Greece...

Comments

-

Here it is coming from a German

http://www.ft.com/cms/s/0/89efec78-a653-11e4-89e5-00144feab7de.html#axzz3fsTxyDqx0 -

A German study has shown that adding up the growth benefits of euro membership results in a profit of nearly €1.2 trillion between 2013 und 2025.” For every German citizen, this represents an average extra income of “about €1,100 per year" during that period, according to the study.

The figures from the Bertelsmann study were based on some of the less immediately tangible advantages of euro membership. For example, "Germany's membership in the currency union reduces costs for international trade and protects it from strong exchange rate fluctuations," said Aart De Geus, chairman and chief executive of the Bertelsmann Stiftung.

“This means that even if Germany had to write off a large percentage of the loans that it has made available to the heavily indebted states of southern Europe as part of the various euro rescue measures, the economic advantages of its membership of the monetary union would continue to predominate (for the germans).”

I'm not saying Germany should write off the loans completely, but the options for the Greeks shouldn't be lose lose. It isn't about people's desire to give the greeks a bloody nose. It is about the sadly rare ability to see the bigger picture. We suffer from that problem in this country too.

3 -

isn't the Bertelsmann Foundation supposed to be dedicated to European integration as part of its constitution? That being so, one should be cautious about output from its studies especially when the study seems to be focused on ten years that haven't happened yet? How does it compare to Germany's position if the EU or the euro did not exist and does it say why these advantages are attributable to euro membership?0

-

read it and make your own mind up0

-

9

9 -

Good work on that, Muttley. It has been said before that the euro benefits the German (export based) economy the most.But your article sums it up succinctly. It is not "pro-euro" to recognise the truth of it.MuttleyCAFC said:read it and make your own mind up

I understand the argument that the Germans should have been more generous and remembered the 50s when their own debt was forgiven. On the other hand, I recognise the Northern European (not just German) fear that the Greeks are incapable of reforming their fundamentally corrupt society to conform to a Northern European approach. Greece should never have been allowed into the euro, and I hope the story of possible legal action against Goldman Sachs is true. But that is what happened, and I think at least Germany's hard line has dissuaded other weaker countries from thinking they can come cap in hand. In this respect, the one to worry about is Italy, IMHO. Another fundamentally corrupt country. If it had not been a founder member of the Common Market, it would never have got into the EU.0 -

My belief is that the best country to get kicked out of the Euro would be Germany if it could ever happen lol. I do agree, and have not said there are not fundamental problems with Greece, but you don't solve them by giving them a choice of being shot or poisoned, maybe a good kicking should have been an option too. The Germans are quite an ignorant lot when it comes to understanding things. They are quite similar to us in many ways.3

-

Reported by the FT now that the IMF say that (significant) debt relief is necessary, otherwise Greek debt is unsustainable. The creditors are insisting that there is no debt relief on the table. I believe that will now freeze the IMF out of this "agreement" as they are unable to lend when debt is judged to be unsustainable.

At some point, the German public will have to accept that German banks made some really bad mistakes and needed to be bailed out in 2010. They will also need to accept that their government bailed those banks out, but instead of lending directly to the banks (which might have resulted in some return), the government used an intermediary who were always unlikely to be able to pay the money back. They won't accept it now, but at some point they'll have to.

Obviously there have been mistakes on the Greek side, poor governance for many years, poor structures, childish negotiation tactics, but the German government are not innocent bystanders.1 -

Neither are the French.

Greece leaving the EU would be disastrous for their ideal of a 'Federal Europe' which they've been working for since 1848.

I desperately struggle to comprehend how Hollande and the French work. I just don't trust them.0 -

Has Hollande still got approval ratings in the 20s? Yeah, I picked on the Germans because they were the most exposed and are most prominent in all this.

