There's a true transfer of wealth away from individuals. If we get into the things like property tax it will happen further and quicker.

I'm not saying I agree at all with corporations buying up property and the potential effect that may have on the market, but that it is not the reason for any transfer of wealth and why Gen Z will own less than 1% at aged 40 (which I don't agree with either by the way).

So a boomer dies. The probate sells their house and pays the relevant taxes. House is brought by a private equity firm as part of a massive nation wide injection of cash into the market driving prices up further. The estate (most cases a house worth less than £1.35m and not much else once care costs have been paid) is split between on average 3 children, some will be passed to grand children and split even further. For the younger people receiving that money it's not enough to get them on the housing market. People who can't afford houses generally don't buy financial assets either so aren't benefitting by the roundabout route of the commidification of our housing market either. The cash is eaten up by increased rent and living costs, maybe a new car or a treat here and there. The majority is simply inflated away.

The wealth is not disappearing. It is being held by a smaller and smaller group of people. Part of the rapidly worsening wealth inequality that has been happening for 20 years. This is just a continuation of that but at a faster rate and exacerbated by the large transfer of wealth coming down the pipeline shortly.

It will go to corporations the likes of Blackrock and Lloyd's who are targeting between them 18bn of UK housing purchases in the next 2 years. Offshore ownerships and private equity are planning to hoover up the assets as they become available as boomers die.

But that doesn't remove wealth simply because someone buys an asset from someone. I bought four gold sovereigns a couple of months ago from a lady at work. Just because I now own the coins, I haven't taken away wealth from her. She has exchanged the coins for cash (no idea what she then did with the cash) and I have less cash!

My example of cash was showing that when Lloyds Bank buys an asset, a house, (let's say from me) they would do so by paying me the asset value in cash. There is no transfer of wealth, I'm not suddenly worse off. I may spend that cash, I may invest that cash, if I invest it I may end up with a greater value than the house that Lloyds now own, or I might not (my pension the last 10 years has far far exceeded in value and growth my home). If Lloyds buy £18bn of property tomorrow, they aren't suddenly worth more and those who sold worth less. There is now £18bn of property owned by Lloyds who have probably £19bn less money due to costs. Conversely the sellers have no longer got 18bn of property but have broadly 18bn of cash (on day 1). Again, no transfer of wealth.

You've yet to give one example or any explanation as to how these house purchases are transferring any wealth to the corporations. But I have shown you how government is currently removing 7.5bn per annum of wealth (asset) which is set to be doubling in the next 4-5 years to 15bn (and I think that is before the 2027 change to pension funds).

I think you are making the observation that property will continue to rise at a greater rate than anything else money may be invested in, history tells us thats not necessarily the case or in more recent times even likely.

I talked about wealth transfers from ordinary people to corporations. You said "who owns those corporations" to which I conceded they are owned by people (via a lot of offshoring and some hidden ownership structures) through financial products, but that those products are owned by a much smaller group of people. This isn't the 70s/80s with a thriving middle class when everyone has a share portfolio! Only about 10% of working aged people have anything invested outside of their workplace pension, and only about half have a workplace pension. So there is a transfer of assets from the large proportion of people who have traditionally owned houses to a smaller proportion of people who own financial services products. Sure on day 1 the wealth calculation will be equal but again you are kidding yourself if you think they are in equally good position. By year 2 that equation will be massively unbalanced and will continue to exponentially get worse. Not owning any assets will very quickly erode the value of that cash, we aren't comparing property growth to other asset growth here. We are comparing asset growth to cash. And even if we ignore the growth in asset values vs cash point. The non-asset owners will be paying rent to the asset owners (via large multi-nationals) in order to live. Therefore more transfer of wealth!

This isn't a new phenomenon. Its been happening for 20 years and much documented. There are literally hundreds of economic papers (selection linked below) explaining this exact thing. The only point I am adding to it is that the bulge in wealth that is now held by those over retirement age and will be transferred in the coming 20 years and I am saying it is going to exponentially speed up what is already happening.

https://blogs.lse.ac.uk/inequalities/2024/10/29/the-uks-wealth-gap-has-grown-by-50-in-eight-years/

https://www.resolutionfoundation.org/app/uploads/2020/12/The-UKs-wealth-distribution.pdf

https://www.jrf.org.uk/narrative-change/changing-the-narrative-on-wealth-inequality

As for your point on Tax, I don't disagree its a leakage and a transfer of wealth (but by your measure "on day 1 the wealth still exists its just in different hands") but in the context of inequality its pretty small beans. If you want to talk about government transfers of wealth why don't we talk about how privatisation means that almost everything the government does is a transfer of wealth to corporations (usually those same private equity funds) through contracts and tax breaks, whether the children's care system, water provision, elderly care all of the cash goes back to the same asset holders. Or we could talk about how during COVID the government directly transferred £700-800bn of taxpayers money to those same corporations and funds.

Every part of our economy, government and system is making the same small (and ever decreasing) group of asset holders richer whilst excluding everybody else.

You are also making the assumption that every man and woman who sells a property to the corporations will leave that money sitting in an Atom savings account to form the opinion that more wealth will be held by the corporations because they're asset value will grow. But thats a completely different matter.

At least we agree that IHT is a true transfer of wealth away from the individual!

I'm not making any assumption I'm literally quoting from the evidence linked above from the LSE, Joseph Rowntree Foundation and Resolution foundation. People who don't own houses very very rarely buy investment products. Only 10% of working aged people hold any investments outside the minimum workplace pension around 50% have a workplace pension. It's much more likely that the cash goes to paying off existing debt than investments. For many investments are now sadly so out of reach.

