Attention: Please take a moment to consider our terms and conditions before posting.

Savings and Investments thread

Comments

-

Just 10 days to go:

Name Level bobmunro 8452 HardyAddick 8548 CAFCWest 8621 PragueAddick 8725 holyjo 8810 Pedro45 8925 Rob7Lee 9000 Solidgone 9021 BalladMan 9058 wwaddick 9104 fat man on a moped 9116 guinnessaddick 9152 valleynick66 9165 RalphMilne 9168 Addickinedi 9176 Carter 9212 CharltonKerry 9234 blackpool72 9245 Housty 9254 WHAddick 9335 cafcpolo 9395 Diebythesword 9400 Addick Addict 9424 Friend or Defoe 9657 Jints 9750 Thread Killer 9761 @TelMc32 aitchyaddick Arsenetatters Bangkokaddick CAFC, we hate palace cafc7-6htfc CAFCsayer Covered End Daarrrzzettbum Er_Be_Ab_Pl_Wo_Wo_Ch Exiledin Manchester Fortune 82nd Minute Gary Poole golfaddick happy valley Hoof_it_up_to_benty Hornchurch Huskaris IdleHans Jamescafc Jon_CAFC_ KentAddick Killer Kish LargeAddick Lenglover Lonelynorthernaddick meldrew66 Morboe MrWalker Name oohaahmortimer Redman Salad StrikerFirmani thecat TheGhostofTomHovi WishIdStayedInThe Pub 1 -

Quite the wide range!1

-

Hi Rob - been a bit busy lately.

9101 for me, please.1 -

8876 please. Too much optimism around2

-

9025 please1

-

9220.1

-

I think a lot of people would think it was a lot. There are plenty of people doing valuable jobs who get paid peanuts because society doesn't value their roles - they'd love to get a decent wage.Diebythesword said:

The point is it’s no longer a “privileged group”. £100k a year in London isn’t a lot. You can have highly specialised relatively junior roles popping into £100k territory. I want people to earn as much as they can so the tax man can take as much as they can without hurting productivity. The 65% tax trap doesn’t do either.hoof_it_up_to_benty said:

First World problem. Privileged group moaning about their lot and expecting sympathy.Huskaris said:First read about "Henry's" in a great article in The Economist, Standard have done a good article below. I find this area and this group of people fascinating.

https://www.standard.co.uk/lifestyle/henrys-high-earners-not-rich-yet-london-struggling-b1238642.html

If this is the biggest problem in your life you don't have too much to worry about.

3 -

Sure, and the answer to that is to try and get them to a point where they are being paid more for what they do. That’s (provably, as it’s currently the case) not done by suppressing the wages of everyone else.hoof_it_up_to_benty said:

I think a lot of people would think it was a lot. There are plenty of people doing valuable jobs who get paid peanuts because society doesn't value their roles - they'd love to get a decent wage.Diebythesword said:

The point is it’s no longer a “privileged group”. £100k a year in London isn’t a lot. You can have highly specialised relatively junior roles popping into £100k territory. I want people to earn as much as they can so the tax man can take as much as they can without hurting productivity. The 65% tax trap doesn’t do either.hoof_it_up_to_benty said:

First World problem. Privileged group moaning about their lot and expecting sympathy.Huskaris said:First read about "Henry's" in a great article in The Economist, Standard have done a good article below. I find this area and this group of people fascinating.

https://www.standard.co.uk/lifestyle/henrys-high-earners-not-rich-yet-london-struggling-b1238642.html

If this is the biggest problem in your life you don't have too much to worry about.2 -

Unfortunately that would lead to higher inflation, which would lead to higher interest rates, which would mean higher mortgage payments.....and for those that rent (which are a lot of the lower paid) will mean higher rents as landlords who have BTL mortgages increase the rent.Diebythesword said:

Sure, and the answer to that is to try and get them to a point where they are being paid more for what they do. That’s (provably, as it’s currently the case) not done by suppressing the wages of everyone else.hoof_it_up_to_benty said:

I think a lot of people would think it was a lot. There are plenty of people doing valuable jobs who get paid peanuts because society doesn't value their roles - they'd love to get a decent wage.Diebythesword said:

The point is it’s no longer a “privileged group”. £100k a year in London isn’t a lot. You can have highly specialised relatively junior roles popping into £100k territory. I want people to earn as much as they can so the tax man can take as much as they can without hurting productivity. The 65% tax trap doesn’t do either.hoof_it_up_to_benty said:

First World problem. Privileged group moaning about their lot and expecting sympathy.Huskaris said:First read about "Henry's" in a great article in The Economist, Standard have done a good article below. I find this area and this group of people fascinating.

https://www.standard.co.uk/lifestyle/henrys-high-earners-not-rich-yet-london-struggling-b1238642.html

If this is the biggest problem in your life you don't have too much to worry about.