I know the argument is on the other side on the EU thread, but for anyone feeling sympathetic to the Greeks and seeing this as a reason to leave the EU (as Farage has done once or twice)... one thing to be clear on this. The dominant figures are names like Wolfgang Schäuble, Alexander Stubb, Mark Rutte, Timo Soini, Angela Merkel. These are national political figures, not faceless bureaucrats. The Brussels crowd (Tusk, Draghi, Juncker) appear to be on the sidelines, supporting not directing. It is national governments - not the European Commission etc - who are making these demands.

In terms of who might be next, I have a feeling that a repeat of Portugal or Ireland is more likely than Italy. But if Spain elect Podemos soon, all bets are off.0 -

Sponsored links:

-

The IMF are now saying this is a bad deal for Greece (as if that was'nt clear monday morning) and that there needs to be some debt write off for the Greek economy to be sustainable. So Tsipras now has to go to the Greek parliament to ask them to sign a deal the IMF say is unsustainable.

The Germans don't want this Greek government in power. And they're not too worried about the people of Greece, They get voted for by Germans.0 -

Ah. Well maybe, having just returned from a marvellous two week holiday in France, I'm bursting to offer insights into how the French work. I don't want to say its a paradise. Every country has pros and cons. But I think I can explain why France is not and never will be one of the "PIGS"Addickted said:Neither are the French.

Greece leaving the EU would be disastrous for their ideal of a 'Federal Europe' which they've been working for since 1848.

I desperately struggle to comprehend how Hollande and the French work. I just don't trust them.

It is not generally appreciated by Brits that France is technically as advanced as Germany. The French too, make stuff the world wants to buy (of the PIGS, only Italy comes near to be able to say that). But they are also good at making sure that French companies come first. That's true both internally (TGV trains are made by Alsthom, a French company) and abroad (the French in Prague cannot understand why the British businesses don't do more to help each other). It's well known that French State owned utility companies now own large chunks of Britain's utility sectors. Having watched my clearly not well-off landlord using a lot of water on the irrigation system for his garden, I now suspect that the French use profits from these companies abroad to ensure the cost of utilities back home remain reasonable. Then there is the fact that small businesses in the service sector (butchers, bakers, independent restaurants and cafes) continue to thrive. Nobody needs to visit a Carrefour for their regular food supplies.

We could have done all that. We used to do all that. Wouldn't you prefer to see the UK doing it that way, living that way?

2 -

You need to have a look at previous IMF interventions to have a look at why they would call this 'unsustainable'. When the IMF has intervened in other countries, this basically involved the country involved ceding sovereignty over its economic and assets, including carving up and selling off nationalised industries to their buddies. The only reason why the IMF is annoyed by this arrangement is because their debt is not being repaid.ken_shabby said:The IMF are now saying this is a bad deal for Greece (as if that was'nt clear monday morning) and that there needs to be some debt write off for the Greek economy to be sustainable. So Tsipras now has to go to the Greek parliament to ask them to sign a deal the IMF say is unsustainable.

The Germans don't want this Greek government in power. And they're not too worried about the people of Greece, They get voted for by Germans.0 -

I think it is too easy for us to look down on Greece and sneer at them. But beneath all of this, there are real people. Prague’s observations on France strike a chord. It is how we used to be, when we tried to do our bit for our country by buying British when we could. We are now mercenary and sadly proud of it. A few people do well and they have sufficient influence to convince enough naïve people that a punch in the face is good for them. The Life of Brian ‘Lucky Bastards’ scene says it all. Fortunately for me, I am ok so I shouldn’t be bothered really – that is the attitude of many of my compatriots it feels so maybe I should just give up and join them. The bottom line with Greece is, you have to find a solution that will give them some hope- that is the only solution that will work. The decisions have to come from sound logic and reasoning, not the hatred and bile of the ignorant masses stirred up by the press. The IMF are simply applying the same sort of reasoning that was applied to Germany in the 50s!3

-

I might if I knew which study you are on about. Any chance of a link?MuttleyCAFC said:read it and make your own mind up

0 -

Hers is a report of it:

http://blogs.reuters.com/macroscope/2013/05/28/why-a-german-exit-from-the-euro-zone-would-be-disastrous-even-for-germany/

I'm sure you will find it if you google it0 -

I did try googling but without even knowing its title it is not readily apparent what study you are on about. But as you have read it and quoted it presumably you can assist those of us who are interested in finding out more on the subject? It appears to be a study from May 2013 - is that right?