Again this is not an assumption about the future it’s evidenced on what's already happening. The only assumption is that it's going to continue to speed up and exponentially so when a massive amount of wealth is transferred in a short period of time.

if I sell my house, my wealth hasn’t transferred to the buyer, the house has, in return the buyer has transferred me the money. Neither I as the seller nor the buyer is any better of worse off and no wealth has gone from one party to another.

we’re now into people who don’t have anything 🙈 what wealth are they transferring?

ps if no one sells their house to Lloyds or any other corp all will be fine 😉

The children and grandchildren of those with wealth and who hold assets will receive a share of an inheritance. But it likely won't enable them to buy a house or other assets. hence a much smaller asset owning class.

So yes we've established that on day 1 the maths says it's the same but we've also understood that going from owning an asset to owning cash means that very quickly you will be much worse off.

Yes the people recieving the cash are not going to be part of the asset owning class. Read one of the studies I linked. As boomers who collectively hold a large amount of wealth, gradually die (sorry but it's whats gonna happen) that wealth will be passed down to their estate. But when the estate is settled and once split between children and grand children the average amounts actually inherited by an individual are not going to be enough to purchase a house. Particularly with the massive targetted corporate investment in the market driving up prices. And so those people who inherit aren't able to buy a house and people who don't own houses generally don't buy financial products either so wont be owning those corprorations through investments. So the cash amount received will either be consumed by ever increasing rent (to the home owning corporations) or inflated away. If it is enough to get them something it will be far less in assets than their parent/grandparents had.

The part of those inheriting can't be part of the asset owning class I disagree with (not that they won't but that they can't). When my father died (a boomer) his estate (which consisted of a house in Eltham) was split between my sister and I and my two children (70/20/5/5), my 20% I also gave to my children (aged 15 and 12 at the time) and I invested that for them in assets (predominantly stocks and shares, but a little bit of gold and some premium bonds), the value of those ISA's/LISA's, Gold & PB's now far exceed what it would have had it remained in property, by at least 2x.

On the flip side, my sister decided to spend the majority of hers, numerous (sometimes 4x a year) expensive holidays, a new car etc, I suspect she has little left. Now that isn't because she couldn't have kept the money in assets, she simply chose not to (for numerous reasons).

That's as much to do with financial education as anything else. Yet financial education is still rarely talked about let alone anything done about it. When I get new starters at work (Apprentices/Graduates) it scares me the lack of financial knowledge they have. I spend a fair amount of time running through that even at a basic level of saving, I'm pleased to say that 90% learn very quickly and start saving and investing straight away. I run a monthly lunch catch up with them all to see how our ISA's are doing!

I have a different view to many as to where house pricing will go, I don't think it will be the appreciating asset it once was (to the levels, it will still appreciate over time), even less so if any government actually pulls it's figures out and starts properly building.

IMHO, and it is just mine, there is no reason for assets to drift away from individuals to corporations or to fewer and fewer people, other than for taxation reasons and financial education. If every boomer put their assets into certain types of trust, there would be little asset transfer aside from periodic tax, and even without trusts it's IHT that will deplete assets of the people together with a lack of financial education, not because LBG are planning on buying houses.

What your describing isn't the average situation either when a person inherits or the amount the will inherit. Again less than 40% of working aged people have any form of pension and less than 10% have any investments above the minimum workplace pension. What your describing is people in that 10% recieving an above average inheritance which is such a long way from the average person.

You can say you don't see any reason for assets to drift away from individuals and towards corporations or a small asset owning class, but its happening. And has been for nearly 20 years. The rate at which its happening has sped up massively since COVID and is IMO the main driver of the bad feeling around the UK and a lot of our economy struggles.

Again I'm describing a phenomenon that already happening and is much reported on. There are literally hundreds of research and economic papers outlining this effect. It's seen as one of the biggest causes of growing inequality in the UK. All I'm pointing out is what's coming down the pipeline in terms of a population bulge and the higher proportional wealth that cohort hold means this effect that is already happening is going to happen exponentially quicker.

Don't disagree that financial education but I think you're way off if your implying for most people the only reason they don't have an investment portfolio is bad choices and lack of knowledge.

I think we can agree to disagree on whether massive targetted corporate investment in the housing market is going to price people out of housing. Which again for most is the only asset they will ever own.

If the inheritance is or once was an asset (i.e. a house) it's not £5 or £10k. Take the average house price of about £270k and even if thats split between 4 people inheriting it, thats still over £65k each. If people (the type of people you refer to, i.e. do not own their own home and have no investments outside of a basic workplace pension) aren't investing at least the majority of that, then that is everything to do with financial education.

I'm not saying ti isn;t happening to a degree, but it doesn't need to be.

Garys economics has a lot to answer for.

Some could be helped with financial education and I'm a big advocate of that. But when people like Martin Lewis are saying that the average person's position is at a point where financial literacy alone isn't going to solve it then I'm listening to that.

Last comment without explanation is just weird.

What would a major life cost be? Whilst sometimes debt is sadly forced upon people, if someone Is inheriting 70k and cannot use the majority of that to buy asset (if they are someone currently with no asset), then in the majority of cases thats everything to do with financial education. Agree with ML, but we are talking about inheriting someone else's assets, not day to day budgetary.

As a starter on financial literacy. No one should 'expect' to inherit anything, not a penny from a previous generation, so any 'windfall' should be exactly that (I know I live in a utopia dream world!).

edit: what about the people who don't own assets when they die but have some cash savings to leave, an opportunity to buy NEW assets.

But how is he in any way relevant to the conversation we're having let alone having "a lot to answer for"? I've quoted and linked reports from the LSE, Joseph Rowntree Foundation and the Resolution Foundation. These are long established, well respected voices in the economics research space. Are you suggesting he somehow influenced them? I can link you to similar research from pretty much any economics Uni research department in the country.

As for your other point Balladman has already answered ot far more eloquently than I ever could. You are just massively underestimating what the situation is like for most people.