No easy answer I'm afraid. Average income is around £32k pa so anyone affected by the reduction in the PA is earning 3x the average.

And it will get worse. Taxes need to rise. No idea where Rachel Reeves will go to next but I suspect it wont be from the low paid.2 -

Came on here to say the FTSE finished above 9000 for the first time ever & the S&P500 hit an intra-day high earlier today.1

-

Sponsored links:

-

Crazy crazy times.golfaddick said:Came on here to say the FTSE finished above 9000 for the first time ever & the S&P500 hit an intra-day high earlier today.Ever since I moved my pension earlier in the year (as cash, which was a little risky) my top performers are (all ETF's):

NASDAQ up 17.1%

FTSE250 up 12.81%

S&P500, FTSE100 with up just under 7.5%

The others range from 3.5-4.5%.

Happy days, just wish I'd have invested more! (still have a bit under half in cash)0 -

8301 again please1

-

Which is what we are told will happen. But we've had ridiculous levels of inflation at the same time as wage suppression so many times in the last 50 years. The wage price spiral is a theory that gets wheeled out every time working people want higher wages but has literally never been bourne out in empirical evidence.golfaddick said:

Unfortunately that would lead to higher inflation, which would lead to higher interest rates, which would mean higher mortgage payments.....and for those that rent (which are a lot of the lower paid) will mean higher rents as landlords who have BTL mortgages increase the rent.Diebythesword said:

Sure, and the answer to that is to try and get them to a point where they are being paid more for what they do. That’s (provably, as it’s currently the case) not done by suppressing the wages of everyone else.hoof_it_up_to_benty said:

I think a lot of people would think it was a lot. There are plenty of people doing valuable jobs who get paid peanuts because society doesn't value their roles - they'd love to get a decent wage.Diebythesword said:

The point is it’s no longer a “privileged group”. £100k a year in London isn’t a lot. You can have highly specialised relatively junior roles popping into £100k territory. I want people to earn as much as they can so the tax man can take as much as they can without hurting productivity. The 65% tax trap doesn’t do either.hoof_it_up_to_benty said:

First World problem. Privileged group moaning about their lot and expecting sympathy.Huskaris said:First read about "Henry's" in a great article in The Economist, Standard have done a good article below. I find this area and this group of people fascinating.

https://www.standard.co.uk/lifestyle/henrys-high-earners-not-rich-yet-london-struggling-b1238642.html

If this is the biggest problem in your life you don't have too much to worry about.

No easy answer I'm afraid. Average income is around £32k pa so anyone affected by the reduction in the PA is earning 3x the average.

And it will get worse. Taxes need to rise. No idea where Rachel Reeves will go to next but I suspect it wont be from the low paid.

I'll say it again if average wages increased with purchasing power since 1980 it would be £85k. If the higher rate of income tax threshold had risen with inflation it would be £162k. We have a low pay problem in the UK.4 -

I don't think that argument about low paid workers being paid an actual living wage causing inflation is without merit. What it means in reality though is some people will pull in a bit less money but a lot of people all of a sudden might have some more to spend on stuff that stimulates economies, holidays, cars, clothes, computers.cantersaddick said:

Which is what we are told will happen. But we've had ridiculous levels of inflation at the same time as wage suppression so many times in the last 50 years. The wage price spiral is a theory that gets wheeled out every time working people want higher wages but has literally never been bourne out in empirical evidence.golfaddick said:

Unfortunately that would lead to higher inflation, which would lead to higher interest rates, which would mean higher mortgage payments.....and for those that rent (which are a lot of the lower paid) will mean higher rents as landlords who have BTL mortgages increase the rent.Diebythesword said:

Sure, and the answer to that is to try and get them to a point where they are being paid more for what they do. That’s (provably, as it’s currently the case) not done by suppressing the wages of everyone else.hoof_it_up_to_benty said:

I think a lot of people would think it was a lot. There are plenty of people doing valuable jobs who get paid peanuts because society doesn't value their roles - they'd love to get a decent wage.Diebythesword said:

The point is it’s no longer a “privileged group”. £100k a year in London isn’t a lot. You can have highly specialised relatively junior roles popping into £100k territory. I want people to earn as much as they can so the tax man can take as much as they can without hurting productivity. The 65% tax trap doesn’t do either.hoof_it_up_to_benty said:

First World problem. Privileged group moaning about their lot and expecting sympathy.Huskaris said:First read about "Henry's" in a great article in The Economist, Standard have done a good article below. I find this area and this group of people fascinating.

https://www.standard.co.uk/lifestyle/henrys-high-earners-not-rich-yet-london-struggling-b1238642.html

If this is the biggest problem in your life you don't have too much to worry about.