Interestingly, the Reuters article suggests that the study shows that if Germany were to revert to the deutschmark, its future GDP would be 0.5 points lower, but it does not say why or how it comes to that conclusion about a wholly hypothetical scenario. If there is any validity in that, it will be relevant to the debate about the Euro project (but not necessarily to the debate about the EU project).0 -

I haven't read it I have researched the message through various articles - that is how I try to educate myself. I would imagine the report is written in German. You have history with me demanding I find the sources for you. What my reply was intended to do was to encourage you to do the same. And yes, it is an article, not an in depth financial report. I could spend my lunch break finding other sources I'm sure but I have done that already for my own understanding. I look at the information and form an opinion. I may be wrong, but my opinion is a honest one.

In your second para , you start with the word interestingly - I encourage you to use that word to find out a bit more about it. You may then agree with me or find reason to not. That is up to you.1 -

I wouldn't call it history. I thought you must have read it that's all. You haven't so I won't dwell on it, but I was just interested in learning more.

I like to think i have an open mind on the EU thing but getting hard facts is not easy. No offence old chap.0 -

No, especially when its a german report. I used it as an illustration and there is quite a lot about it online if you look. There are also numerous other articles and reports which come to a similar conclusion. The german line would be that Greece can't take credit for being useless even if the fact does help them and that they are helped mostly by being efficient. If there were hard facts that told us the answer to every question, there would be no arguments. No offence taken but the search for hard facts will always end in disappointment. Instead look at different positions and test them against what you know and believe and decide where you stand.0

-

Sponsored links:

-

Bryan

I think the general argument the Germans have been huge beneficiaries of the Euro has been aired consistently for many years. Whether it's a bad thing or not, is where the argument starts. But there seems to be an agreement that if Germany left, a new DM would soar in value, making your Beemer far more expensive.0 -

There is an additional argument that it is a bad thing because of Germany’s recent domestic policies. Basically german wage growth has been tiny everywhere but in the case of the very rich over the last few years. So the positive impact a lot of well off germans spending money on European products is not there – despite many of us thinking it is. It is one of the big arguments against austerity. In that if you give lower to middle class workers more money in their pockets, they spend it rather than save it and they tend to spend it on local produce/services which stimulates the local economies. Money is then stimulating and doing its job as spent money doesn't disappear.

The problem is – from my perspective – the interdependencies are quite complex and people prefer to relate everything to their household finances. Debt is currently seen as this terrible thing, but with interest rates so low, it is a positive tool for instance in the right conditions. Not that Greek debt is healthy, but there is no way Greece is going to be turned into another Germany. People have to be realistic and find a way to get them to a place where they at least don't get back into this position. That requires making logical rather than emotional decisions. Unless you want to see Greece crushed - which I don't think any right thinking person does or at least should do.0 -

The article is interesting but it assumes that if the Southern European nations were to have their debts waived (at least in part) they would go on to manage their economies properly and become better customers/consumers of German goods that would offset some of the debt write off.

Sadly there is every chance that the new found levels of debt would lead to running up more debt that is unaffordable. Thus the Germans would merely be running up lines of credit which would look good on paper but may well never be paid - again.

I know nations are different but I have friends and clients that run up debts to unsustainable levels and then they are 'helped' to clear them by relatives (normally Mum and Dad), or they refinance their homes and 'debt consolidate' and they then go on to run up the debts again. The only answer for people like this is that all lines of credit need to be taken away so that they can only spend what they, actually, have.

I imagine that there can be little more frustrating than giving money to someone, that has wasted a fortune, to clear their debts only to see them do it again - this time with, effectively, your money.