I agree no one should expect an inheritance in a perfect world it wouldn't exist as its the biggest factor preventing social mobility and those who receive an inheritance have already received a massive leg up in life before they receive it anyway. But thats a perfect world.

not sure I agree that in a perfect world there’d be no inheritances, how would that play out around the assets of the baby boomers once they die which was your initial concern? We’ve gone from at the start of the conversation you worrying/believing that the boomer generations assets when they die are going to be bought up by institutions (for all the reasons you’ve articulated) and now your advocating in an ideal world assets shouldn’t be inherited anyway? Where should they go?

on Gary’s economics, it was showing financial acumen/literacy. Here is a guy getting quite a following who doesn’t even understand the basics about taxation (yet the majority if not all of his proposed solution to the wealth gap is taxation).

I still don't understand how that means he has a lot to answer for or even how its relevant to the issues we were talking about. He isn't talking about individual finances or financial literacy or even tax that much. His key issue is inequality. He admits he isn't an expert on tax he regularly says that the details need to be worked out and calls on various organisations (RF, Tax Research UK etc.) to do the analysis and I know some are in the background. I get that you don't agree with his solution (Which BTW is IMO more about playing the soundbitey social media game that people like Farage do in order to simplify a message and make it land, I don't think he thinks its the whole picture solution) so what then is your solution to rapidly worsening inequality?

My reference to him is not about corps buying up property or assets moving, but simply even someone with the audience and ear of people he has, his financial knowledge in many aspects is hugely lacking (the lack of knowledge generally was what I was highlighting) . So my reference is he has a lot to answer for, is many who follow him believe the solution to all their problems is just tax the rich more.

If I had a solution I'd be sitting in a different job!! There are probably 101 different things i would do. But to start with, much like I know you are an advocate of early intervention on health and education (i.e. rather than the NHS patching people up, lets 'educate' for better health outcomes in the first place, or things like bring back Sure Start for early intervention for education). Better financial education to children in schools would be a start. Give people the knowledge and we just may get different outcomes. It's certainly what I do with the Apprentices and Grads I employ/encounter and it is working, all be it on a tiny tiny scale.

'Wealth' in the world we now live is too mobile, I don't believe you can tax your way out of any deemed inequality. I wouldn't put myself in the bracket that many are calling for a wealth tax on, nor most of the people i work with. But if I can remove myself from the situation, you can guarantee the true wealth can do so and much much easier.

Give people the tools to improve there own lives and where necessary top that up with government assistance. but if the only answer out there is tax, we are all heading in a ever increasing downward spiral.

I agree with the education and early intervention in health and many aspects of life are key as the basis of building a better society but that has to be paid for by something so tax has to be raised in the meantime.

I fundamentally disagree that "you cant tax yourself out of inequality" basically the only time this country has reduced inequality has been the post war years when it was largely done through massive progressive taxes and that money invested into society. The difference then was that everyone paid it in full, all individuals and companies. There was no avoidance or even perfectly legal but not moral things like the ability to shift income through companies to pay much lower rates of tax.

Professor Richard Murphy of tax research UK wrote a 2024 report on taxing wealth. He identifies £90bn of tax changes that could be made to address this that only affect the top 10%. He doesnt suggest doing all of them but they are things a government could select from. He has (not in that report but elsewhere) talked about a wealth tax he supports the idea but thinks we should resolve though existing taxes where possible and only go to a direct wealth tax if still needed - he doesnt think it will be to anyone other than billionaires if a lot of his other ideas are done.

My favourite is this : "Charging an investment income surcharge of 15% on income earned from interest, dividends, rents, and other sources might raise £18 bn of extra tax per annum. Lower rates could, of course, be charged. This estimate assumes no such charge on the first £5,000 of such income a year, with a higher allowance for pensioners." BTW an investment income surcharge was Tory party Policy until the late 60's so hardly a radical socialist idea.

I also like "Charging VAT on the supply of financial services, which are inevitably consumed by the best off, could raise £8.7 bn of extra tax per annum." because currently we have a regressive system where the only financial services lower income people buy - insurance - is subject to IPT (a VAT Equivalent tax) but the services only bought by the top 10% are not subject to any tax. I would make the basic level workplace pension exempt though.

https://taxingwealth.uk/wp-content/uploads/2024/04/Taxing-Wealth-Report-2024-Summary.pdf

For me its imperative that we do tackle the inequality. The hoarding of wealth at the top of the distribution is acting as an anchor on our economy. Due to Marginal Propensity to Consume, the velocity of money and the fact they are exponentially more likely to spend their cash aboard than someone lower down the distribution. If we directly took cash from the top 1% and put it directly in the hands of the bottom 1% (not suggesting we should) we would get an economic boost for those reasons. Better still we use it to fund services, employ people lower down the distribution who spend it in the UK and sooner, that creates someone else's income and boom - multiplier effect due to the velocity of money and growth.

A selection of those proposals plus what I said a couple posts up about tackling oligopoly power through taxes and pricing schemes would be more than enough to properly invest in services, education and building a better society for everyone.

And there you have my manifesto! 0

0 -

It is just maths but what thats missing is that this has happened in a period where the UK economy has barely grown, wages have stagnated and living standards have fallen. So where has this additional wealth for those at the top come from? Squeezing everyone below themRob7Lee said:

In it's simplest form isn't that chart a simple math/economics when asset prices increase? (it seems to be based on wealth and asset).cantersaddick said:This chart is brilliant. Made by the guardian but from a Resolution foundation report. shows how for the bottom 50% there is almost no change since 06-08 but for the top 10% there has been massive growth. As that's not even the full picture as within that top 10% the growth has been massively concentrated for the top 1%.

https://www.theguardian.com/inequality/2025/oct/08/lifetime-of-earnings-not-enough-for-uk-workers-to-join-wealthiest-10-report-says

By virtue of the fact someone is in the top x% means they hold more asset. If asset prices increase then of course the gap will widen. If asset prices dropped, i.e. a housing market crash, stock market and/or gold prices plummet, the chart would look very different.