No easy answer I'm afraid. Average income is around £32k pa so anyone affected by the reduction in the PA is earning 3x the average.

And it will get worse. Taxes need to rise. No idea where Rachel Reeves will go to next but I suspect it wont be from the low paid.

I'll say it again if average wages increased with purchasing power since 1980 it would be £85k. If the higher rate of income tax threshold had risen with inflation it would be £162k. We have a low pay problem in the UK.

1 -

There has been a spike in inflation this year partly driven by the train drivers & doctors getting big pay rises as soon as Labour came in last July.Carter said:

I don't think that argument about low paid workers being paid an actual living wage causing inflation is without merit. What it means in reality though is some people will pull in a bit less money but a lot of people all of a sudden might have some more to spend on stuff that stimulates economies, holidays, cars, clothes, computers.cantersaddick said:

Which is what we are told will happen. But we've had ridiculous levels of inflation at the same time as wage suppression so many times in the last 50 years. The wage price spiral is a theory that gets wheeled out every time working people want higher wages but has literally never been bourne out in empirical evidence.golfaddick said:

Unfortunately that would lead to higher inflation, which would lead to higher interest rates, which would mean higher mortgage payments.....and for those that rent (which are a lot of the lower paid) will mean higher rents as landlords who have BTL mortgages increase the rent.Diebythesword said:

Sure, and the answer to that is to try and get them to a point where they are being paid more for what they do. That’s (provably, as it’s currently the case) not done by suppressing the wages of everyone else.hoof_it_up_to_benty said:

I think a lot of people would think it was a lot. There are plenty of people doing valuable jobs who get paid peanuts because society doesn't value their roles - they'd love to get a decent wage.Diebythesword said:

The point is it’s no longer a “privileged group”. £100k a year in London isn’t a lot. You can have highly specialised relatively junior roles popping into £100k territory. I want people to earn as much as they can so the tax man can take as much as they can without hurting productivity. The 65% tax trap doesn’t do either.hoof_it_up_to_benty said:

First World problem. Privileged group moaning about their lot and expecting sympathy.Huskaris said:First read about "Henry's" in a great article in The Economist, Standard have done a good article below. I find this area and this group of people fascinating.

https://www.standard.co.uk/lifestyle/henrys-high-earners-not-rich-yet-london-struggling-b1238642.html

If this is the biggest problem in your life you don't have too much to worry about.

No easy answer I'm afraid. Average income is around £32k pa so anyone affected by the reduction in the PA is earning 3x the average.

And it will get worse. Taxes need to rise. No idea where Rachel Reeves will go to next but I suspect it wont be from the low paid.

I'll say it again if average wages increased with purchasing power since 1980 it would be £85k. If the higher rate of income tax threshold had risen with inflation it would be £162k. We have a low pay problem in the UK.

It's not an arguement its fact.4 -

9088 please1

-

What indice are you using for purchasing power? The average salary in 1980 was £6k, on inflation (BoE) to today that's £25.8k.cantersaddick said:

Which is what we are told will happen. But we've had ridiculous levels of inflation at the same time as wage suppression so many times in the last 50 years. The wage price spiral is a theory that gets wheeled out every time working people want higher wages but has literally never been bourne out in empirical evidence.golfaddick said:

Unfortunately that would lead to higher inflation, which would lead to higher interest rates, which would mean higher mortgage payments.....and for those that rent (which are a lot of the lower paid) will mean higher rents as landlords who have BTL mortgages increase the rent.Diebythesword said:

Sure, and the answer to that is to try and get them to a point where they are being paid more for what they do. That’s (provably, as it’s currently the case) not done by suppressing the wages of everyone else.hoof_it_up_to_benty said:

I think a lot of people would think it was a lot. There are plenty of people doing valuable jobs who get paid peanuts because society doesn't value their roles - they'd love to get a decent wage.Diebythesword said:

The point is it’s no longer a “privileged group”. £100k a year in London isn’t a lot. You can have highly specialised relatively junior roles popping into £100k territory. I want people to earn as much as they can so the tax man can take as much as they can without hurting productivity. The 65% tax trap doesn’t do either.hoof_it_up_to_benty said:

First World problem. Privileged group moaning about their lot and expecting sympathy.Huskaris said:First read about "Henry's" in a great article in The Economist, Standard have done a good article below. I find this area and this group of people fascinating.

https://www.standard.co.uk/lifestyle/henrys-high-earners-not-rich-yet-london-struggling-b1238642.html

If this is the biggest problem in your life you don't have too much to worry about.

