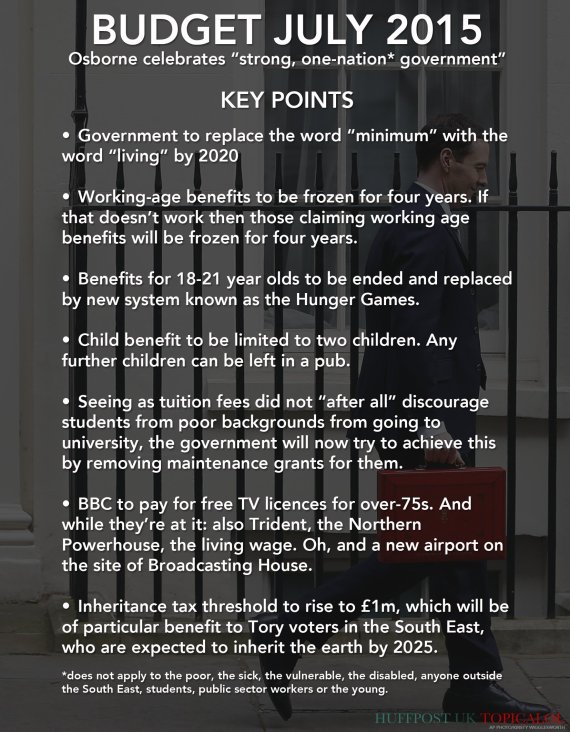

The July Budget

Comments

-

That's not too shabby. I worked for banks for 30 years and that's comfortably better than mine, after 30 years.ShootersHillGuru said:

You forgot to add "Gold Plated" to that.LenGlover said:

That might help.ShootersHillGuru said:Will mean the differential between private and public sectors will be the greatest since records began.

Too late for me to get too uptight. I'm six years from retirement and tied in because of pension etc but how the NHS hopes to attract graduate entrants into Its professions I have no idea.

Actually after 30 years my gold plated pension will allow me to retire on £14.500 per year.0 -

At least you both have a company one.Covered End said:

That's not too shabby. I worked for banks for 30 years and that's comfortably better than mine, after 30 years.ShootersHillGuru said:

You forgot to add "Gold Plated" to that.LenGlover said:

That might help.ShootersHillGuru said:Will mean the differential between private and public sectors will be the greatest since records began.

Too late for me to get too uptight. I'm six years from retirement and tied in because of pension etc but how the NHS hopes to attract graduate entrants into Its professions I have no idea.

Actually after 30 years my gold plated pension will allow me to retire on £14.500 per year.

The projected annual pension from the personal one I took out close on 30 years ago (87 I think it was just before the abolition of retirement relief under a Conservative government incidentally) would not be enough to buy a season ticket in the Lower West!

:-(

I don't think, as someone working almost exclusively for very small organisations, that I am alone either.

0 -

Comparisons without salary details are difficult but I'm guessing that your salary was greater than mine. One of the trade offs in the great private v public sector debate is salary v pension.Covered End said:

That's not too shabby. I worked for banks for 30 years and that's comfortably better than mine, after 30 years.ShootersHillGuru said:

You forgot to add "Gold Plated" to that.LenGlover said:

That might help.ShootersHillGuru said:Will mean the differential between private and public sectors will be the greatest since records began.

Too late for me to get too uptight. I'm six years from retirement and tied in because of pension etc but how the NHS hopes to attract graduate entrants into Its professions I have no idea.

Actually after 30 years my gold plated pension will allow me to retire on £14.500 per year.

We don't of course know either our relative roles in our respective jobs do we. If I had spent 30 years as a porter then that figure would be very different.

0 -

The problem with this attitude is that you're punishing the child as well as the parents.Covered End said:

Financially responsible parents, will have to decide, in future, whether or not they can provide for further children.SELR_addicks said:

The parents spend the money on the child. There's no monetary benefit for them personally other than the fact they can provide food and clothes for their kids.Covered End said:

So you are complaining that CTC will only be paid for the first two children in the future,whilst also complainingSELR_addicks said:

I think you've got it all backwards on the child tax credits. They're for the child, not the parents. By withdrawing it you're basically punishing children for being born in the wrong household.LargeAddick said:

child tax credits, what are they about anyway. should be limited to the first two kids, after that you want more you pay for them. with benefits, the only problem i have is when you can get more on benefits than you could working. that is wrong. anything to limit that is good imo.SELR_addicks said:Saving 80 pounds a year. Probably miniscule in comparison to the cuts the government is making to benefits and child tax credits.