It's like saying I have £10,000 in the bank @ 5% APR earning or increasing my assets by £500, yet someone who has £1,000 in the bank only increase by £50 with the same 5% APR, therefore the gap widens - of course it will.

Unless we lived in a communist state where everyone owns the same and earns the same, the chart is always going to head that way in a time of asset appreciation.

If all assets dropped 50% would it be OK for the top percentiles to complain they've reduced more than the lower percentiles and that's really unfair? Or is that basic math?

What that points to is one of the issues I've been talking about - conventional/traditional economic theory just not holding anymore in the modern world. In this case the idea that Growth is the driver of increases in wealth and living standards. What we now have is an economy where those at the top win either way, growth or no growth through corporate power suppressing wages despite record profits, lower tax exposure so services get underfunded and the ability to hoover up assets at a discount in a downturn so as to monopolise the benefits of any growth that does come right at the very top.0 -

The point of being provocative (not me but others) is to counter the same level of provocative soundbites coming from the likes of Farage. At least this one is borne out in data even if the presentation is provocative.valleynick66 said:

Yes. But the reason you / the authors use ‘Victorian’ as the base / reference point is to be provocative and it implies something more.cantersaddick said:

I get what you're saying that overall living standards even for the worst off are higher than in the Victorian era. But inequality - the difference between the richest and poorest is very much moving in that direction. IOts not saying that people are living in Victorian conditions but they are as far (or rather getting there) from the very rich as they were in the Victorian era. Social mobility is not that far behind either peaking in the late 70s early 80s.valleynick66 said:

surely the best measure is the standard of living of those impacted? It doesn’t matter as much if the super rich outstrip me if I am ‘better off’ than I would have comparatively been in ‘Victorian’ times.cantersaddick said:Jints said:cantersaddick said:But pointing out that we are at near Victorian era levels of inequality and social mobility is an important message. Whether or not you agree with his approach to fixing it you can't argue with that fact. Or were people hoping we would all just collectively be gaslit into thinking everything was fine for a couple decades longer?

You can point it out if you like, but it's not even close to being true. The top 10% earned 55.8% of income in 1900 and 35.7% in 2021. The bottom 50% earned 13.8% in 1900 and 20.4% in 2021, a little down from the peak in 1970 of 21.4% but higher than in 2013 (18.4%) https://equalitytrust.org.uk/scale-economic-inequality-uk/

You've made the age old mistake of quoting income inequality in a conversation about wealth inequality. You've also selected some very specific points on the scale which dilute the problem. Its the top 1% or even 0.1% who are showing massive growth and are largely the problem.

50 Families in the UK own more wealth than 50% of the population combined. Its becoming more and more like an old fashioned aristocratic class, or even worse a feudalistic land owning class. https://www.theguardian.com/news/2025/may/19/uk-50-richest-families-hold-more-wealth-than-50-of-population-analysis-finds

Read the LSE report on it here (actually only uses pre COVID data so likely underestimates the scale of the issue) https://blogs.lse.ac.uk/inequalities/2024/10/29/the-uks-wealth-gap-has-grown-by-50-in-eight-years/

or the Joseph Rowntree foundation https://www.jrf.org.uk/narrative-change/changing-the-narrative-on-wealth-inequality

Or the Resolution foundation https://www.resolutionfoundation.org/app/uploads/2020/12/The-UKs-wealth-distribution.pdf

As I observed earlier sometimes labels are misleading - millionaires and Victorian for example. It’s what people can or can’t do with their ‘wealth’.Lies damned lies and statistics.I’m not suggesting home ownership is anything other than a challenge and worse than it was a couple of decades ago but it’s not Victorian.I don’t disagree the gap is moving the wrong way but the very top earners/wealthiest are so far removed from us mere mortals and so few in number they aren’t the most important group (to me).I’m more concerned by the executive level (for want of a better label) who reward themselves with salaries far in excess of their junior staff and outsource to squeeze every last penny and can’t put themselves in the shoes of their junior employees as to what life looks like to them.The growing social concern is more about that group of people who live very different lives to their employees but squeeze them even harder.I’m all for a restriction on multiple of earnings someone can get relative to their junior staff.

Agree with a lot of that. exec pay is an issue. I read ages ago that J.P. Morgan (the bloke) was unpopular back in the day in the US because he lobbied government to be able to increase his pay to (something like) 16x his companies average salary. Now its so much worse than that.

Still think those at the very top need to pay in to a society though.0 -

I agree this on paper makes sense:

My favourite is this : "Charging an investment income surcharge of 15% on income earned from interest, dividends, rents, and other sources might raise £18 bn of extra tax per annum. Lower rates could, of course, be charged. This estimate assumes no such charge on the first £5,000 of such income a year, with a higher allowance for pensioners." BTW an investment income surcharge was Tory party Policy until the late 60's so hardly a radical socialist idea.

I’d be interested in what the rationale counter argument is that really would scare away investment.1 -

Sponsored links:

-

But the chart is on wealth and asset, asset prices almost across the board have increased considerably in that time period, thats where the additional wealth has come from, in the main. Whether the UK economy has grown is broadly irrelevant as in the main assets aren't the UK economy, nor has it (in the main) happened by squeezing people below. If you hold 10x the asset I do, lets say in Gold and Stocks and Shares, you £100,000 me £10,000, and in the next 12 months those assets increase by 25%, then of course the gap between what I hold and what you hold will widen in £'s terms (which is what the chart shows) from £90k to £112,500. You've not squeezed me.cantersaddick said:

It is just maths but what thats missing is that this has happened in a period where the UK economy has barely grown, wages have stagnated and living standards have fallen. So where has this additional wealth for those at the top come from? Squeezing everyone below themRob7Lee said:

In it's simplest form isn't that chart a simple math/economics when asset prices increase? (it seems to be based on wealth and asset).cantersaddick said:This chart is brilliant. Made by the guardian but from a Resolution foundation report. shows how for the bottom 50% there is almost no change since 06-08 but for the top 10% there has been massive growth. As that's not even the full picture as within that top 10% the growth has been massively concentrated for the top 1%.

https://www.theguardian.com/inequality/2025/oct/08/lifetime-of-earnings-not-enough-for-uk-workers-to-join-wealthiest-10-report-says

By virtue of the fact someone is in the top x% means they hold more asset. If asset prices increase then of course the gap will widen. If asset prices dropped, i.e. a housing market crash, stock market and/or gold prices plummet, the chart would look very different.