No easy answer I'm afraid. Average income is around £32k pa so anyone affected by the reduction in the PA is earning 3x the average.

And it will get worse. Taxes need to rise. No idea where Rachel Reeves will go to next but I suspect it wont be from the low paid.

I'll say it again if average wages increased with purchasing power since 1980 it would be £85k. If the higher rate of income tax threshold had risen with inflation it would be £162k. We have a low pay problem in the UK.

In 1980 we had 6 income tax bands, yes if you take the very top one (£27,750) it would be £120k, however tax at 40% which came in at £11,250 that's around £48k in todays money.

Of course income tax rates back then were much higher as well, ranging from 30% to 60% (only a couple of years before they were 34% - 83%). Personal allowance was £1375 which is only just under 6k in todays money (again, BoE inflation calc).0 -

Yes it's a different metric. We basically think that the traditional inflation measures whilst good for looking at the costs of say a project over time they have never been any good at assessing pay over time. I would try and explain in my own words but on my work laptop I have properly written up definitions and explanations and details on the calculations and I wouldn't do them justice. Will share when I'm in the office.Rob7Lee said:

What indice are you using for purchasing power? The average salary in 1980 was £6k, on inflation (BoE) to today that's £25.8k.cantersaddick said:

Which is what we are told will happen. But we've had ridiculous levels of inflation at the same time as wage suppression so many times in the last 50 years. The wage price spiral is a theory that gets wheeled out every time working people want higher wages but has literally never been bourne out in empirical evidence.golfaddick said:

Unfortunately that would lead to higher inflation, which would lead to higher interest rates, which would mean higher mortgage payments.....and for those that rent (which are a lot of the lower paid) will mean higher rents as landlords who have BTL mortgages increase the rent.Diebythesword said:

Sure, and the answer to that is to try and get them to a point where they are being paid more for what they do. That’s (provably, as it’s currently the case) not done by suppressing the wages of everyone else.hoof_it_up_to_benty said:

I think a lot of people would think it was a lot. There are plenty of people doing valuable jobs who get paid peanuts because society doesn't value their roles - they'd love to get a decent wage.Diebythesword said:

The point is it’s no longer a “privileged group”. £100k a year in London isn’t a lot. You can have highly specialised relatively junior roles popping into £100k territory. I want people to earn as much as they can so the tax man can take as much as they can without hurting productivity. The 65% tax trap doesn’t do either.hoof_it_up_to_benty said:

First World problem. Privileged group moaning about their lot and expecting sympathy.Huskaris said:First read about "Henry's" in a great article in The Economist, Standard have done a good article below. I find this area and this group of people fascinating.

https://www.standard.co.uk/lifestyle/henrys-high-earners-not-rich-yet-london-struggling-b1238642.html

If this is the biggest problem in your life you don't have too much to worry about.

No easy answer I'm afraid. Average income is around £32k pa so anyone affected by the reduction in the PA is earning 3x the average.

And it will get worse. Taxes need to rise. No idea where Rachel Reeves will go to next but I suspect it wont be from the low paid.

I'll say it again if average wages increased with purchasing power since 1980 it would be £85k. If the higher rate of income tax threshold had risen with inflation it would be £162k. We have a low pay problem in the UK.

In 1980 we had 6 income tax bands, yes if you take the very top one (£27,750) it would be £120k, however tax at 40% which came in at £11,250 that's around £48k in todays money.

Of course income tax rates back then were much higher as well, ranging from 30% to 60% (only a couple of years before they were 34% - 83%). Personal allowance was £1375 which is only just under 6k in todays money (again, BoE inflation calc).1 -

9301 pls1

-

9525 please1

-

Sponsored links:

-

Think you missed mine, posted last week. It's 8998.1

-

The word "partly" is doing a lot of heavy lifting there. Inflation is almost entirely supply led (energy, food prices), not demand. There a good budgetary reasons for not giving big public sector pay rises but inflation is not really relevant in the way in was in the 1960s-80s.golfaddick said:

There has been a spike in inflation this year partly driven by the train drivers & doctors getting big pay rises as soon as Labour came in last July.Carter said:

I don't think that argument about low paid workers being paid an actual living wage causing inflation is without merit. What it means in reality though is some people will pull in a bit less money but a lot of people all of a sudden might have some more to spend on stuff that stimulates economies, holidays, cars, clothes, computers.cantersaddick said:

Which is what we are told will happen. But we've had ridiculous levels of inflation at the same time as wage suppression so many times in the last 50 years. The wage price spiral is a theory that gets wheeled out every time working people want higher wages but has literally never been bourne out in empirical evidence.golfaddick said:

Unfortunately that would lead to higher inflation, which would lead to higher interest rates, which would mean higher mortgage payments.....and for those that rent (which are a lot of the lower paid) will mean higher rents as landlords who have BTL mortgages increase the rent.Diebythesword said:

Sure, and the answer to that is to try and get them to a point where they are being paid more for what they do. That’s (provably, as it’s currently the case) not done by suppressing the wages of everyone else.hoof_it_up_to_benty said:

I think a lot of people would think it was a lot. There are plenty of people doing valuable jobs who get paid peanuts because society doesn't value their roles - they'd love to get a decent wage.Diebythesword said:

The point is it’s no longer a “privileged group”. £100k a year in London isn’t a lot. You can have highly specialised relatively junior roles popping into £100k territory. I want people to earn as much as they can so the tax man can take as much as they can without hurting productivity. The 65% tax trap doesn’t do either.hoof_it_up_to_benty said:

First World problem. Privileged group moaning about their lot and expecting sympathy.Huskaris said:First read about "Henry's" in a great article in The Economist, Standard have done a good article below. I find this area and this group of people fascinating.

https://www.standard.co.uk/lifestyle/henrys-high-earners-not-rich-yet-london-struggling-b1238642.html

If this is the biggest problem in your life you don't have too much to worry about.

No easy answer I'm afraid. Average income is around £32k pa so anyone affected by the reduction in the PA is earning 3x the average.

And it will get worse. Taxes need to rise. No idea where Rachel Reeves will go to next but I suspect it wont be from the low paid.

I'll say it again if average wages increased with purchasing power since 1980 it would be £85k. If the higher rate of income tax threshold had risen with inflation it would be £162k. We have a low pay problem in the UK.

It's not an arguement its fact.3 -

Just absolutely not true. Its almost entirely due to global factors. Oil and gas price volatility given world events. Trump fucking around with tarrifs. Almost none of it is domestic driven and of that the majority is due to things like our stupid pricing mechanism for energy. If those pay increases have had an effect it will be negligible in the calculation.golfaddick said:

There has been a spike in inflation this year partly driven by the train drivers & doctors getting big pay rises as soon as Labour came in last July.Carter said:

I don't think that argument about low paid workers being paid an actual living wage causing inflation is without merit. What it means in reality though is some people will pull in a bit less money but a lot of people all of a sudden might have some more to spend on stuff that stimulates economies, holidays, cars, clothes, computers.cantersaddick said:

Which is what we are told will happen. But we've had ridiculous levels of inflation at the same time as wage suppression so many times in the last 50 years. The wage price spiral is a theory that gets wheeled out every time working people want higher wages but has literally never been bourne out in empirical evidence.golfaddick said:

Unfortunately that would lead to higher inflation, which would lead to higher interest rates, which would mean higher mortgage payments.....and for those that rent (which are a lot of the lower paid) will mean higher rents as landlords who have BTL mortgages increase the rent.Diebythesword said:

Sure, and the answer to that is to try and get them to a point where they are being paid more for what they do. That’s (provably, as it’s currently the case) not done by suppressing the wages of everyone else.hoof_it_up_to_benty said:

I think a lot of people would think it was a lot. There are plenty of people doing valuable jobs who get paid peanuts because society doesn't value their roles - they'd love to get a decent wage.Diebythesword said:

The point is it’s no longer a “privileged group”. £100k a year in London isn’t a lot. You can have highly specialised relatively junior roles popping into £100k territory. I want people to earn as much as they can so the tax man can take as much as they can without hurting productivity. The 65% tax trap doesn’t do either.hoof_it_up_to_benty said:

First World problem. Privileged group moaning about their lot and expecting sympathy.Huskaris said:First read about "Henry's" in a great article in The Economist, Standard have done a good article below. I find this area and this group of people fascinating.

https://www.standard.co.uk/lifestyle/henrys-high-earners-not-rich-yet-london-struggling-b1238642.html

If this is the biggest problem in your life you don't have too much to worry about.

No easy answer I'm afraid. Average income is around £32k pa so anyone affected by the reduction in the PA is earning 3x the average.

And it will get worse. Taxes need to rise. No idea where Rachel Reeves will go to next but I suspect it wont be from the low paid.