And before everyone starts by saying parents spend it on other things, everyone knows that children cost more than £14 a week to care for and bring up. So what monetary benefit are the parents getting from this?

http://www.telegraph.co.uk/news/uknews/11360819/Average-cost-of-raising-a-child-in-UK-230000.html

Many parents, obviously spend, child benefit as well as child tax credit money on their children.SELR_addicks said:

I think you've got it all backwards on the child tax credits. They're for the child, not the parents. By withdrawing it you're basically punishing children for being born in the wrong household.LargeAddick said:

child tax credits, what are they about anyway. should be limited to the first two kids, after that you want more you pay for them. with benefits, the only problem i have is when you can get more on benefits than you could working. that is wrong. anything to limit that is good imo.SELR_addicks said:Saving 80 pounds a year. Probably miniscule in comparison to the cuts the government is making to benefits and child tax credits.

And before everyone starts by saying parents spend it on other things, everyone knows that children cost more than £14 a week to care for and bring up. So what monetary benefit are the parents getting from this?

http://www.telegraph.co.uk/news/uknews/11360819/Average-cost-of-raising-a-child-in-UK-230000.html

The parents obviously get the monetary benefit.

I've never seen any children in the sweet or toy shop spending their benefits.

Yes, perhaps some parents, save the money for their children's future, in which case it is not essential, it is a very nice to have.

The UK, with a population, increasing by 250,000 per annum and a lack of housing, should not be rewarding families to have more children.

If they want to have more children, that's absolutely fine, but don't give them a bigger financial incentive.

You don't see children spending their benefit because they're wearing and eating it. Or going to school with it. £14 a week is not expensive and makes sure that every child in this country is out of poverty no matter what their parents' (or parent's) financial situation is.

It's not a reward! It's a safety net so that every child can be provided with an acceptable standard of living.

There's no 'bigger reward', every child gets the same rate. That's fair.

Would I have a cap over a certain income level? Maybe. But I wouldn't take it away from children because they're 3rd born rather than 1st.

If they do not have the financial means, to support further children, they should not have them.

In exactly the same way, that they shouldn't spend money on anything else, that they cannot afford.

They will have to take responsibility, instead of expecting the taxpayer to take responsibility.

As I said, have as many children as you like, as long as you can provide for them.0 -

I agree that the state must do something to "discourage" people from having children and to take responsibility for those they do have. I also think it's wrong that low wages paid by profit making companies are topped up by the taxpayer. There has to be a change in ethos.

I just think that what Osborne has done is get his figures wrong. This will cause quite a few (3 million) ? Hard working families a lot of pain.2 -

But isn't that what the Tories stand for, hence I never vote for them?SELR_addicks said:

It's where those tax rises are that points to why it's a Tory budget. Removing tax on pension savings for people earning over £150,000, cutting corporation tax and raising inheritence tax to £1,000,000 tax free.AFKABartram said:I meant in the sense Seth there are net tax rises than tax cuts, the extent of welfare savings was less than half previously expected, higher borrowing levels than expected, the pace of return to surplus much more shallow than expected, and an address of non dom status and buy-to-let.

It was (as a generalisation) far less austere than expectations, or what a coalition pre-budget suggested.

All nice tax cuts for the higher earners in the country. Shame the working class didn't get similar treatment, instead they'll have their income support removed and rent increased.

0 -

Presumably you forgot to pay into it ?LenGlover said:

At least you both have a company one.Covered End said:

That's not too shabby. I worked for banks for 30 years and that's comfortably better than mine, after 30 years.ShootersHillGuru said:

You forgot to add "Gold Plated" to that.LenGlover said:

That might help.ShootersHillGuru said:Will mean the differential between private and public sectors will be the greatest since records began.

Too late for me to get too uptight. I'm six years from retirement and tied in because of pension etc but how the NHS hopes to attract graduate entrants into Its professions I have no idea.

Actually after 30 years my gold plated pension will allow me to retire on £14.500 per year.

The projected annual pension from the personal one I took out close on 30 years ago (87 I think it was just before the abolition of retirement relief under a Conservative government incidentally) would not be enough to buy a season ticket in the Lower West!