It's like saying I have £10,000 in the bank @ 5% APR earning or increasing my assets by £500, yet someone who has £1,000 in the bank only increase by £50 with the same 5% APR, therefore the gap widens - of course it will.

Unless we lived in a communist state where everyone owns the same and earns the same, the chart is always going to head that way in a time of asset appreciation.

If all assets dropped 50% would it be OK for the top percentiles to complain they've reduced more than the lower percentiles and that's really unfair? Or is that basic math?

What that points to is one of the issues I've been talking about - conventional/traditional economic theory just not holding anymore in the modern world. In this case the idea that Growth is the driver of increases in wealth and living standards. What we now have is an economy where those at the top win either way, growth or no growth through corporate power suppressing wages despite record profits, lower tax exposure so services get underfunded and the ability to hoover up assets at a discount in a downturn so as to monopolise the benefits of any growth that does come right at the very top.

Conversely if those assets dropped 25% the gap (in £'s terms) would reduce. Rather than a £90,000 gap it's now only £67,500.

the odd's are that those in the top percentiles also will earn more than those in the bottom percentiles.

I'm struggling to see why that chart should be any sort of shock to anyone at a time when asset prices have increased considerable. Shock horror my wealth has grown more than my children's in that time......

0 -

Ps, not going to quote the entire post, but just to clarify @cantersaddick VAT is not charged on Insurance, it’s exempt.0

-

Sorry wrong wording but an equivalent tax is levied on them. Insurance premium tax. Important distinction will edit.Rob7Lee said:Ps, not going to quote the entire post, but just to clarify @cantersaddick VAT is not charged on Insurance, it’s exempt.0 -

Again this is one we aren't gonna agree on. But we aren't comparing people with assets vs people with less assets. We're comparing people with loads of assets to people with no assets.Rob7Lee said:

But the chart is on wealth and asset, asset prices almost across the board have increased considerably in that time period, thats where the additional wealth has come from, in the main. Whether the UK economy has grown is broadly irrelevant as in the main assets aren't the UK economy, nor has it (in the main) happened by squeezing people below. If you hold 10x the asset I do, lets say in Gold and Stocks and Shares, you £100,000 me £10,000, and in the next 12 months those assets increase by 25%, then of course the gap between what I hold and what you hold will widen in £'s terms (which is what the chart shows) from £90k to £112,500. You've not squeezed me.cantersaddick said:

It is just maths but what thats missing is that this has happened in a period where the UK economy has barely grown, wages have stagnated and living standards have fallen. So where has this additional wealth for those at the top come from? Squeezing everyone below themRob7Lee said:

In it's simplest form isn't that chart a simple math/economics when asset prices increase? (it seems to be based on wealth and asset).cantersaddick said:This chart is brilliant. Made by the guardian but from a Resolution foundation report. shows how for the bottom 50% there is almost no change since 06-08 but for the top 10% there has been massive growth. As that's not even the full picture as within that top 10% the growth has been massively concentrated for the top 1%.

https://www.theguardian.com/inequality/2025/oct/08/lifetime-of-earnings-not-enough-for-uk-workers-to-join-wealthiest-10-report-says

By virtue of the fact someone is in the top x% means they hold more asset. If asset prices increase then of course the gap will widen. If asset prices dropped, i.e. a housing market crash, stock market and/or gold prices plummet, the chart would look very different.

It's like saying I have £10,000 in the bank @ 5% APR earning or increasing my assets by £500, yet someone who has £1,000 in the bank only increase by £50 with the same 5% APR, therefore the gap widens - of course it will.

Unless we lived in a communist state where everyone owns the same and earns the same, the chart is always going to head that way in a time of asset appreciation.

If all assets dropped 50% would it be OK for the top percentiles to complain they've reduced more than the lower percentiles and that's really unfair? Or is that basic math?

What that points to is one of the issues I've been talking about - conventional/traditional economic theory just not holding anymore in the modern world. In this case the idea that Growth is the driver of increases in wealth and living standards. What we now have is an economy where those at the top win either way, growth or no growth through corporate power suppressing wages despite record profits, lower tax exposure so services get underfunded and the ability to hoover up assets at a discount in a downturn so as to monopolise the benefits of any growth that does come right at the very top.

Conversely if those assets dropped 25% the gap (in £'s terms) would reduce. Rather than a £90,000 gap it's now only £67,500.

the odd's are that those in the top percentiles also will earn more than those in the bottom percentiles.

I'm struggling to see why that chart should be any sort of shock to anyone at a time when asset prices have increased considerable. Shock horror my wealth has grown more than my children's in that time......