This is why it seems, to me, that the heads of the EU nations are demanding that Greece shows willingness to stop pissing money up the wall before we 'lend' them any more. On the face of it that sounds reasonable to me.0 -

Most of their debt was bailing out the banks. Your examples of individuals going heavy on the credit cards are irrelevant. Countries are not like individuals. Others that build up debt are companies (who just go bust to avoid their debts) and of course banks who just get bailed out. Why not the same treatment for Greece as the capitalists?kings hill addick said:The article is interesting but it assumes that if the Southern European nations were to have their debts waived (at least in part) they would go on to manage their economies properly and become better customers/consumers of German goods that would offset some of the debt write off.

Sadly there is every chance that the new found levels of debt would lead to running up more debt that is unaffordable. Thus the Germans would merely be running up lines of credit which would look good on paper but may well never be paid - again.

I know nations are different but I have friends and clients that run up debts to unsustainable levels and then they are 'helped' to clear them by relatives (normally Mum and Dad), or they refinance their homes and 'debt consolidate' and they then go on to run up the debts again. The only answer for people like this is that all lines of credit need to be taken away so that they can only spend what they, actually, have.

I imagine that there can be little more frustrating than giving money to someone, that has wasted a fortune, to clear their debts only to see them do it again - this time with, effectively, your money.

This is why it seems, to me, that the heads of the EU nations are demanding that Greece shows willingness to stop pissing money up the wall before we 'lend' them any more. On the face of it that sounds reasonable to me.0 -

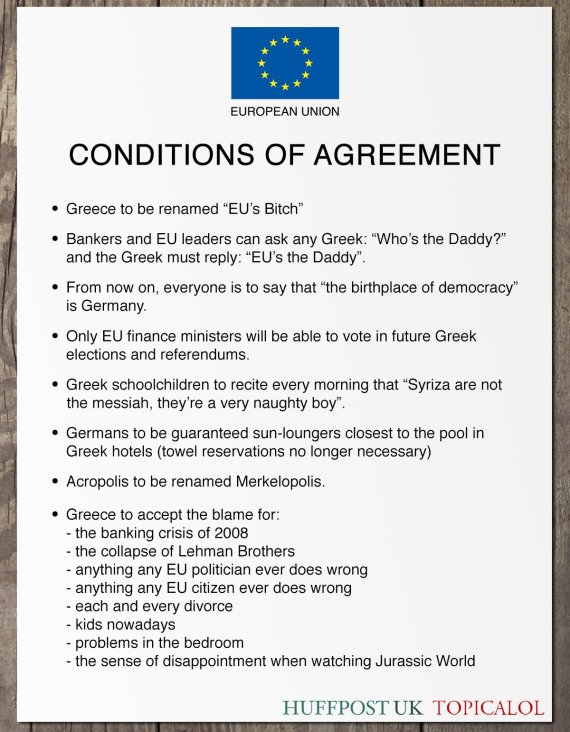

Germany finds a new way to prop up Greece. (With apologies to anyone eating).

4

4 -

Want to understand why Schauble has behaved like such a ----? This German authored article may help

http://www.theguardian.com/commentisfree/2015/jul/17/germany-greece-wolfgang-schauble-bailout1 -

That's nice. It leaves out the fact that Schäuble was lobbying for €50bn Greek assets to be handed to a company of which he is a director.

The Germans have a word for this...2 -

Was it because the Greeks wanted to write off billions of euros that they owed to Germany and other countries?PragueAddick said:Want to understand why Schauble has behaved like such a ----? This German authored article may help

http://www.theguardian.com/commentisfree/2015/jul/17/germany-greece-wolfgang-schauble-bailout0 -

You could try reading the article and see if it persuades you that it's not quite as simple (simplistic) as that. The bloke appeared at times to be out of control. His idea of a temporary Grexit was universally condemned by people who are otherwise unwilling to let the Greeks off both a repayment and a more responsible future approach to their finances.MrOneLung said:

Was it because the Greeks wanted to write off billions of euros that they owed to Germany and other countries?PragueAddick said:Want to understand why Schauble has behaved like such a ----? This German authored article may help

http://www.theguardian.com/commentisfree/2015/jul/17/germany-greece-wolfgang-schauble-bailout

1