:-(

I don't think, as someone working almost exclusively for very small organisations, that I am alone either. 0

0 -

No I paid into it alright but was unable to increase my contributions as much as I would have liked or rather needed to.Covered End said:

Presumably you forgot to pay into it ?LenGlover said:

At least you both have a company one.Covered End said:

That's not too shabby. I worked for banks for 30 years and that's comfortably better than mine, after 30 years.ShootersHillGuru said:

You forgot to add "Gold Plated" to that.LenGlover said:

That might help.ShootersHillGuru said:Will mean the differential between private and public sectors will be the greatest since records began.

Too late for me to get too uptight. I'm six years from retirement and tied in because of pension etc but how the NHS hopes to attract graduate entrants into Its professions I have no idea.

Actually after 30 years my gold plated pension will allow me to retire on £14.500 per year.

The projected annual pension from the personal one I took out close on 30 years ago (87 I think it was just before the abolition of retirement relief under a Conservative government incidentally) would not be enough to buy a season ticket in the Lower West!

:-(

I don't think, as someone working almost exclusively for very small organisations, that I am alone either. 0

0 -

If the parents can't afford further children, then there shouldn't be a child "to punish".SELR_addicks said:

The problem with this attitude is that you're punishing the child as well as the parents.Covered End said:

Financially responsible parents, will have to decide, in future, whether or not they can provide for further children.SELR_addicks said:

The parents spend the money on the child. There's no monetary benefit for them personally other than the fact they can provide food and clothes for their kids.Covered End said:

So you are complaining that CTC will only be paid for the first two children in the future,whilst also complainingSELR_addicks said:

I think you've got it all backwards on the child tax credits. They're for the child, not the parents. By withdrawing it you're basically punishing children for being born in the wrong household.LargeAddick said:

child tax credits, what are they about anyway. should be limited to the first two kids, after that you want more you pay for them. with benefits, the only problem i have is when you can get more on benefits than you could working. that is wrong. anything to limit that is good imo.SELR_addicks said:Saving 80 pounds a year. Probably miniscule in comparison to the cuts the government is making to benefits and child tax credits.

And before everyone starts by saying parents spend it on other things, everyone knows that children cost more than £14 a week to care for and bring up. So what monetary benefit are the parents getting from this?

http://www.telegraph.co.uk/news/uknews/11360819/Average-cost-of-raising-a-child-in-UK-230000.html

Many parents, obviously spend, child benefit as well as child tax credit money on their children.SELR_addicks said:

I think you've got it all backwards on the child tax credits. They're for the child, not the parents. By withdrawing it you're basically punishing children for being born in the wrong household.LargeAddick said:

child tax credits, what are they about anyway. should be limited to the first two kids, after that you want more you pay for them. with benefits, the only problem i have is when you can get more on benefits than you could working. that is wrong. anything to limit that is good imo.SELR_addicks said:Saving 80 pounds a year. Probably miniscule in comparison to the cuts the government is making to benefits and child tax credits.

And before everyone starts by saying parents spend it on other things, everyone knows that children cost more than £14 a week to care for and bring up. So what monetary benefit are the parents getting from this?

http://www.telegraph.co.uk/news/uknews/11360819/Average-cost-of-raising-a-child-in-UK-230000.html

The parents obviously get the monetary benefit.

I've never seen any children in the sweet or toy shop spending their benefits.

Yes, perhaps some parents, save the money for their children's future, in which case it is not essential, it is a very nice to have.

The UK, with a population, increasing by 250,000 per annum and a lack of housing, should not be rewarding families to have more children.

If they want to have more children, that's absolutely fine, but don't give them a bigger financial incentive.

You don't see children spending their benefit because they're wearing and eating it. Or going to school with it. £14 a week is not expensive and makes sure that every child in this country is out of poverty no matter what their parents' (or parent's) financial situation is.

It's not a reward! It's a safety net so that every child can be provided with an acceptable standard of living.

There's no 'bigger reward', every child gets the same rate. That's fair.

Would I have a cap over a certain income level? Maybe. But I wouldn't take it away from children because they're 3rd born rather than 1st.

If they do not have the financial means, to support further children, they should not have them.

In exactly the same way, that they shouldn't spend money on anything else, that they cannot afford.

They will have to take responsibility, instead of expecting the taxpayer to take responsibility.

As I said, have as many children as you like, as long as you can provide for them.

If the parents have children they can't afford, it's the parents fault, not the government (of any colour) or you and I the taxpayer.