The bigger question for me is why and how have those asset prices increased so much over such a long period with no growth whilst living standards have fallen and wages have been suppressed. Again proving another of those traditional economic links is now broken. There is definitely as squeeze, not by the asset holders but by the corporations they hold assets in. Wages have been suppressed for a generation despite profits, increased profits haven't generated proportional increase in tax take (another traditional economic link that's been broken) so cant be used to improve services.0 -

Out of the frying pan, into the firecantersaddick said:This chart is brilliant. Made by the guardian but from a Resolution foundation report. shows how for the bottom 50% there is almost no change since 06-08 but for the top 10% there has been massive growth. As that's not even the full picture as within that top 10% the growth has been massively concentrated for the top 1%.

https://www.theguardian.com/inequality/2025/oct/08/lifetime-of-earnings-not-enough-for-uk-workers-to-join-wealthiest-10-report-says 2

2 -

I had lunch with a family friend (in her 60s, Boris is too left wing for her, she's a Farage lover through and through, not that I'm trying to take this to politics, I'm painting a picture). To be clear she's a top lawyer well into 6 figures

She agreed with the view that CGT and Income tax should be equalised, and unbelievably, unprompted said there should be a tapering on the state pension with means testing etc

I think the "overton window" on taxation is moving to the left, whilst many things are moving to the right...

I think you either a) flat rate money-in relief (20%) on pensions or b) means test/taper pensions, with the caveat that savings must be funnelled back into improving state pensions for those in poverty.

Personally as someone who due to salary issues is about to want to smash shit loads into my pension, would prefer the latter.