I'll say it again if average wages increased with purchasing power since 1980 it would be £85k. If the higher rate of income tax threshold had risen with inflation it would be £162k. We have a low pay problem in the UK.

It's not an arguement its fact.3 -

Interesting, so CPI is no good at comparing purchasing power - CPI being the change over time of the costs of services and goods bought by households (including things such as rent, food and energy).cantersaddick said:

Yes it's a different metric. We basically think that the traditional inflation measures whilst good for looking at the costs of say a project over time they have never been any good at assessing pay over time. I would try and explain in my own words but on my work laptop I have properly written up definitions and explanations and details on the calculations and I wouldn't do them justice. Will share when I'm in the office.Rob7Lee said:

What indice are you using for purchasing power? The average salary in 1980 was £6k, on inflation (BoE) to today that's £25.8k.cantersaddick said:

Which is what we are told will happen. But we've had ridiculous levels of inflation at the same time as wage suppression so many times in the last 50 years. The wage price spiral is a theory that gets wheeled out every time working people want higher wages but has literally never been bourne out in empirical evidence.golfaddick said:

Unfortunately that would lead to higher inflation, which would lead to higher interest rates, which would mean higher mortgage payments.....and for those that rent (which are a lot of the lower paid) will mean higher rents as landlords who have BTL mortgages increase the rent.Diebythesword said:

Sure, and the answer to that is to try and get them to a point where they are being paid more for what they do. That’s (provably, as it’s currently the case) not done by suppressing the wages of everyone else.hoof_it_up_to_benty said:

I think a lot of people would think it was a lot. There are plenty of people doing valuable jobs who get paid peanuts because society doesn't value their roles - they'd love to get a decent wage.Diebythesword said:

The point is it’s no longer a “privileged group”. £100k a year in London isn’t a lot. You can have highly specialised relatively junior roles popping into £100k territory. I want people to earn as much as they can so the tax man can take as much as they can without hurting productivity. The 65% tax trap doesn’t do either.hoof_it_up_to_benty said:

First World problem. Privileged group moaning about their lot and expecting sympathy.Huskaris said:First read about "Henry's" in a great article in The Economist, Standard have done a good article below. I find this area and this group of people fascinating.

https://www.standard.co.uk/lifestyle/henrys-high-earners-not-rich-yet-london-struggling-b1238642.html

If this is the biggest problem in your life you don't have too much to worry about.

No easy answer I'm afraid. Average income is around £32k pa so anyone affected by the reduction in the PA is earning 3x the average.

And it will get worse. Taxes need to rise. No idea where Rachel Reeves will go to next but I suspect it wont be from the low paid.

I'll say it again if average wages increased with purchasing power since 1980 it would be £85k. If the higher rate of income tax threshold had risen with inflation it would be £162k. We have a low pay problem in the UK.

In 1980 we had 6 income tax bands, yes if you take the very top one (£27,750) it would be £120k, however tax at 40% which came in at £11,250 that's around £48k in todays money.

Of course income tax rates back then were much higher as well, ranging from 30% to 60% (only a couple of years before they were 34% - 83%). Personal allowance was £1375 which is only just under 6k in todays money (again, BoE inflation calc).

Your model must be very different if CPI calculate a move from 6k to 26k, whereas your model moves it from 6k to 85k! Be interesting to see the definition and how you are calculating, but for now I'll stick to CPI as a tried and tested and relevant indices.

You may also want to correct your comment about the higher rate income tax threshold as you aren't comparing apples with apples, you are taking a band/s that were long ago removed. For instance the top band in the early to mid 70's (83%) was on income over £20,000, equivalent today to around £220k, but those bands have long since been removed, mid 70's we had at least 10 bands, even by 1980 when thatcher started to do her stuff we still had 6.2 -

Soz, now added!Bangkokaddick said:Think you missed mine, posted last week. It's 8998.0 -

Yes CPI is useful for it's original purpose. You want to assess the time value of money in terms of an investment in a public building/infrastructure project say a new railway or motorway. It can give an opportunity cost of that investment. But it has never been very (any) good at assessing pay over time. Not least because of the ridiculous way it considers housing costs.Rob7Lee said:

Interesting, so CPI is no good at comparing purchasing power - CPI being the change over time of the costs of services and goods bought by households (including things such as rent, food and energy).cantersaddick said:

Yes it's a different metric. We basically think that the traditional inflation measures whilst good for looking at the costs of say a project over time they have never been any good at assessing pay over time. I would try and explain in my own words but on my work laptop I have properly written up definitions and explanations and details on the calculations and I wouldn't do them justice. Will share when I'm in the office.Rob7Lee said:

What indice are you using for purchasing power? The average salary in 1980 was £6k, on inflation (BoE) to today that's £25.8k.cantersaddick said:

Which is what we are told will happen. But we've had ridiculous levels of inflation at the same time as wage suppression so many times in the last 50 years. The wage price spiral is a theory that gets wheeled out every time working people want higher wages but has literally never been bourne out in empirical evidence.golfaddick said:

Unfortunately that would lead to higher inflation, which would lead to higher interest rates, which would mean higher mortgage payments.....and for those that rent (which are a lot of the lower paid) will mean higher rents as landlords who have BTL mortgages increase the rent.Diebythesword said:

Sure, and the answer to that is to try and get them to a point where they are being paid more for what they do. That’s (provably, as it’s currently the case) not done by suppressing the wages of everyone else.hoof_it_up_to_benty said:

I think a lot of people would think it was a lot. There are plenty of people doing valuable jobs who get paid peanuts because society doesn't value their roles - they'd love to get a decent wage.Diebythesword said:

The point is it’s no longer a “privileged group”. £100k a year in London isn’t a lot. You can have highly specialised relatively junior roles popping into £100k territory. I want people to earn as much as they can so the tax man can take as much as they can without hurting productivity. The 65% tax trap doesn’t do either.hoof_it_up_to_benty said:

First World problem. Privileged group moaning about their lot and expecting sympathy.Huskaris said:First read about "Henry's" in a great article in The Economist, Standard have done a good article below. I find this area and this group of people fascinating.

https://www.standard.co.uk/lifestyle/henrys-high-earners-not-rich-yet-london-struggling-b1238642.html

If this is the biggest problem in your life you don't have too much to worry about.

No easy answer I'm afraid. Average income is around £32k pa so anyone affected by the reduction in the PA is earning 3x the average.

And it will get worse. Taxes need to rise. No idea where Rachel Reeves will go to next but I suspect it wont be from the low paid.

I'll say it again if average wages increased with purchasing power since 1980 it would be £85k. If the higher rate of income tax threshold had risen with inflation it would be £162k. We have a low pay problem in the UK.

In 1980 we had 6 income tax bands, yes if you take the very top one (£27,750) it would be £120k, however tax at 40% which came in at £11,250 that's around £48k in todays money.

Of course income tax rates back then were much higher as well, ranging from 30% to 60% (only a couple of years before they were 34% - 83%). Personal allowance was £1375 which is only just under 6k in todays money (again, BoE inflation calc).

Your model must be very different if CPI calculate a move from 6k to 26k, whereas your model moves it from 6k to 85k! Be interesting to see the definition and how you are calculating, but for now I'll stick to CPI as a tried and tested and relevant indices.

You may also want to correct your comment about the higher rate income tax threshold as you aren't comparing apples with apples, you are taking a band/s that were long ago removed. For instance the top band in the early to mid 70's (83%) was on income over £20,000, equivalent today to around £220k, but those bands have long since been removed, mid 70's we had at least 10 bands, even by 1980 when thatcher started to do her stuff we still had 6.