Why is it wrong for people to be responsible for their own actions ?3 -

I think this is incorrect, according to BBC website the amount people can contribute to their pension tax-free, to be reduced for individuals with incomes over £150,000SELR_addicks said:

It's where those tax rises are that points to why it's a Tory budget. Removing tax on pension savings for people earning over £150,000, cutting corporation tax and raising inheritence tax to £1,000,000 tax free.AFKABartram said:I meant in the sense Seth there are net tax rises than tax cuts, the extent of welfare savings was less than half previously expected, higher borrowing levels than expected, the pace of return to surplus much more shallow than expected, and an address of non dom status and buy-to-let.

It was (as a generalisation) far less austere than expectations, or what a coalition pre-budget suggested.

All nice tax cuts for the higher earners in the country. Shame the working class didn't get similar treatment, instead they'll have their income support removed and rent increased.0 -

Sponsored links:

-

Tories make relief for bigger earners.. While the poor suffer. Shocking stuff..... Never saw this coming. Still the token guester is a referendum on leaving the Eu, as we all know the poor will be better off without as many pesky immigrants right ?0

-

I doubt he got his figures wrong, but perhaps he did.ShootersHillGuru said:I agree that the state must do something to "discourage" people from having children and to take responsibility for those they do have. I also think it's wrong that low wages paid by profit making companies are topped up by the taxpayer. There has to be a change in ethos.

I just think that what Osborne has done is get his figures wrong. This will cause quite a few (3 million) ? Hard working families a lot of pain.

But if we are to reduce benefits and are quite rightly ring fencing the disabled, it has got to impact on a large number, unless we want an even bigger impact on a smaller number.

It's not pleasant, but I do believe we need to get our house in order.0 -

Are you sure? Assuming you are in the NHS pension scheme, your pension should be indexed linked to inflation.ShootersHillGuru said:

No.LenGlover said:

Index linked?ShootersHillGuru said:

You forgot to add "Gold Plated" to that.LenGlover said:

That might help.ShootersHillGuru said:Will mean the differential between private and public sectors will be the greatest since records began.

Too late for me to get too uptight. I'm six years from retirement and tied in because of pension etc but how the NHS hopes to attract graduate entrants into Its professions I have no idea.

Actually after 30 years my gold plated pension will allow me to retire on £14.500 per year.

Anyway, I think it's a bit of a sterile debate. Public sector final salary schemes are generous compared to most private sector ones, but not as much as some people think. The NHS contributes about 14% per employee's pension to fund the scheme. Most reasonable size private sector companies contribute 6 or 7%, so I guess that the public sector pension adds about 8% of the salary.

0 -

You've paid into a pension for 30 years and it's worth less than a £1,000 ?LenGlover said:

No I paid into it alright but was unable to increase my contributions as much as I would have liked or rather needed to.Covered End said:

Presumably you forgot to pay into it ?LenGlover said:

At least you both have a company one.Covered End said:

That's not too shabby. I worked for banks for 30 years and that's comfortably better than mine, after 30 years.ShootersHillGuru said:

You forgot to add "Gold Plated" to that.LenGlover said:

That might help.ShootersHillGuru said:Will mean the differential between private and public sectors will be the greatest since records began.

Too late for me to get too uptight. I'm six years from retirement and tied in because of pension etc but how the NHS hopes to attract graduate entrants into Its professions I have no idea.

Actually after 30 years my gold plated pension will allow me to retire on £14.500 per year.

The projected annual pension from the personal one I took out close on 30 years ago (87 I think it was just before the abolition of retirement relief under a Conservative government incidentally) would not be enough to buy a season ticket in the Lower West!

:-(

I don't think, as someone working almost exclusively for very small organisations, that I am alone either. 0

0 -

You're right. Tax relief on pension contributions for high earners is to be reduced (or rather tapered).ME14addick said:

I think this is incorrect, according to BBC website the amount people can contribute to their pension tax-free, to be reduced for individuals with incomes over £150,000SELR_addicks said:

It's where those tax rises are that points to why it's a Tory budget. Removing tax on pension savings for people earning over £150,000, cutting corporation tax and raising inheritence tax to £1,000,000 tax free.AFKABartram said:I meant in the sense Seth there are net tax rises than tax cuts, the extent of welfare savings was less than half previously expected, higher borrowing levels than expected, the pace of return to surplus much more shallow than expected, and an address of non dom status and buy-to-let.

It was (as a generalisation) far less austere than expectations, or what a coalition pre-budget suggested.