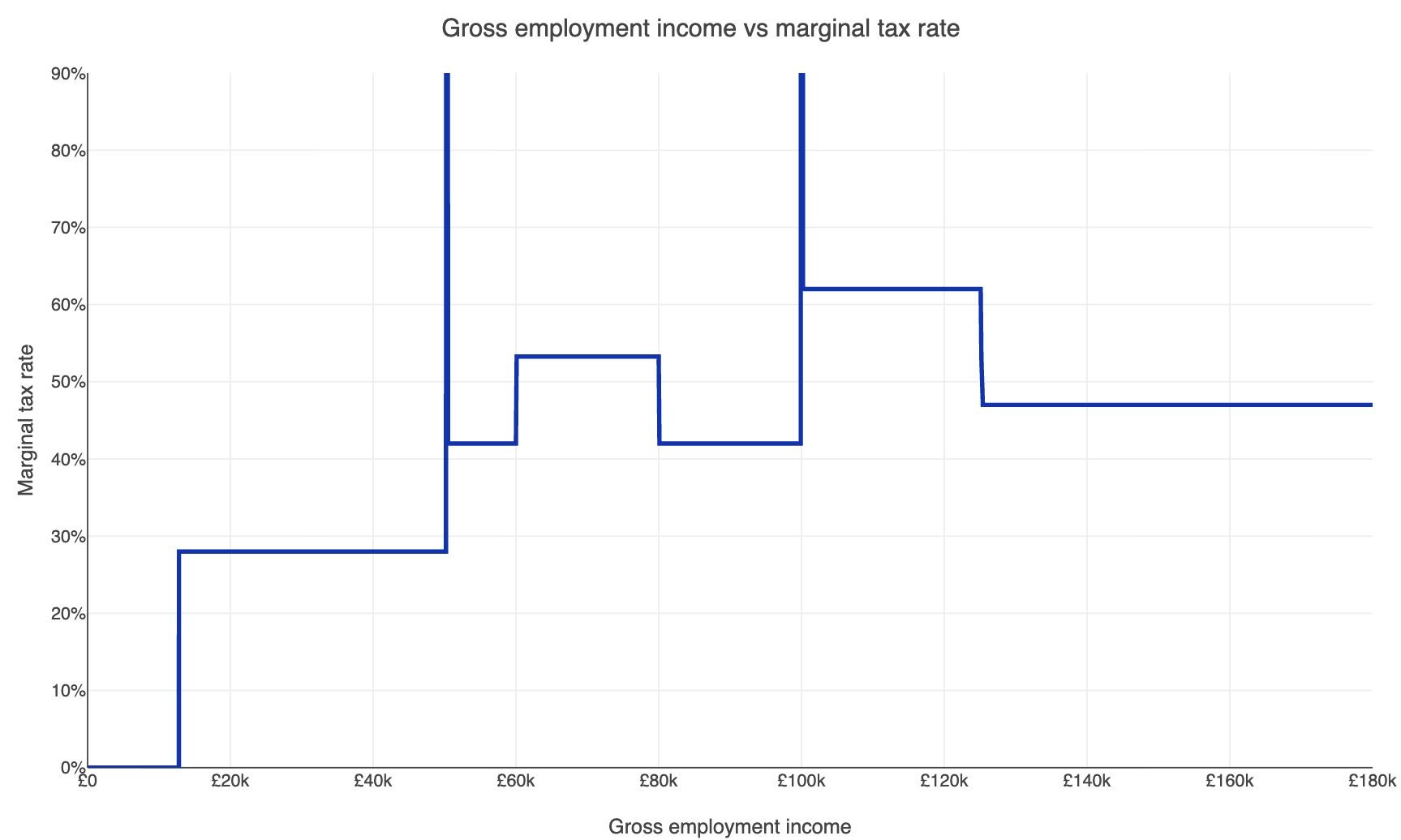

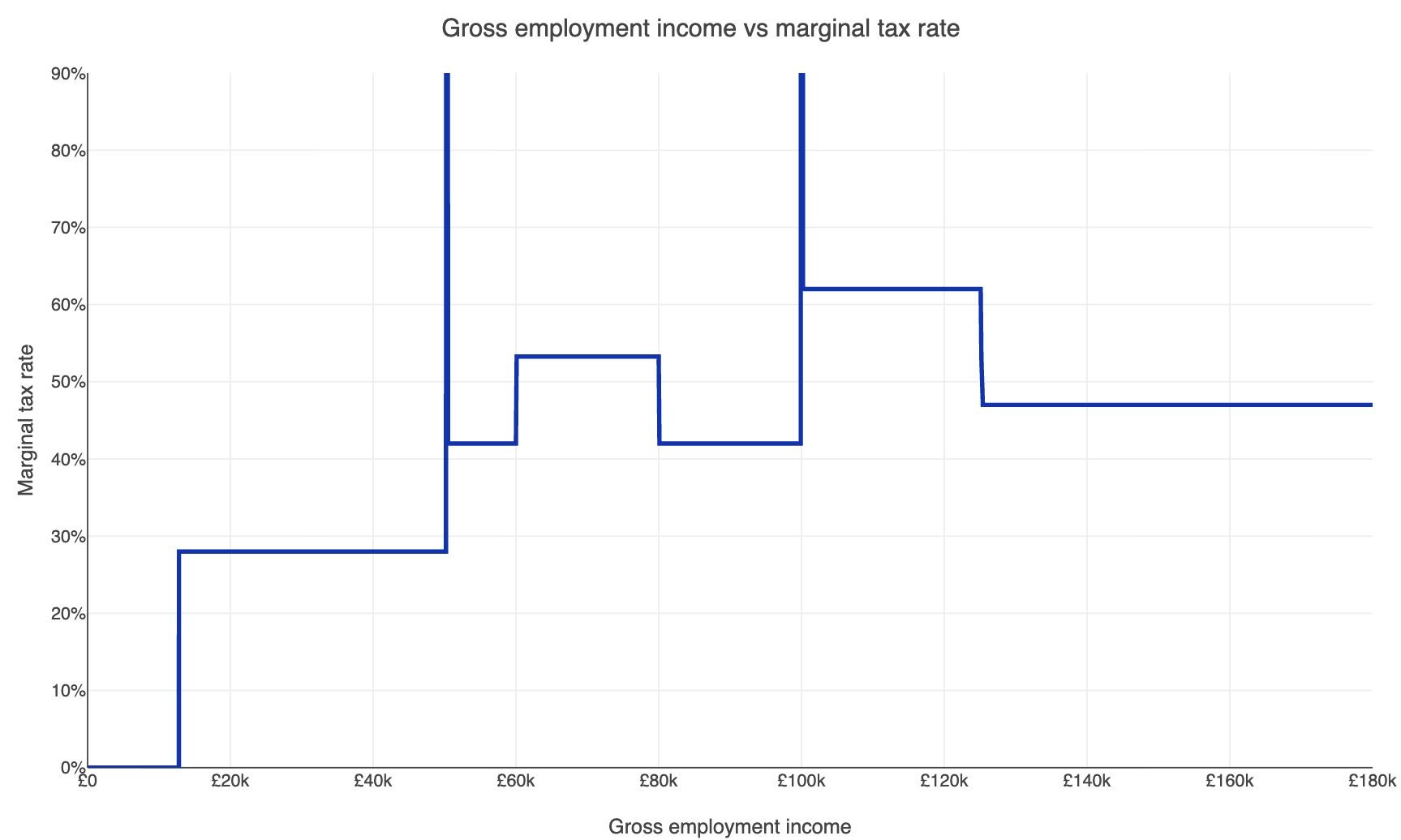

I know we all know this, but this chart is such a blocker on productivity due to benefits lost. I'm not complaining about the progressiveness of the tax system, I'm complaining about the cliff edges. 2

2 -

Same maths applies then. What happens when asset prices increase on someone with no assets v’s someone with assets? Or if asset prices decrease does the gap increase or decrease between those with assets v’s without? Use my example but assume I’ve nothing in the bank!! I just don’t see how in times when asset prices increase the chart can do anything than what it’s doing and the reverse if asset prices go down.cantersaddick said:

Again this is one we aren't gonna agree on. But we aren't comparing people with assets vs people with less assets. We're comparing people with loads of assets to people with no assets.Rob7Lee said:

But the chart is on wealth and asset, asset prices almost across the board have increased considerably in that time period, thats where the additional wealth has come from, in the main. Whether the UK economy has grown is broadly irrelevant as in the main assets aren't the UK economy, nor has it (in the main) happened by squeezing people below. If you hold 10x the asset I do, lets say in Gold and Stocks and Shares, you £100,000 me £10,000, and in the next 12 months those assets increase by 25%, then of course the gap between what I hold and what you hold will widen in £'s terms (which is what the chart shows) from £90k to £112,500. You've not squeezed me.cantersaddick said:

It is just maths but what thats missing is that this has happened in a period where the UK economy has barely grown, wages have stagnated and living standards have fallen. So where has this additional wealth for those at the top come from? Squeezing everyone below themRob7Lee said:

In it's simplest form isn't that chart a simple math/economics when asset prices increase? (it seems to be based on wealth and asset).cantersaddick said:This chart is brilliant. Made by the guardian but from a Resolution foundation report. shows how for the bottom 50% there is almost no change since 06-08 but for the top 10% there has been massive growth. As that's not even the full picture as within that top 10% the growth has been massively concentrated for the top 1%.

https://www.theguardian.com/inequality/2025/oct/08/lifetime-of-earnings-not-enough-for-uk-workers-to-join-wealthiest-10-report-says

By virtue of the fact someone is in the top x% means they hold more asset. If asset prices increase then of course the gap will widen. If asset prices dropped, i.e. a housing market crash, stock market and/or gold prices plummet, the chart would look very different.

It's like saying I have £10,000 in the bank @ 5% APR earning or increasing my assets by £500, yet someone who has £1,000 in the bank only increase by £50 with the same 5% APR, therefore the gap widens - of course it will.

Unless we lived in a communist state where everyone owns the same and earns the same, the chart is always going to head that way in a time of asset appreciation.

If all assets dropped 50% would it be OK for the top percentiles to complain they've reduced more than the lower percentiles and that's really unfair? Or is that basic math?

What that points to is one of the issues I've been talking about - conventional/traditional economic theory just not holding anymore in the modern world. In this case the idea that Growth is the driver of increases in wealth and living standards. What we now have is an economy where those at the top win either way, growth or no growth through corporate power suppressing wages despite record profits, lower tax exposure so services get underfunded and the ability to hoover up assets at a discount in a downturn so as to monopolise the benefits of any growth that does come right at the very top.