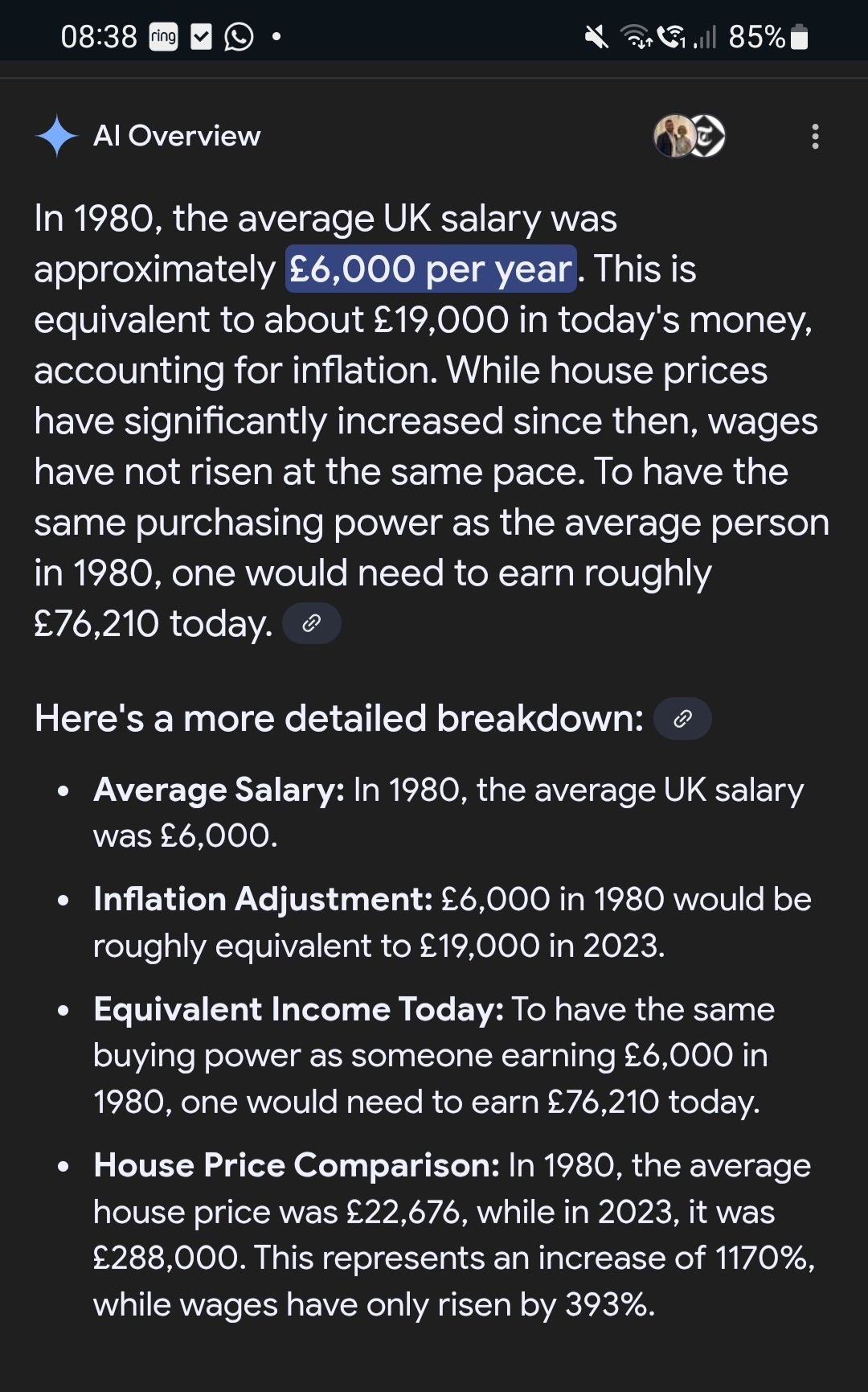

Trains running late so here is the AI overview of it from Google. My model uses a slightly higher starting point (6.6k or something based on what I thought was ONS stats but will check that as Google doesn't seem to agree) which is why I was getting 85k rather than just over 76k. Equivalent income today basically shows the purchasing power index we use in economics (may be ever so slightly differently modelled).

0 -

It seems you are purely looking at one element, house price comparison (not even purchase costs, interest rates in 1980 were 14% and it was much harder to get a mortgage), whilst I'm sure most would agree salaries (even taking into account interest rates) have not kept up with property value growth in large parts of the country, that's very different to a blanket I'll say it again if average wages increased with purchasing power since 1980 it would be £85k.

That's simply not true. If the comment was average wages increased in line with average property prices then it's nearer the mark!0 -

No. Have a look at the screenshot. I'm not looking at the housing bit I'm looking at- Equivalent income today. To have the same buying power (housing is just one element) as someone earning £6000 in 1980, one would need to earn £76,210 today.

Buying power/purchasing power. The same thing. And takes into account interest rates too. Its a much better method of comparing pay over time. This is accepted across economics. It's literally my career to know these things. The difference between the 76k and 85k in my model is likely due to the starting point used (I need to check mine) and the bespoke-ness of my model to the issue its focused on.

0 -

That is only looking at the house price comparison, not inflation as a whole.

It quotes house prices as being up 1170% vs 1980s

6,000x12.7=76,200. It's only looking at the housing element...2 -

How does this fit with the second bullet point i.e. that £6,000 in 1980 if adjusted for inflation would be equivalent to £19,000 in 2023?cantersaddick said:No. Have a look at the screenshot. I'm not looking at the housing bit I'm looking at- Equivalent income today. To have the same buying power (housing is just one element) as someone earning £6000 in 1980, one would need to earn £76,210 today.

Buying power/purchasing power. The same thing. And takes into account interest rates too. Its a much better method of comparing pay over time. This is accepted across economics. It's literally my career to know these things. The difference between the 76k and 85k in my model is likely due to the starting point used (I need to check mine) and the bespoke-ness of my model to the issue its focused on.1