All nice tax cuts for the higher earners in the country. Shame the working class didn't get similar treatment, instead they'll have their income support removed and rent increased.1 -

You're forgetting this also affects children that are already born. Millions of families that have managed to budget and get by thanks to child benefit are now £728 worse off per child a year. The income tax decreases doesn't even come close to that.Covered End said:

If the parents can't afford further children, then there shouldn't be a child "to punish".SELR_addicks said:

The problem with this attitude is that you're punishing the child as well as the parents.Covered End said:

Financially responsible parents, will have to decide, in future, whether or not they can provide for further children.SELR_addicks said:

The parents spend the money on the child. There's no monetary benefit for them personally other than the fact they can provide food and clothes for their kids.Covered End said:

So you are complaining that CTC will only be paid for the first two children in the future,whilst also complainingSELR_addicks said:

I think you've got it all backwards on the child tax credits. They're for the child, not the parents. By withdrawing it you're basically punishing children for being born in the wrong household.LargeAddick said:

child tax credits, what are they about anyway. should be limited to the first two kids, after that you want more you pay for them. with benefits, the only problem i have is when you can get more on benefits than you could working. that is wrong. anything to limit that is good imo.SELR_addicks said:Saving 80 pounds a year. Probably miniscule in comparison to the cuts the government is making to benefits and child tax credits.

And before everyone starts by saying parents spend it on other things, everyone knows that children cost more than £14 a week to care for and bring up. So what monetary benefit are the parents getting from this?

http://www.telegraph.co.uk/news/uknews/11360819/Average-cost-of-raising-a-child-in-UK-230000.html

Many parents, obviously spend, child benefit as well as child tax credit money on their children.SELR_addicks said:

I think you've got it all backwards on the child tax credits. They're for the child, not the parents. By withdrawing it you're basically punishing children for being born in the wrong household.LargeAddick said:

child tax credits, what are they about anyway. should be limited to the first two kids, after that you want more you pay for them. with benefits, the only problem i have is when you can get more on benefits than you could working. that is wrong. anything to limit that is good imo.SELR_addicks said:Saving 80 pounds a year. Probably miniscule in comparison to the cuts the government is making to benefits and child tax credits.

And before everyone starts by saying parents spend it on other things, everyone knows that children cost more than £14 a week to care for and bring up. So what monetary benefit are the parents getting from this?

http://www.telegraph.co.uk/news/uknews/11360819/Average-cost-of-raising-a-child-in-UK-230000.html

The parents obviously get the monetary benefit.

I've never seen any children in the sweet or toy shop spending their benefits.

Yes, perhaps some parents, save the money for their children's future, in which case it is not essential, it is a very nice to have.

The UK, with a population, increasing by 250,000 per annum and a lack of housing, should not be rewarding families to have more children.

If they want to have more children, that's absolutely fine, but don't give them a bigger financial incentive.

You don't see children spending their benefit because they're wearing and eating it. Or going to school with it. £14 a week is not expensive and makes sure that every child in this country is out of poverty no matter what their parents' (or parent's) financial situation is.

It's not a reward! It's a safety net so that every child can be provided with an acceptable standard of living.

There's no 'bigger reward', every child gets the same rate. That's fair.

Would I have a cap over a certain income level? Maybe. But I wouldn't take it away from children because they're 3rd born rather than 1st.

If they do not have the financial means, to support further children, they should not have them.

In exactly the same way, that they shouldn't spend money on anything else, that they cannot afford.

They will have to take responsibility, instead of expecting the taxpayer to take responsibility.

As I said, have as many children as you like, as long as you can provide for them.

If the parents have children they can't afford, it's the parents fault, not the government (of any colour) or you and I the taxpayer.

Why is it wrong for people to be responsible for their own actions ?0 -

So SELR got all 3 wrong then.ME14addick said:

I think this is incorrect, according to BBC website the amount people can contribute to their pension tax-free, to be reduced for individuals with incomes over £150,000SELR_addicks said:

It's where those tax rises are that points to why it's a Tory budget. Removing tax on pension savings for people earning over £150,000, cutting corporation tax and raising inheritence tax to £1,000,000 tax free.AFKABartram said:I meant in the sense Seth there are net tax rises than tax cuts, the extent of welfare savings was less than half previously expected, higher borrowing levels than expected, the pace of return to surplus much more shallow than expected, and an address of non dom status and buy-to-let.

It was (as a generalisation) far less austere than expectations, or what a coalition pre-budget suggested.