Conversely if those assets dropped 25% the gap (in £'s terms) would reduce. Rather than a £90,000 gap it's now only £67,500.

the odd's are that those in the top percentiles also will earn more than those in the bottom percentiles.

I'm struggling to see why that chart should be any sort of shock to anyone at a time when asset prices have increased considerable. Shock horror my wealth has grown more than my children's in that time......

The bigger question for me is why and how have those asset prices increased so much over such a long period with no growth whilst living standards have fallen and wages have been suppressed. Again proving another of those traditional economic links is now broken. There is definitely as squeeze, not by the asset holders but by the corporations they hold assets in. Wages have been suppressed for a generation despite profits, increased profits haven't generated proportional increase in tax take (another traditional economic link that's been broken) so cant be used to improve services.

IPT is levied the same for everyone at the two different rates depending on the product (there is a nil rate/exemption for certain products).

On tax v profits, Tesco was cited earlier - how much Corp tax are they paying now compared to 5 years ago, less or more? I’ll save you looking, £611m in 2025 v £104m in 2021.

I’d agree on wage suppression, think there was a time not so long ago I went more than 5 years without a pay increase.

theres a lot of reasons why living standards and services have worsened, still trying to fathom how the country (Government) is spending double what it did 6-7 years ago and yet…..…..0 -

Again I think you're missing the point. Im not denying it happened. It obviously happened. What I'm saying is if the economic theory (Neo-liberal economics) that forms the basis for all our policy and has done for nearly 50 years was actually happening then this situation wouldnt be occurring. The economic link that says that without growth these things shouldn't be happening clearly no longer holds. Therefore the policy solutions from that same theory of economics should not be the ones we apply. We need to find a different solution.Rob7Lee said:

Same maths applies then. What happens when asset prices increase on someone with no assets v’s someone with assets? Or if asset prices decrease does the gap increase or decrease between those with assets v’s without? Use my example but assume I’ve nothing in the bank!! I just don’t see how in times when asset prices increase the chart can do anything than what it’s doing and the reverse if asset prices go down.cantersaddick said:

Again this is one we aren't gonna agree on. But we aren't comparing people with assets vs people with less assets. We're comparing people with loads of assets to people with no assets.Rob7Lee said:

But the chart is on wealth and asset, asset prices almost across the board have increased considerably in that time period, thats where the additional wealth has come from, in the main. Whether the UK economy has grown is broadly irrelevant as in the main assets aren't the UK economy, nor has it (in the main) happened by squeezing people below. If you hold 10x the asset I do, lets say in Gold and Stocks and Shares, you £100,000 me £10,000, and in the next 12 months those assets increase by 25%, then of course the gap between what I hold and what you hold will widen in £'s terms (which is what the chart shows) from £90k to £112,500. You've not squeezed me.cantersaddick said:

It is just maths but what thats missing is that this has happened in a period where the UK economy has barely grown, wages have stagnated and living standards have fallen. So where has this additional wealth for those at the top come from? Squeezing everyone below themRob7Lee said:

In it's simplest form isn't that chart a simple math/economics when asset prices increase? (it seems to be based on wealth and asset).cantersaddick said:This chart is brilliant. Made by the guardian but from a Resolution foundation report. shows how for the bottom 50% there is almost no change since 06-08 but for the top 10% there has been massive growth. As that's not even the full picture as within that top 10% the growth has been massively concentrated for the top 1%.

https://www.theguardian.com/inequality/2025/oct/08/lifetime-of-earnings-not-enough-for-uk-workers-to-join-wealthiest-10-report-says

By virtue of the fact someone is in the top x% means they hold more asset. If asset prices increase then of course the gap will widen. If asset prices dropped, i.e. a housing market crash, stock market and/or gold prices plummet, the chart would look very different.

It's like saying I have £10,000 in the bank @ 5% APR earning or increasing my assets by £500, yet someone who has £1,000 in the bank only increase by £50 with the same 5% APR, therefore the gap widens - of course it will.

Unless we lived in a communist state where everyone owns the same and earns the same, the chart is always going to head that way in a time of asset appreciation.

If all assets dropped 50% would it be OK for the top percentiles to complain they've reduced more than the lower percentiles and that's really unfair? Or is that basic math?

What that points to is one of the issues I've been talking about - conventional/traditional economic theory just not holding anymore in the modern world. In this case the idea that Growth is the driver of increases in wealth and living standards. What we now have is an economy where those at the top win either way, growth or no growth through corporate power suppressing wages despite record profits, lower tax exposure so services get underfunded and the ability to hoover up assets at a discount in a downturn so as to monopolise the benefits of any growth that does come right at the very top.

Conversely if those assets dropped 25% the gap (in £'s terms) would reduce. Rather than a £90,000 gap it's now only £67,500.

the odd's are that those in the top percentiles also will earn more than those in the bottom percentiles.

I'm struggling to see why that chart should be any sort of shock to anyone at a time when asset prices have increased considerable. Shock horror my wealth has grown more than my children's in that time......

The bigger question for me is why and how have those asset prices increased so much over such a long period with no growth whilst living standards have fallen and wages have been suppressed. Again proving another of those traditional economic links is now broken. There is definitely as squeeze, not by the asset holders but by the corporations they hold assets in. Wages have been suppressed for a generation despite profits, increased profits haven't generated proportional increase in tax take (another traditional economic link that's been broken) so cant be used to improve services.

IPT is levied the same for everyone at the two different rates depending on the product (there is a nil rate/exemption for certain products).

On tax v profits, Tesco was cited earlier - how much Corp tax are they paying now compared to 5 years ago, less or more? I’ll save you looking, £611m in 2025 v £104m in 2021.