All nice tax cuts for the higher earners in the country. Shame the working class didn't get similar treatment, instead they'll have their income support removed and rent increased.0 -

The projected income yes.Covered End said:

You've paid into a pension for 30 years and it's worth less than a £1,000 ?LenGlover said:

No I paid into it alright but was unable to increase my contributions as much as I would have liked or rather needed to.Covered End said:

Presumably you forgot to pay into it ?LenGlover said:

At least you both have a company one.Covered End said:

That's not too shabby. I worked for banks for 30 years and that's comfortably better than mine, after 30 years.ShootersHillGuru said:

You forgot to add "Gold Plated" to that.LenGlover said:

That might help.ShootersHillGuru said:Will mean the differential between private and public sectors will be the greatest since records began.

Too late for me to get too uptight. I'm six years from retirement and tied in because of pension etc but how the NHS hopes to attract graduate entrants into Its professions I have no idea.

Actually after 30 years my gold plated pension will allow me to retire on £14.500 per year.

The projected annual pension from the personal one I took out close on 30 years ago (87 I think it was just before the abolition of retirement relief under a Conservative government incidentally) would not be enough to buy a season ticket in the Lower West!

:-(

I don't think, as someone working almost exclusively for very small organisations, that I am alone either.

The 'capital' is more than that.

It was a 'money purchase' scheme which, uncharacteristically as I am the worlds most cynical when it comes to salesmen of any type, I signed up to being all too aware that I had no other pension provision at the time.

Hindsight tells me that money purchase schemes are / were crap!0 -

I got the pension one wrong. So 1 not 3...

Corporation tax lowering helps corporations take money away from the country without paying back in, straight into profits and dividends for its shareholders. Corporations now pay less % tax on profits than the people they employ on income.

IHT tax should've had a different rate in London and kept the same elsewhere. The rise everywhere benefits the higher earners far more than anyone else.0 -

http://www.itv.com/news/update/2015-07-08/child-tax-credit-limited-to-two-children-after-2017/SELR_addicks said:

You're forgetting this also affects children that are already born. Millions of families that have managed to budget and get by thanks to child benefit are now £728 worse off per child a year. The income tax decreases doesn't even come close to that.Covered End said:

If the parents can't afford further children, then there shouldn't be a child "to punish".SELR_addicks said:

The problem with this attitude is that you're punishing the child as well as the parents.Covered End said:

Financially responsible parents, will have to decide, in future, whether or not they can provide for further children.SELR_addicks said:

The parents spend the money on the child. There's no monetary benefit for them personally other than the fact they can provide food and clothes for their kids.Covered End said:

So you are complaining that CTC will only be paid for the first two children in the future,whilst also complainingSELR_addicks said:

I think you've got it all backwards on the child tax credits. They're for the child, not the parents. By withdrawing it you're basically punishing children for being born in the wrong household.LargeAddick said:

child tax credits, what are they about anyway. should be limited to the first two kids, after that you want more you pay for them. with benefits, the only problem i have is when you can get more on benefits than you could working. that is wrong. anything to limit that is good imo.SELR_addicks said:Saving 80 pounds a year. Probably miniscule in comparison to the cuts the government is making to benefits and child tax credits.

And before everyone starts by saying parents spend it on other things, everyone knows that children cost more than £14 a week to care for and bring up. So what monetary benefit are the parents getting from this?

http://www.telegraph.co.uk/news/uknews/11360819/Average-cost-of-raising-a-child-in-UK-230000.html

Many parents, obviously spend, child benefit as well as child tax credit money on their children.SELR_addicks said:

I think you've got it all backwards on the child tax credits. They're for the child, not the parents. By withdrawing it you're basically punishing children for being born in the wrong household.LargeAddick said:

child tax credits, what are they about anyway. should be limited to the first two kids, after that you want more you pay for them. with benefits, the only problem i have is when you can get more on benefits than you could working. that is wrong. anything to limit that is good imo.SELR_addicks said:Saving 80 pounds a year. Probably miniscule in comparison to the cuts the government is making to benefits and child tax credits.

And before everyone starts by saying parents spend it on other things, everyone knows that children cost more than £14 a week to care for and bring up. So what monetary benefit are the parents getting from this?

http://www.telegraph.co.uk/news/uknews/11360819/Average-cost-of-raising-a-child-in-UK-230000.html

The parents obviously get the monetary benefit.

I've never seen any children in the sweet or toy shop spending their benefits.

Yes, perhaps some parents, save the money for their children's future, in which case it is not essential, it is a very nice to have.

The UK, with a population, increasing by 250,000 per annum and a lack of housing, should not be rewarding families to have more children.

If they want to have more children, that's absolutely fine, but don't give them a bigger financial incentive.

You don't see children spending their benefit because they're wearing and eating it. Or going to school with it. £14 a week is not expensive and makes sure that every child in this country is out of poverty no matter what their parents' (or parent's) financial situation is.

It's not a reward! It's a safety net so that every child can be provided with an acceptable standard of living.

There's no 'bigger reward', every child gets the same rate. That's fair.

Would I have a cap over a certain income level? Maybe. But I wouldn't take it away from children because they're 3rd born rather than 1st.

If they do not have the financial means, to support further children, they should not have them.

In exactly the same way, that they shouldn't spend money on anything else, that they cannot afford.

They will have to take responsibility, instead of expecting the taxpayer to take responsibility.

As I said, have as many children as you like, as long as you can provide for them.

If the parents have children they can't afford, it's the parents fault, not the government (of any colour) or you and I the taxpayer.

Why is it wrong for people to be responsible for their own actions ?

"Those starting a family after April 2017 will only be entitled to child tax credits for their first two children."

I think you have got that wrong as well. I apologise if I am, but it's not what I have read/heard.1 -

Sponsored links:

-

My mistake! That detail missed me. I still don't agree with the policy but at least it makes more financial sense now.1

-

good luck to you with your views @SELR_addicks though i have a slightly different slant.

Sadly in my opinion there is too much manipulation in a lot of these benefits that despite best intentions, they are in too many cases not fulfilling the purpose they are intentioned for (and what i believe you class as their importance).

People have to take responsibility of their actions. It is wrong imo that if people choice to have large families that they are being continuously financially supported / encouraged in making that decision.

It is also wrong that young girls have so little personal aspiration that they see having kids as a sustainable route of living because the benefit system is generous enough to support that. Those are things in my opinion that need to be addressed without truely impacting those in need.

The are still much that can be done to tweak benefits to make them fairer imo. Carers allowance, the rules areound reduction of child benefit if an individual earns £40,001 yet no reduction if a couple earn £79,999 etc.2 -

So another six years with a 5% return pa will bring you in £19,431 paShootersHillGuru said:

You forgot to add "Gold Plated" to that.LenGlover said:

That might help.ShootersHillGuru said:Will mean the differential between private and public sectors will be the greatest since records began.

Too late for me to get too uptight. I'm six years from retirement and tied in because of pension etc but how the NHS hopes to attract graduate entrants into Its professions I have no idea.

Actually after 30 years my gold plated pension will allow me to retire on £14.500 per year.

And a £50k tax free lump sum

And the increase in income tax allowances will reduce your tax liability further

And not too long to wait for your state pension worth a further £7,800 a year.

And of course cheaper Season Tickets. 10% off B&Q on a Wednesday - it's all happening for you in 2021

Well done SHG - you'll be voting Tory next, just as soon as you get your bus pass

2 -

Perhaps I should have added that's at age 66.0

-

3

3 -

Budget 2015: Squeeze to hit 13m families, says IFS

http://www.bbc.co.uk/news/business-334638640 -

Tilbrook and Difford will be pleased with those audience numbers!1

-

So the poorer you are the more you pay - both literally and proportionally. That can't be the right thing surely! To dress this budget up as a pay rise is cynical politics at its worst.razil said:Budget 2015: Squeeze to hit 13m families, says IFS

http://www.bbc.co.uk/news/business-33463864

Add in the abolition of University grants and it is very clear that we are not all in this together.

Still with all the problems facing the country is reassuring that MPs can spare the time to consider how many dogs can be used to flout the ban on fox hunting.

Only another four years ten months.........

4 -

A friend of mine did a study on public sector pensions aa part of his PHD....

He told me in short that for those such as teachers or those middle paid upwards in the nhs pay around £100000 over their working life to receive a certain level of pension.

Under a private sector workplace pensions scheme to receive the same level of pension you would need to play in over £550000 in your working life. and under a private pension scheme that is not workplace funded you would need to pay £650000...

So essentially private sector workers are half a million better off...

So a limit of 1% on pay rises which is still above inflation is pretty fair...0 -

Don't you mean, PUBLIC sector workers are £1/2M better off ?0